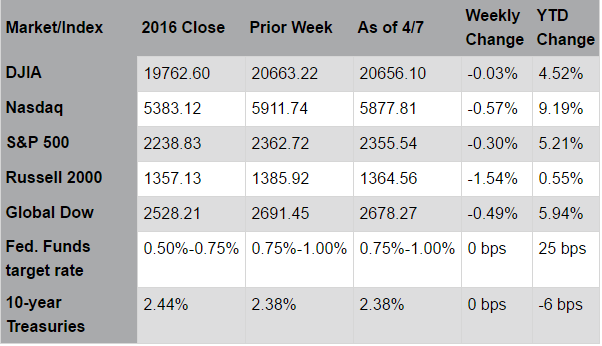

Markets last week varied from unchanged (for the Dow Jones Industrial Average) to modest, or more significant, declines for the S&P 500® Index, the NASDAQ and the Russell 2000® Index, respectively. The mixed results followed the midweek release of the Federal Reserve’s March meeting minutes. Discussions among Fed officials on the gradual unwinding of bond holdings, a process known as “balance sheet normalization,” unsettled investors. Most members of the monetary policy committee anticipated the normalization process to begin sometime this year; the timeframe apparently surprised the markets. We note that the timing, which reflects the Fed’s increased confidence in the economy, should bode well for companies and stock prices. On Friday, the March employment report fell well short of expectations; yet, the unemployment rate declined to 4.5%, the lowest level since 2008, even as labor force participation has increased. Moreover, harsh weather conditions during the period almost certainly contributed to the lower-than-expected job gains. Other economic data this week offered some reassurance. Car sales in March, albeit at lower levels than February, continue to track near historically high levels. Heavy duty truck orders, meanwhile, jumped 42% as energy, construction, and transportation activity increased. And, oil prices, which hit a three-month low of $47.70 on March 23rd, rose above $52 per barrel as global stockpiles are beginning to rebalance.

Earnings season starts in earnest next week with reports from JPMorgan Chase, Wells Fargo, Citigroup, and Delta Air Lines. Heading into the period, analysts expect companies in the S&P to report sales growth of 7.1% and earnings per share (EPS) growth of 8.5%. The latter would represent an acceleration compared to the 3.1% and 5.1% EPS growth rates reported for the third and fourth quarters, respectively, of 2016. At the sector level, Materials (+13.6%), Financials (+13.0%), and Information Technology (+12.8%) are forecast to produce the strongest EPS gains. Energy companies are expected to deliver an impressive 36.9% growth in sales as the sector rebounds from last year’s extremely low activity levels. Continued improvement in this important sector would further benefit the manufacturing, construction, and transportation industries in the quarters ahead. Investors will be particularly interested in management commentaries regarding business conditions and the outlook for company-specific growth initiatives for the remainder of the year. As a result, the earnings period will likely set the tone for markets over the next several weeks.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

- The employment sector continued to strengthen in March, although job growth slowed compared to the first two months of the quarter. According to the report from the Bureau of Labor Statistics, total employment edged up by 98,000 in March. By comparison, there were 219,000 new jobs added in February and 216,000 new jobs added in January. The unemployment rate declined 0.2 percentage point to 4.5%. The number of unemployed persons dropped 326,000 to 7.2 million. Over the past 12 months, the number of long-term unemployed was down by 526,000. At 63.0%, the labor participation rate was unchanged from the prior month. The employment-to-population ratio was 60.1% — 0.1 percentage point more than February. Over the month, employment growth occurred in professional and business services (+56,000) and in mining (+11,000), while retail trade lost jobs (-30,000). The average workweek in March was 34.3 hours, and the average hourly earnings increased $0.05 to $26.14 following a $0.07 increase in February.

- The manufacturing sector expanded in March, but at a slower pace than February. According to the latest Manufacturing ISM® Report On Business®, the March purchasing managers' index came in at 57.2%, down slightly from the February reading of 57.7%. A reading of 50% or better indicates expansion. The Markit U.S. Manufacturing PMI™ fell to 53.3 in March compared to 54.2 in February. Both the ISM® and Markit reports showed new orders and manufacturing output slowed in March.

- Economic activity in the non-manufacturing sector also grew in March, according to the latest Non-Manufacturing ISM® Report On Business®. The non-manufacturing index registered 55.2%, which is 2.4 percentage points lower than the February reading of 57.6%. Business activity and new orders increased in March, but not at the level of expansion in February. Growth in prices and employment also slowed in March compared to the prior month. While respondents were generally positive about the overall economy and business conditions, they expressed a degree of uncertainty about future government policies on health care, trade and immigration, and the potential impact on business.

- The final report on international trade in goods and services for February revealed the goods and services deficit was $43.6 billion for the month, down $4.6 billion from $48.2 billion in January, revised. February exports were $192.9 billion, $0.4 billion more than January exports. February imports were $236.4 billion, $4.3 billion less than January imports. Year-to-date, the goods and services deficit increased $2.8 billion, or 3.1%, from the same period in 2016. Exports increased $25.8 billion, or 7.2%. Imports increased $28.6 billion, or 6.4%. Year-to-date, the largest U.S. trade deficit in goods is with China at $61.9 billion, followed by the European Union at $25.4 billion.

- In the week ended April 1, the advance figure for seasonally adjusted initial claims for unemployment was 234,000, a decrease of 25,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 258,000 to 259,000. The advance seasonally adjusted insured unemployment rate remained at 1.5%. The advance number for seasonally adjusted insured unemployment during the week ended March 25 was 2,028,000, a decrease of 24,000 from the previous week's unrevised level of 2,052,000. The four-week moving average was 2,023,000, a decrease of 7,750 from the previous week's unrevised average of 2,030,750. This is the lowest level for this average since June 17, 2000, when it was 2,016,750.

Eye on the Week Ahead

The week focuses on inflationary indicators as the latest information on consumer prices, producer prices, and retail sales becomes available for March. Also, investors will be watching for first-quarter corporate earnings reports, which should begin coming out this week.