COVID-19 cases in the United Kingdom, France, and Spain have been picking up, prompting London Mayor Sadiq Khan to have talks for new restrictions aimed to slow the spread of the virus. Treasury yields dropped over the course of the week on the increased COVID concerns in Europe and comments from the Federal Reserve. On Tuesday, Fed Chairman Jerome Powell testified before Congress and said another fiscal stimulus would be important to aid the economy. These calls for additional stimulus were echoed by other senior U.S central bank officials on Wednesday. This all led investors to seek the perceived safety of Treasuries and yields to fall. Investors also worried about a slower economic recovery as initial jobless claims on Thursday were 870k, compared to estimates of 850k, and continuing claims were 12.58m compared to estimates of 12.3m. Gold prices also dropped 5% over the week.

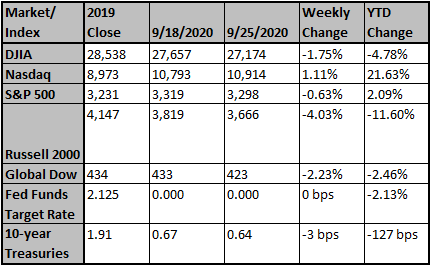

With less than a week to close out the third quarter, stocks closed slightly lower than last week with the S&P 500 contracting by -0.61%. Hopes of a stimulus package dwindled last week after representatives expressed doubts of a deal between House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin being struck by election day. However, most headlines were overshadowed by the passing of Supreme Court Justice Ruth Bader-Ginsburg. The partisan divide was expressed on whether a confirmation hearing would be appropriate in the last weeks of President Trump’s first term.

Business confidence is trying to recover, with the Business Roundtable CEO index rising to 64 in 3Q. Housing has also been a source of strength in the U.S. (new home sales existing home sales, mtg apps for purchase, homebuilders sentiment, etc). There are still uniquely-impaired areas in this pandemic (eg, aircraft). But CEO’s appear to be planning for a durable economic bottom, even if it will take time to recover the prior level of economic activity. A sense of hope was felt in the restaurant industry as Darden Inc., the parent company of Olive Garden and Red Lobster, reported better than expected earnings and margins. Reduced capacity dining was offset by carryout orders, boosting the company’s first-quarter earnings. Investors will gauge the economy next week when 2Q GDP is released on Wednesday, closing out the quarter and preceding earning season.

True, there remains plenty of worrisome news, with second-virus-wave concerns in Europe & other locations. U.S. initial jobless claims rising slightly w/w to 870,000 in the Sep 19th week also indicate some loss of momentum. But businesses appear to be pushing through with their overall plans, even if there are local lockdowns in activity. Manufacturing (especially global companies that can tap into growth from Asia) is still performing better than services. The problem is not really with goods now. Goods production & global trade matter for the S&P 500.

Academic research has also indicated that the full lockdown is too blunt a tool, and medical knowledge & treatment for COVID-19 have improved significantly in the past 6 months. NBER working paper #27719 notes that: “First: across all countries and U.S. states that we study, the growth rates of daily deaths from COVID-19 fell from a wide range of initially high levels to levels close to zero within 20-30 days after each region experienced 25 cumulative deaths. Second: after this initial period, growth rates of daily deaths have hovered around zero or below everywhere in the world. Third: the cross-section standard deviation of growth rates of daily deaths across locations fell very rapidly in the first 10 days of the epidemic and has remained at a relatively low level since then. Fourth: when interpreted through a range of epidemiological models, these first three facts about the growth rate of COVID deaths imply that both the effective reproduction numbers and transmission rates of COVID-19 fell from widely dispersed initial levels and the effective reproduction number has hovered around one after the first 30 days of the epidemic virtually everywhere in the world … failing to account for these four stylized facts may result in overstating the importance of policy mandated NPIs [non-pharmaceutical interventions] for shaping the progression of this deadly pandemic.” (Atkeson, Kopecky, Zha, 8/2020)

Bottom line: for the average person, there’s little new information coming from health officials on COVID-19, simply a repetition of previous concerns. That doesn’t mean there won’t be additional local virus worries, indeed there already are in numerous places (Europe, Canada, etc). The non-pharma health response just doesn’t seem to matter one way or the other statistically. We’re more interested in the plans of business leaders, who seem intent on fading a global lockdown now.

In Florida, “Gov. Ron DeSantis says he is lifting all restrictions on businesses statewide that were imposed to control the spread of the virus … Most significantly, that means restaurants and bars in the state can now operate at full capacity.” (NPR)

Businesses may fail, but they appear to be giving it a go first. For those affected by local lockdowns, there are economic policies that have proven effective (eg, the U.S. CARES act). The biggest risk remains that we end policies that are effective too early, in our view. Of course, we could be wrong, there could be virus mutations, compounding conditions (flu), or other medical considerations. But if we are trying to distinguish what is the base case and what is the risk case, it looks like the economy is still biased toward growth at the moment.

Source: Strategas, First Trust

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark the performance of specific investments

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Market Snapshot: Dow surges nearly 500 points to set upbe...

U.S. stock indexes traded higher at midday Monday, as investors brace for a period in which the race for the White House and the state of the economy may come into greater clarity.

Economic Preview: U.S. September job report is going to s...

The September job report will signal that the U.S. economic recovery has entered a more tenuous phase.

Durable-Goods Orders Rise for Fourth Straight Month

Orders for long-lasting factory goods increased for the fourth consecutive month in August, a sign of the manufacturing industry's continued recovery from coronavirus pandemic-related dis...

Trump-Biden delayed election outcome worries overblown: G...

Markets are overestimating the possibility the 2020 election result will be delayed, according to Goldman Sachs Group.