Since the beginning of 2022, the media has regularly warned a recession is coming. As we suggested previously, if a recession did occur, it would be the most well forecasted recession ever on record.

Something else has indeed happened. As discussed in numerous measures suggest a recession is forthcoming. However, that recession has yet to reveal itself. Such has led to a fierce debate between the bulls and the bears. The bears contend that a recession is still coming, while the bulls are betting more heavily on a “no landing” scenario or, instead, avoiding a recession. Even the Federal Reserve is no longer expecting a recession.

But how is a “no recession” outcome possible amid the most aggressive rate hiking campaign in history, deeply inverted yield curves, and other measures warning of its inevitability?

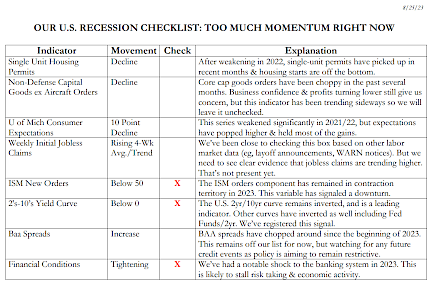

We believe we have been seeing rolling recessions in different parts of the economy over 2022 – 2023 so far. Let’s look at the Recession check list we have been following from our research provider Strategas.

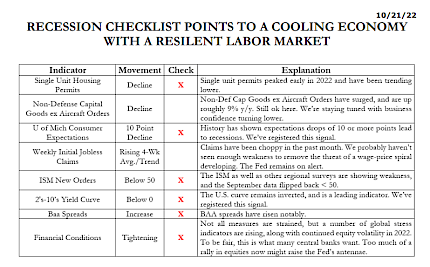

Looking at the normal key indicators of recession, In October of 2022 the list looked almost complete indicating Recession was imminent over the next few months. This was also the low of the market pull back in 2022:

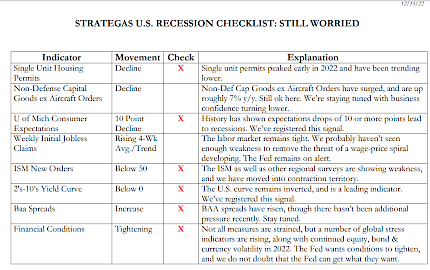

The key indicators looked the same in December 2022 as the market was trending sideways:

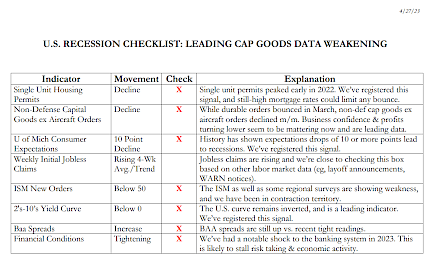

In April 2023, the Key indicators got worse as one would expect and showed we were basically in recession in every key indicator, other than unemployment and the S&P and Nasdaq 100 were rallying like the start of a new bull market:

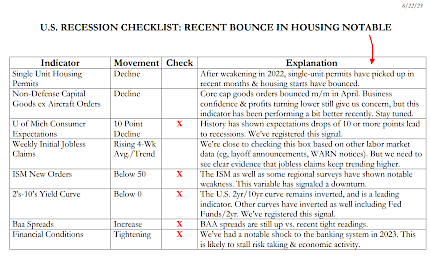

Then just as the FED was hitting its stride with interest rate increases and the 30-year Mortgage rate above 7% for the first time in more than two decades Housing permits picked up:

Fast forward to August and you can see the key indicators are in much better shape, and other than the inverted yield curve and ISM in traditionally what is a sign of a downturn in the economy, the media is still suggesting Recession is imminent. But the key indicators tell a different story:

Reviewing the above timeline through the key indicators over the last year you can see a full business cycle unfold. One that looked like recession was just around the corner to the latest report showing we are basically at the beginning of a new bull market and business cycle.

How can this be? We suggest you follow the MONEY

Let’s review the actions to date to keep some consistency in the analysis.

As the economy shut down in March 2020 due to the pandemic, the Federal Reserve flooded the system with liquidity. Simultaneously, Congress passed a massive fiscal stimulus bill. That bill extended Unemployment Benefits by $600 weekly and sent $1200 checks directly to households.

Then in December 2020, Congress passed another $900 billion stimulus bill. That bill again extended unemployment benefits at a reduced amount of $300 per week, plus sending $600 checks to individuals again.

Not to be outdone, after Biden took office, the Administration passed the solely Democrat-supported $1.9 trillion “spend-fest.” In that bill, $900 billion went to individuals through $400 extended unemployment benefits and $1400 checks directly to households. The remaining $1.1 trillion had little economic value as bailing out municipalities and funding pet projects didn’t boost consumption.

Unsurprisingly, the result of stopping supply by shuttering the economy and flooding households with money was, you guessed it, inflation.

M2 As A Percentage Of GDP

However, this surge in money supply also explains why a recession remains so elusive. While the annual rate of change in the money supply has plunged, which is why inflation is contracting, the money injected into the economy is still in circulation. We know this by examining the money supply as a percentage of the economy.

Yes, M2 as a percentage of GDP spiked during the pandemic-driven spending frenzy, but M2 has risen steadily since the “Financial Crisis.” This explains why the economy held up over the last 13 years to various economic events that should have likely resulted in a recession.

Avoiding a recession is easier to understand when put into the context of the surge in money supply derived from continued fiscal and monetary inputs.

However, the cost of all this government spending and increased money supply has led to subpar economic growth and lower standards of prosperity.

But that, as they say, is “history.” With all of those Covid-era programs ending, the Fed hiking interest rates, and reducing their balance sheet, how is the economy still avoiding the “inevitable recession?”

While many economists and analysts expect a recession due to the many historically accurate indicators and we have shown above, one thing continues to get overlooked. That is the $1.7 Trillion Inflation Reduction Act (IRA) passed by the Biden Administration in 2022. While the bill did pass, it has nothing to do with reducing either inflation or the deficit.

While the deficit did decline along with inflation, such was a function of the massive stimulus not being renewed and the normalizing of supply and demand. Secondly was the passage of the most recent “debt ceiling” bill, which automatically increases spending by 8% each year due to baseline budgeting in Washington. Such is why the deficit continues to swell each year.

Unsurprisingly, considering there is no fiscal responsibility in Washington, D.C., Federal spending continues to rise markedly. That spending continues to keep the economy from the widely expected recession.

However, such may not always be the case. As noted above, the massive flood of monetary stimulus is still working through the system. When combined with increases in the deficit, the economy has managed to maintain some growth. However, one key statistic that is just starting to be talked about is that federal and state tax receipts are falling which has long been a leading recessionary indication.

The recessionary onset remains delayed as the Federal government continues its spending orgy. However, if or when some fiscal sanity returns to Washington, the spending contraction will likely trigger the recession’s onset.

However, until then, the “no recession” view may continue to support the bullish case.

Source: Strategas, Lance Roberts Chief Portfolio Strategist/Economist RIA Advisors

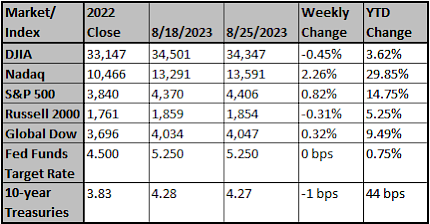

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Post-pandemic, world facing gloomy stew of debt, trade wars and poor productivity

Record levels of government debt, geopolitical tensions that threaten to split the global trading system, and the likely persistence of weak productivity gains may saddle the world with a slow-growth future that stunts development in some countries even before it starts.

Reuters

Futures rise as focus shifts to inflation, jobs data

U.S. stock index futures edged higher on Monday ahead of key inflation and jobs data due later this week that will offer more clues on the Federal Reserve's interest rate trajectory, while China's measures to boost its markets provided further support.

Reuters