Most of the world is now hunkered down. We’re socially distancing ourselves from each other in the tiny clusters of our nuclear families for an unknown period. The stock market has plunged at a record speed, wiping out gains made since December 2018, and with fears of more selling to come. But there is light at the end of the tunnel as efforts are underway on various fronts, healthcare therapies and Government financial stimulus, that may show us the path forward. And finding that path is the key for the markets.

One of the questions I’ve been getting frequently from clients and peers: is this like 2008 (the Global Financial Crisis), 2000 (dotcom bust), 2001 (9/11), 1987 crash? This crisis is like none of those prior ones, and yet it’s like all of them.

We need to go further back in history to find an event that may offer us both insight and foresight. We need to look at World War II. Obviously, we are not in a global military conflict, but we are in conflict against an unseen enemy at a global scale.

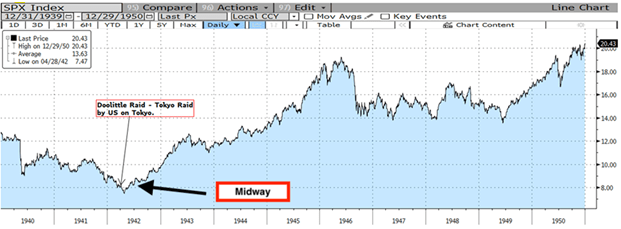

When WWII started in 1939, the S&P 500 Index, if it had been in existence at that time, would have started correcting from around 12 and dropped to 7.47 in 1942 (see chart). Counterintuitively, the market didn’t start its march upward when we won the war. Rather it started rallying once there was a path forward towards victory. That turning point occurred in 1942, three years before the war ended, sparked by the Doolittle Raid on Tokyo followed by the victory at Midway.

Source: Bloomberg

The Launch Date of the S&P 500 Index is March 4, 1957; all information for the index prior to its Launch Date is back-tested, based on the methodology that was in effect on the Launch Date. Back-tested performance, which is hypothetical and not actual performance, is subject to inherent limitations because it reflects application of an Index methodology and selection of index constituents in hindsight.

The market tends to move to extremes when driven by investors’ fear and greed. And it currently seems to be reflecting the worst fears of a wholesale economic shutdown.

Our current fight is on four fronts:

- Local response: City and state authorities are doing what they can to marshal their local resources and infrastructure to slow down if not stop the spread of Covid-19. We are living this ourselves daily. This is a sudden shock to local economies, but a necessary step in this fight. Our social distancing efforts are working and we are already seeing an effect on the contagion curve in Washington state and New York.

- Healthcare response: This is the front line. Thousands of healthcare professionals are fighting to protect and save lives. Scientists and researchers globally are racing to find a vaccine and therapies are being rolled out and studies as we write this and they are having better success than expected. This is the long-term solution but will take time to achieve. A vaccine is the victory we’re all after, but current therapeutics will greatly reduce the contagion curve we were expecting. We are currently seeing a leveling off of new cases in New York and a reduction in Washington State.

- Fiscal Response: The US Federal government is working to provide short-term and near-term support to the halting national economy. Through the Stimulus package passed last night by the Senate, tax relief, programs for small and medium sized businesses and even direct cash is on the way to help those most affected. This is necessary, but we will need more, and we will need it fast as we move forward, in the shape of long-term programs and projects to help get the economy on its feet again. Unfortunately, this will be expensive – but if we can spark growth to return on a broader scale, we will be able pay our way out of it over time.

- Monetary response: This is the financial front line. The need is immediate, and the fix is necessary. The Federal Reserve (Fed) is deploying an ever-increasing set of tools at its disposal to keep the financial markets from seizing up. The Fed has announced it will do whatever it takes to Keep credit flowing through Quantitative Easing (QE), providing USD Swap lines to other central banks, trying to flatten the yield curve as investors dash to cash, etc., are critical. But we need more.

The market needs more QE to stabilize. It’s a very acute problem that can have cascading effects on the rest of the global economy, such as corporate bankruptcies and large-scale unemployment. The Fed’s announcement of the enormous QE Unlimited program leading a round of fresh new buying for those who need to sell may provide the floor to those liquidity risks. Given the scale of the potential economic slowdown, the Senates plan for fiscal action is a little late but will give us much needed assistance in restarting our self-imposed stall to our economy. The current Senate Plan gives us a view of some stability, or a way out of the tunnel through these efforts, we expect the market will rally back in anticipation of that recovery.

Portfolio positioning for our Doolittle moment

Just like in WWII, it seems to us that the market will rally before the war against COVID-19 is won. So, while we don’t know exactly when the Doolittle Raid-equivalent will be against COVID-19, we like the following areas of focus to prepare a portfolio:

- High Quality: Focusing on the highest quality companies in the universe has historically worked well in this type of environment. For example, by allocating to companies with a proven record of increasing their dividends over time.

- Systematically Tactical: A tactical allocation approach can be an effective tool to de-risk a portion of the portfolio when market trends begin to shift. However, with these types of strategies it’s also important to have a disciplined action plan to put money to work back in the market when it feels the most difficult. To combat behavioral finance headwinds, we prefer systematic strategies that move to cash and reinvest automatically to navigate these environments.

- Dollar cost average: Given the speed and steepness of the selloff, consider rebalancing into stocks in small increments over time.

- Active Fixed Income: We believe in actively managed fixed income strategies. In these volatile markets, it becomes paramount to find managers and strategies that can independent evaluate the credit and liquidity risks within a portfolio and, perhaps more importantly, take advantage of opportunities that arise from fear and forced selling.

- Relative Valuation: Based on our relative valuation work, we like (1) Value stocks over growth stocks. After underperforming for years, Value may be well positioned for a rebound rally. (2) Strategies that risk weight instead of market cap weight. During this selloff we have seen all names being cut, but the severity of decline has been generally been sharper as you go down in market cap, with the largest mega cap growth names holding up better on a relative basis. We think many of these same securities outside the largest mega cap growth companies could potentially ride a tailwind when the market starts to recover.

Source: Victory Capital

Sincerely,

Fortem Financial

www.fortemfin.com

(760) 206-8500