The equity markets certainly took investors on a wild ride in the holiday shortened week. On Monday, the Dow Jones Industrial Average lost 650 points; on Wednesday, the markets rallied with the Dow gaining 1086 points, its largest one-day gain in history. On Thursday, extreme volatility drove the Dow down over 600 points before reversing course to close up 260 points. For the week, the major indices posted gains for the first time in December, the Nasdaq rebounded from bear market territ… View More

December 2018

Post 1 to 10 of 10

Today is a great example of the danger of trying to time the market. In October, November, and December, investor sentiment began to sour, and the markets trended lower. The S&P 500 sold off 19.8% from September 21, 2018 through December 24, 2018. The Dow sold off 18.5% and the Nasdaq sold off 22.5% during the same period. With market losses mounting, 2018 was beginning to feel a lot like 2008. However, there are sharp contrasts between 2008 and 2018. In 2008, the US (and glob… View More

The federal government is headed for a partial government shutdown that will likely last until January 3rd when the new Congress is sworn in. This is not the first time we have had a government shutdown through the holiday season, as we had one in 1995 when Bill Clinton was president. The major difference between today and 1995 is that this will be a “partial” shutdown with nearly 75 percent of the government already funded and completely unaffected by the shutdown. That leaves just 25 pe… View More

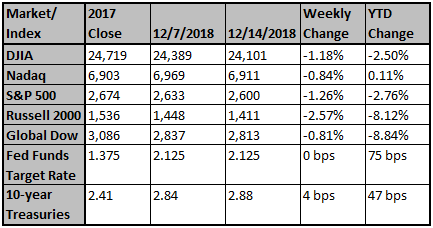

With attention on the Federal Reserve's decision to increase rates and their updated outlook for 2019, we wanted to share an article today that CNBC published (included below). As we wrote in our commentary after the Fed's press release on Wednesday, we believe the Fed and Powell were (1) buying themselves time - and the ability to review the data that will come in that time, and (2) leaving the door wide open to reduce the number of rate hikes they may do in 2019 without closing the door on f… View More

The markets are giving investors a rational reason to remain optimistic, but with investors' focus on the Fed's statement yesterday (and their interpretation of what they think it meant) seems to be clouding their vision. The chart below shows the S&P 500's earnings per share (green line), which is what ultimately moves the stock market (blue line)higher or lower. Looking over the last three years, we've seen consistent, stable earnings growth. In early 2018, we can see the dramati… View More

As was widely expected, the Fed raised the Federal Funds Rate 0.25%, bringing it to 2.5%. The press release shows a balance of demonstrating a willingness to ease the previously outlined path of interest rate hikes and a desire to avoid giving the unintended impression that they view the economy as weak. Rather than stating today that there will be no rate hikes next year, their outlook changed from an expectation of 3 rate hikes to 2 potential rate hikes next year. In their statement, they s… View More

There were very few places to hide by the end of last week, as even the “safe” stocks and groups got hit on Friday with Consumer Staples down nearly -2%, Utilities weaker on the day, Software under pressure, and even the Healthcare sector clipped -3.3% by day’s end. Flows into Healthcare have turned particularly frothy over the last several months. Former leaders like Equipment and Managed Care are unlikely to be spared. That’s the thing about corrective phases – ultimately, even t… View More

Over the last few weeks we have gotten a lot of questions as to what is up with the markets. We have explained in great detail a few things that are weighing down the market, like the recent oil sell off, the Federal reserve tightening too quickly, and the trade negotiations with China. All of these things are affecting the market but they should not be making the market swing like it has since the election just a few weeks ago. We read a great article this morning that echo’s some of … View More

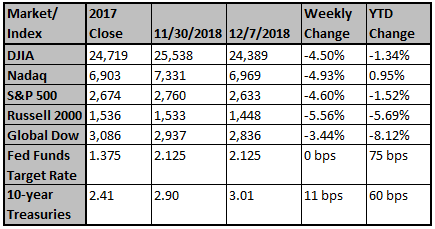

Turmoil reigned over the markets last week despite generally positive economic news. The last two weeks (months) have been wild, to say the least. For the week, a “risk off” sentiment prevailed; the Russell 2000® Index fell 5.56%; the Nasdaq lost 4.93%, S&P 500® Index fell 4.60% and the Dow Jones Industrial Average fell 4.50%. The week began positively, with the announcement that the U.S. would delay tariffs as it negotiated terms of a new trade pact with China. The euphoria quickl… View More

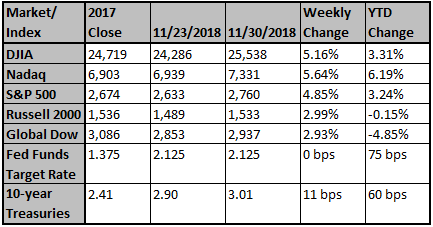

Last week we discussed the Federal Reserve policy as one of the items weighing down market performance. Other items currently weighing on the market are trade with China and the big sell-off in oil. The last 5 days appear to have broken favorably. Ultimately it’s the response from price action to news that we care about, and on that score, last Wednesday’s post-Powell move was among the strongest internal days we’ve seen for stocks this year. It looks like we may get another shot t… View More