The question is where does the market and economy go from here? With tax reform looking like it will pass this week, unemployment at or below 4% and an accommodative Federal reserve and reductions in regulations, we think there is still more room to run in 2018 and beyond. Yes there may be a pause but we think that pause will be the one the refreshes, instead of one that undermines current gains. Stocks rose to all-time highs on Friday as expectations rose for passage of tax reform; several congressional Republicans, who had threatened ‘no’ votes, pledged their support for the ‘final’ bill. Details of the compromise legislation were revealed late Friday. This week’s likely schedule involves a vote by the House on Tuesday, followed by a Senate vote, with the goal of presenting the bill to the President on Friday. The signature element of the legislation will reduce the U.S. corporate tax rate from 35% to 21%; by comparison, the average corporate tax rates in Asia and Europe are around 20%. Next on the Congressional agenda is infrastructure; here the hope would be a bipartisan spending program to rebuild the nation’s roads, bridges, and buildings, and, in the process, accelerate economic growth. Meanwhile, Disney announced an agreement to acquire certain assets from Twenty-First Century Fox in a deal valued at approximately $52.4 billion. The transaction includes the rights to the X-Men, Simpsons, and Avatar franchises and will create a formidable media giant with a vast content library; the move was driven, in part, in response to emerging technology-based competitors such as Netflix and Amazon. The new Fox will retain live news, national sports networks, and real estate assets.

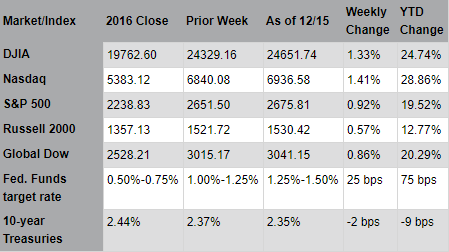

The Federal Reserve raised benchmark interest rates by 25 basis points last week; the markets treated the widely-anticipated announcement, though, as a non-event. Fed officials reiterated their October estimate of three rate hikes in 2018 and two in 2019. This was Janet Yellen’s final meeting as Fed Chair; the broadly positive reviews of her tenure reflect the steady growth in the economy, rising stock valuations, and subdued market volatility. Economic data remained robust: the National Federation of Independent Business (NFIB) Index of Small Business Optimism for November reached its second-highest reading in its 44-year history; retail sales grew 5.8% year-over-year; and an early report on December manufacturing activity pointed to strong growth with increases in production, new orders, and employment. Meanwhile, Germany’s central bank revised its 2017 growth forecast from 1.9% to 2.6%, and increased the 2018 GDP forecast from 1.7% to 2.5%. In China, industrial production rose 6.1% in November; new construction starts increased 18.8%; and retail sales gained 10.2% year-over-year.

Heading into 2018, investors seem almost universally optimistic regarding the outlook for the global economy, and for the stock market. Yet, clouds may appear on the horizon. These might include monetary policy changes under a new Fed Chair, or the possibility of a more aggressive schedule of interest rate hikes. Midterm elections may also re-introduce market volatility. Finally, heightened investor bullishness could, by itself, contribute to conditions that increase the likelihood of a market reversal or correction. Nevertheless, underlying economic fundamentals support continued growth in corporate sales and earnings. And, tax reform should provide a near-term boost to the economy that would enable the market rally to continue. Indeed, companies have expressed confidence in the positive impact of tax reform on both hiring and investment. Next year, potential legislation related to infrastructure spending could further buoy corporate and investor spirits.

* Pacific Global Management

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

1. Not unexpectedly, the Federal Open Market Committee decided to raise the target range for the federal funds rate 25 basis points to 1.25%-1.50%. This marks the third such rate increase in 2017. The Committee based this rate hike on continued strengthening of the labor market and rising economic activity. Despite hurricane-related disruptions, the Committee continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace and labor market conditions will remain strong. Inflation on a 12-month basis is expected to remain somewhat below 2% in the near term but to stabilize around the Committee's 2% objective over the medium term.

2. Producer prices increased 0.4% in November, the same increase as in each of the previous two months. Over the last 12 months, producer prices are up 3.1%, which is the largest 12-month price gain since the 12-month period ended January 2012. The producer prices less foods, energy, and trade services rose 0.4% in November, the largest advance since increasing 0.6% in April. For the 12 months ended in November, prices less foods, energy, and trade services moved up 2.4%.

3. The increase in producer prices may be impacting consumer prices. The Consumer Price Index (CPI) rose 0.4% in November and is up 2.2% over the past 12 months. Energy prices rose 3.9% for the month and accounted for about three-fourths of the increase in the CPI. The index for all items less food and energy increased a marginal 0.1%, and is up 1.7% over the 12 months ended in November.

4. November retail sales were $492.7 billion, an increase of 0.8% from the previous month, and 5.8% above November 2016. Retail sales excluding auto sales increased 1.0% in November. Gasoline station sales increased 2.8% for the month and are up 12.2% over last November. Nonstore (online) retail sales climbed 2.5% in November and are 10.4% ahead of November 2016 sales.

5. The number of job openings dipped by about 181,000 in October compared to September, according to the latest Job Openings and Labor Turnover report from the Bureau of Labor Statistics. Job openings have been at or near record high levels since June. Job openings increased in accommodation and food services (+94,000), construction (+48,000), and real estate and rental and leasing (+40,000). Job openings decreased in wholesale trade (-90,000), finance and insurance (-47,000), information (-32,000), and nondurable goods manufacturing (-26,000). In October, hires increased to 5.6 million and separations were little changed at 5.2 million. Over the 12 months ended in October, hires totaled 64.3 million and separations totaled 62.2 million, yielding a net employment gain of 2.1 million.

6.The federal deficit for November soared to $138.5 billion, about $75 billion higher than the October deficit and $1.8 billion higher than the November 2016 deficit. Total government receipts for November were $208.4 billion, and total government outlays were $346.9 billion. Over the first two months of the 2018 fiscal year, the deficit stands at $201.8 billion, which is 10.6% greater than the deficit over the same period last fiscal year.

7. U.S. import prices rose 0.7% in November after ticking up 0.1% in October. Higher prices for fuel drove the increase in November as nonfuel prices recorded no change. Import fuel prices rose 22.2% over the past year, driven by a 24.1% increase in petroleum prices. U.S. export prices increased 0.5% in November following a 0.1% advance the previous month. Export prices advanced 3.1% over the past 12 months and have not recorded an over-the-year decrease since the index fell 0.2% in November 2016.

8. According to the Federal Reserve, industrial production moved up 0.2% in November after posting an upwardly revised increase of 1.2% in October. Manufacturing production also rose 0.2% in November, its third consecutive monthly gain. The output of utilities dropped 1.9%. The index for mining increased 2.0%. The index for mining increased 2.0%, as oil and gas extraction returned to normal levels after being held down in October by Hurricane Nate. Excluding the post-hurricane rebound in oil and gas extraction, total industrial production would have been unchanged in November. Total industrial production was 3.4% above its year-earlier level.

9. In the week ended December 9, the advance figure for initial claims for unemployment insurance was 225,000, a decrease of 11,000 from the previous week's level. The advance insured unemployment rate slipped to 1.3%. The advance number of those receiving unemployment insurance benefits during the week ended December 2 was 1,886,000, a decrease of 27,000 from the previous week's level, which was revised up 5,000.

According to the Federal Reserve, industrial production moved up 0.2% in November after posting an upwardly revised increase of 1.2% in October. Manufacturing production also rose 0.2% in November, its third consecutive monthly gain. The output of utilities dropped 1.9%. The index for mining increased 2.0%. The index for mining increased 2.0%, as oil and gas extraction returned to normal levels after being held down in October by Hurricane Nate. Excluding the post-hurricane rebound in oil and gas extraction, total industrial production would have been unchanged in November. Total industrial production was 3.4% above its year-earlier level.

Eye on the Week Ahead

The week before Christmas is a busy one for economic news. The third and final report on the gross domestic product for the third quarter is available this week, along with November's monthly report on sales of new and existing homes.