There were very few places to hide by the end of last week, as even the “safe” stocks and groups got hit on Friday with Consumer Staples down nearly -2%, Utilities weaker on the day, Software under pressure, and even the Healthcare sector clipped -3.3% by day’s end. Flows into Healthcare have turned particularly frothy over the last several months. Former leaders like Equipment and Managed Care are unlikely to be spared. That’s the thing about corrective phases – ultimately, even the best companies are sold.

With 10 trading days left in the year, the S&P again finds itself back below the 2,600 level. More than 50% of constituents are down -20% from their respective 52-week high, but we’re reluctant to call price deeply oversold, at least compared to the 2011 and 2015/16 drawdowns. The Value Line Index has continued to underperform as well, a decent barometer for the “average stock” and uncharacteristic of any big change to the market’s tone. Absent any meaningful changes in leadership / momentum, we’d look for near-term rallies to be met with S&P resistance near the 2,730 level.

It’s a big week for the FOMC (FED). With solid retail sales (ex gasoline) and U.S. industrial production data last week, the Atlanta Fed GDPNow tracker is at 3.0% q/q A.R. for 4Q. The U.S. economy can likely take another Dec rate hike. But this could put interest rates above the level financial markets (U.S. & global) are comfortable with.

The FOMC should be commended for bringing real fed funds out of negative territory. Negative rates are an emergency setting, and no longer necessary. At the same time, the Fed should be well aware of the signal the markets are currently sending about the pace at which it is tightening. The interest rate the economy can take & the interest rate that makes financial markets consistent need to converge slowly, in our opinion. As the Fed discovered in early 2016, it must tread carefully in a world of low interest rates. We believe the FED will slow on its interest rates next year as they have indicated.

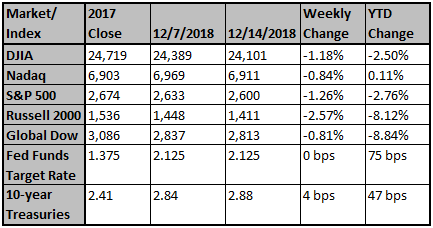

The equity markets have fallen in four out of the last five weeks as investors have paused, at least temporarily, in climbing the wall of worry. The “risk off” sentiment continued with the Russell 2000® down 2.57%, S&P 500® Index lost 1.26%, Dow Jones Industrial Average lost 1.18%, and Nasdaq fell -0.84%. All of the major indices closed the week in correction territory with losses of 10% or more from recent highs. Weaker-than-expected economic data in China and Europe prompted Friday’s selloff as fears of slowing global growth dominated sentiment. In China, industrial production fell to 5.4%, the slowest pace in three years; retail sales slowed to a 15-year low. In the Eurozone, economic data also disappointed, and business optimism deteriorated; several issues, including demonstrations in France, Italy’s latest budget revision to avoid EU sanction, and the latest uncertainties over the Brexit, were no doubt contributing factors.

More positive developments, though, include China’s announcement that it is reducing higher tariffs on auto imports, renewing purchases of oil and soybean products, and discussing other measures to open up their economy. Also, Canada’s release of the CFO of Huawei on bail does not seem to be a factor in trade discussions. U.S. retail sales rose in November; holiday sales should surpass last year’s level. Unemployment claims this week fell to 206,000, the largest weekly drop since April, 2015. Inflation remains in check with lower fuel prices increasing spending power. This week’s meeting of the Federal Reserve will likely include a 25 basis point increase in interest rates; investors will parse the Fed’s commentary for insight into planned rate increases in 2019.

Throughout 2018, some analysts have predicted the end of the bull market and a looming recession. Through September, positive economic data, including corporate revenue and earnings growth, propelled the markets. More recently, though, investors could not ignore the crescendo of concerns related to trade negotiations, the pace of Fed rate increases, Brexit votes, and excessive oil inventories that pushed oil prices down over 30%. Certainly, the on-going headlines about trade disruptions have fueled anxieties about a global slowdown. When sentiment turns negative, it typically endures until a change catalyst emerges. Oftentimes, the catalyst may have been known, but ignored by investors, until an event occurs to ignite a rally. Most recently changes in Fed commentary; the resumption of trade negotiations with China; and the OPEC agreement to cut production to rebalance supply and demand, have been significant positive developments. At current levels, many small and midcap stocks are significantly oversold; many now trade at discounts of more than forty percent despite favorable business conditions.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Latest News

Fear of interest rate hikes is fading as next Fed meeting...

As of Monday, the odds were pretty low in the futures market that the Fed would raise interest rates more than one more time, though traders still expect the Fed to hike the fed funds rat ...

Online Brands Are Embracing 'Clicks-to-Bricks' by Opening...

The cost of acquiring new customers online is soaring as more brands compete on platforms like instagram, so many businesses are going back to the basics.

Fed Says Two Welcome Things: Most Missed One Of Them

Last month, the Fed told investors that it was about done with its long-held policy of raising interest rates and also hinted that it had abandoned the use of forward guidance. Both bits...

Outside the Box: The stock market is overreacting because ...

Growth will slow, but there won't be a recession in 2019.