Last week OPEC and Russia met to discuss cutting oil production by 1.5 million barrels per day; a move in response to slowing demand due to the Coronavirus outbreak in China. Russia decided NOT to participate in the cut, and in response, OPEC has "declared a price war" on Russia and has flooded the market with oil, increasing its production and causing a sharp drop in the price of oil (-30%).

Historically, oil has been a proxy for the overall condition of the economy and stock market. This made sense because so many jobs were dependent on the oil industry. When oil was doing well, the economy was doing well, and when oil was suffering, the economy was too. Much of this had to do with employment data. The oil industry was a major employer; it directly employed hundreds of thousands of workers. Further, it indirectly employed many more. Some examples of outside industries affected by oil and gas were manufacturing (building trucks, tools, machinery, rail cars, rail roads, tankers, etc), shipping, and finance (the banks that supported the industry).

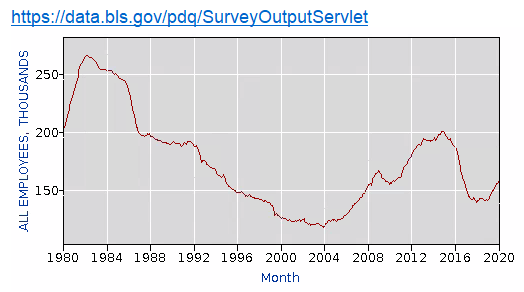

While it is still true today that energy employs thousands of people and that the industry affects many other industries, its impact is not nearly as significant as it used to be. Below is a chart of the number of jobs (reported by the Bureau of Labor Statistics) in the oil and gas extraction industry from 1980 until 2020. At its peak, there were nearly 275,000 jobs in the US directly focused on oil and gas extraction. Today that number is barely 150,000. This is a 45% drop in the number of jobs in the US that are focused on oil and gas exploration. Although this is a dramatic shift, this alone does not tell the full story. It's equally important to note that the decrease in jobs in oil and gas exploration came during a period when the total number of jobs in the US grew by more than 67% (source - Payroll Survey All Employment Non-Farm Payroll).

To put it in clear terms, the Oil & Gas Industry accounts for only 5.23% of the Dow Jones Industrial Average today. Looking at the S&P 500, it is even less relevant, accounting for only 3.28% of the index. Within the Dow Jones Industrial Average, technology accounts for 39%, healthcare accounts for 13%, and consumer services accounts for 12.5%. Each of these industries is benefited by cheaper energy (both directly and indirectly). Additionally, cheap oil and gas is GOOD FOR THE AIRLINES, SHIPPING, CONSUMER GOODS, INDUSTRIALS (that use a lot of energy), etc. It is also good for the consumer (which now drives 70% of the US economy). Cheap oil and gas will very likely prove to be a stimulus to the economy, not a drag on it.

We also want to highlight that this is NOT the first time in recent history OPEC has declared a price war on other energy producers. In 2014, as US oil and gas production was growing strongly, OPEC increased supply, pushing prices down, trying to squeeze the US out of the energy market. Their plan backfired. US energy producers were far more resilient than OPEC had accounted for, and by 2016, OPEC had given up on squeezing the US out of the energy market.

Because technological improvements have helped US energy producers cut their cost of production so sharply, we continue to believe the US will fare reasonably well despite OPECs best efforts to force others out of the market. There will certainly be some energy companies that are squeezed out, but that will create more opportunities for those that are more efficient producers and remain.

Here is an article from Reuters that we thought gives a good background of what's happening in the energy market:

TOKYO, March 9 (Reuters) - Oil fell by the most since 1991 on Monday after Saudi Arabia started a price war with Russia by slashing its selling prices and pledging to unleash its pent-up supply onto a market reeling from falling demand because of the coronavirus outbreak.

Brent crude futures fell by as much as $14.25, or 31.5%, to $31.02 a barrel. That was the biggest percentage drop since Jan. 17, 1991, at the start of the first Gulf War and the lowest since Feb. 12, 2016. It was trading at $35.75 at 0114 GMT. U.S. West Texas Intermediate (WTI) crude fell by as much as $11.28, or 27.4%, to $30 a barrel. That was also the biggest percentage drop since the first Gulf War in January 1991 and the lowest since Feb. 22, 2016. It was trading at $32.61. Saudi Arabia, the world's biggest oil exporter, is attempting to punish Russia, the world's second-largest producer, for balking on Friday at production cuts proposed by the Organization of the Petroleum Exporting Countries (OPEC). OPEC and other producers supported the cuts to stabilize falling prices caused by the economic fallout from the coronavirus outbreak.

Saudi Arabia plans to boost crude output above 10 million barrels per day (bpd) in April after the current supply deal between OPEC and Russia, - known as OPEC+ - expires at the end of March, two sources told Reuters on Sunday. Saudi Arabia, Russia, and other major producers last battled for market share like this between 2014 and 2016 to try to squeeze out production from the United States, now the world's biggest oil producer as flows from shale oil fields doubled the country's output during the last decade.

"Saudi Arabia and Russia are entering into an oil price war that is likely to be limited and tactical," Eurasia Group said in a note. "The most likely outcome of this crisis is entrenchment into a painful process that lasts several weeks or months, until prices are low enough to ... some form of compromise on resumed OPEC+ production restraint," Eurasia said. Saudi Arabia has opened the war by cutting its official selling prices for April for all crude grades to all destinations by between $6 to $8 a barrel.

China's efforts to curtail the coronavirus outbreak has disrupted the world's second-largest economy and curtailed shipments to the largest oil importer. The spread to other major economies such as Italy and South Korea and the burgeoning cases in the United States has increased the concerns that oil demand will slump this year.

Major banks such as Morgan Stanley and Goldman Sachs have cut their demand growth forecasts, with Morgan Stanley predicting China will have zero demand growth in 2020 while Goldman is seeing a contraction of global demand of 150,000 barrels per day.

In other markets, the dollar was down sharply against the yen, Asian stock markets were set for big falls and gold rose to the highest since 2013 as investors fled to safe havens. (Reporting by Scott DiSavino and Aaron Sheldrick in Tokyo; Editing by Diane Craft and Christian Schmollinger)

Please call or email us with any questions.

Sincerely,

Fortem Financial

www.fortemfin.com