Talk of a Recession is increasing and the yield curve is inverted again. These are usually sure signs that a recession is on the horizon. As with many things these days, the definition of a Recession is ever changing. In the past, the technical definition of a Recession was two quarters or more of Negative Gross Domestic Product (GDP). However, because of the economic disruptions from COVID-19, they have expanded the definition to make it more difficult to say whether we are going into a Recession, In a recession, or coming out of a recession.

Here is the definition of Recession according to Investopedia:

What is a Recession?

A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It had been typically recognized as two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators such as a rise in unemployment. However, the National Bureau of Economic Research (NBER), which officially declares recessions, says the two consecutive quarters of decline in real GDP are not how it is defined anymore. The NBER defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales. (1)

Recessions are visible in industrial production, employment, real income, and wholesale-retail trade. The working definition of a recession is two consecutive quarters of negative economic growth as measured by a country's gross domestic product (GDP), although the National Bureau of Economic Research (NBER) does not necessarily need to see this occur to call a recession, and uses more frequently reported monthly data to make its decision, so quarterly declines in GDP do not always align with the decision to declare a recession.

Understanding Recessions

Since the Industrial Revolution, the long-term macroeconomic trend in most countries has been economic growth. Along with this long-term growth, however, have been short-term fluctuations when major macroeconomic indicators have shown slowdowns or even outright declining performance, over time frames of six months up to several years, before returning to their long-term growth trend. These short-term declines are known as recessions.

A recession is a normal, albeit unpleasant, part of the business cycle. Recessions are characterized by a rash of business failures and often bank failures, slow or negative growth in production, and elevated unemployment. The economic pain caused by recessions, though temporary, can have major effects that alter an economy. This can occur due to structural shifts in the economy as vulnerable or obsolete firms, industries, or technologies fail and are swept away; dramatic policy responses by government and monetary authorities, which can literally rewrite the rules for businesses; or social and political upheaval resulting from widespread unemployment and economic distress.

For investors, one of the best strategies to have during a recession is to invest in companies with low debt, good cash flow, and strong balance sheets. Conversely, avoid companies that are highly leveraged, cyclical, or speculative.

Recession Predictors and Indicators

There is no single way to predict how and when a recession will occur. Aside from two consecutive quarters of GDP decline, economists assess several metrics to determine whether a recession is imminent or already taking place. According to many economists, there are some generally accepted predictors that when they occur together may point to a possible recession.

First, are leading indicators that historically show changes in their trends and growth rates before corresponding shifts in macroeconomic trends. These include the ISM Purchasing Managers Index, the Conference Board Leading Economic Index, the OECD Composite Leading Indicator, and the Treasury yield curve. These are critically important to investors and business decision makers because they can give advance warning of a recession. Second, are officially published data series from various government agencies that represent key sectors of the economy, such as housing stats and capital goods new orders data published by the U.S. Census. Changes in these data may slightly lead or move simultaneously with the onset of a recession, in part because they are used to calculate the components of GDP, which will ultimately be used to define when a recession begins. Last are lagging indicators that can be used to confirm an economy’s shift into recession after it has begun, such as a rise in unemployment rates.

What Causes Recessions?

Numerous economic theories attempt to explain why and how the economy might fall off of its long-term growth trend and into a period of temporary recession. These theories can be broadly categorized as based on real economic factors, financial factors, or psychological factors, with some theories that bridge the gaps between these.

Some economists believe that real changes and structural shifts in industries best explain when and how economic recessions occur. For example, a sudden, sustained spike in oil prices due to a geopolitical crisis might simultaneously raise costs across many industries or a revolutionary new technology might rapidly make entire industries obsolete, in either case triggering a widespread recession.

The spread of the COVID-19 epidemic and the resulting public health lock-downs in the economy in 2020 are an example of the type of economic shock that can precipitate a recession. It may also be the case that other underlying economic trends are at work leading toward a recession, and an economic shock just triggers the tipping point into a downturn.

(1) National Bureau of Economic Research. "Business Cycle Dating Committee, National Bureau of Economic Research."

https://www.nber.org/cycles/jan08bcdc_memo.html

Let’s look at GDP

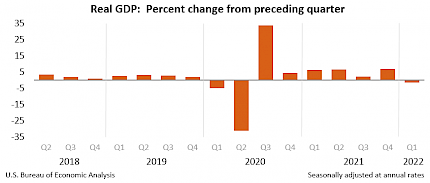

Real gross domestic product (GDP) decreased at an annual rate of -1.6 percent in the first quarter of 2022, according to the "third" estimate released by the Bureau of Economic Analysis. In the fourth quarter of 2021, real GDP increased 6.9 percent.

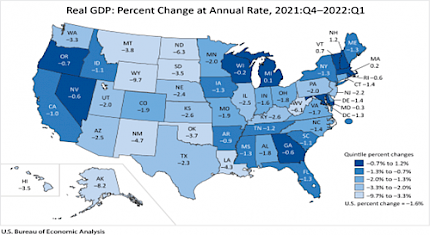

Real gross domestic product (GDP) decreased in 46 states and the District of Columbia in the first quarter of 2022, as real GDP for the nation decreased at an annual rate of -1.6 percent, according to statistics released today by the U.S. Bureau of Economic Analysis (BEA). The percent change in real GDP in the first quarter ranged from 1.2 percent in New Hampshire to –9.7 percent in Wyoming (table 1).

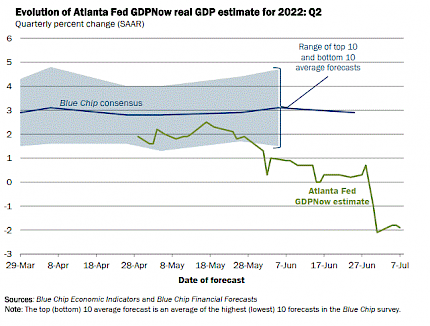

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.9 percent on July 7, up from -2.1 percent on July 1.

After this week's releases from the Institute for Supply Management, the US Census Bureau, and the US Bureau of Economic Analysis, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth increased from 0.8 percent and -15.1 percent, respectively, to 1.3 percent and -14.9 percent, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth decreased from 0.38 percentage points to 0.21 percentage points.

Recession Talk Approaching Shutdown Levels

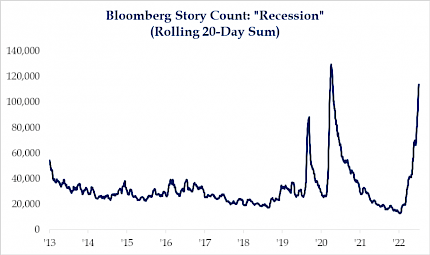

The Bloomberg story count for the word “Recession” has exploded higher over the past two weeks. Perhaps the yield curve inverting once again is driving some of this news. However, the latest reading now exceeds what was seen in the back half of 2019 when the curve inverted. Furthermore, it is not far from the peak seen during the shutdowns in 2020.

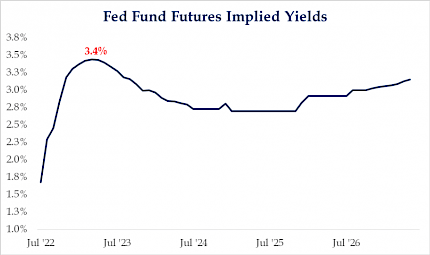

Fed Fund Futures Show Peak Rate Of 3.4%

Due to the increased concerns about a recession, the Fed Fund Futures are suggesting that the peak rate this cycle will be 3.4% in early 2023 before the Fed has to begin cutting rates. As we have said multiple times, if the Fed were to end its tightening cycle with a rate between 3.25-3.50, it would be the first time since 1970 that the Fed Funds rate was lower than the inflation rate. Therefore, we are still of the view there is no Fed put.

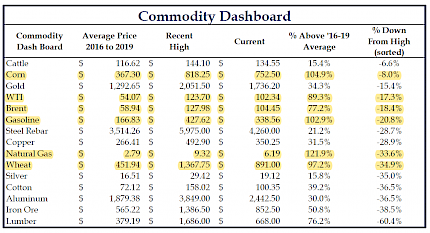

Commodity Prices Off The Highs But Still Elevated

It feels to us that the peak inflation story as of late is being driven by a broad-based decline in commodity prices from their recent highs. While most of the commodities on our dashboard are down more than -15% from the highs, the majority also remain well above where they were pre-covid. In particular, Food and Energy related commodities are up the most.

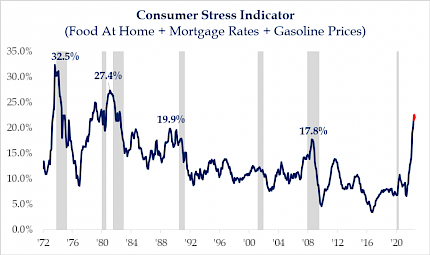

First Sign of Stress Easing For The Consumer

Preliminary July data shows that stress for the consumer may be about to ease some as two of the three inputs (gas & mortgage rates) have been falling. Next week we will receive the Food At Home CPI for June, which could still be accelerating, but either way, it appears we are nearing a peak. That is not to say consumers won’t remain stressed, but more so, conditions may not be worsening, at least for the time being.

Bottom line: the U.S. economy doesn’t go into recession without labor-market weakness, based on history. So, the weak GDP prints in 1Q and likely 2Q have not created typical economic slack. Inflation pressure remains. The Fed’s plan for additional rate hikes + Quantitative Tightening (QT) in the next several meetings still looks intact. From here (at full employment) job growth m/m should be slowing – we’re still waiting.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com