At the beginning of every new year we look toward the future in anticipation of what it will bring, and for years we've shared Bob Doll's Top 10 Predictions because he tends to get over 70% of them correct every year. As we begin the second half of the year, we wanted to share an update on how this year's predictions are working out. Below is his mid-year scorecard. The BLUE predictions are correct so far, and the RED predictions are too early to call yet. So far, 2018 has been a … View More

June 2018

Post 1 to 8 of 8

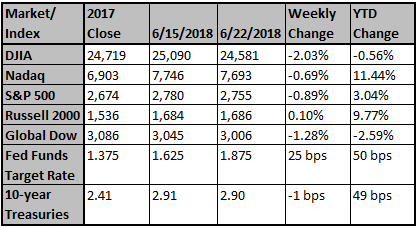

Trade headlines are likely to continue dominating markets; that is, until the second quarter corporate earnings season begins in July. The trade tensions between the U.S. and China continued. Thus far, the Trump administration has threatened to impose tariffs on roughly $450 billion of Chinese goods, nearly equivalent to the total value of Chinese imports last year. China promised a strong response including retaliatory tariffs as well as increased regulatory scrutiny on U.S. companies o… View More

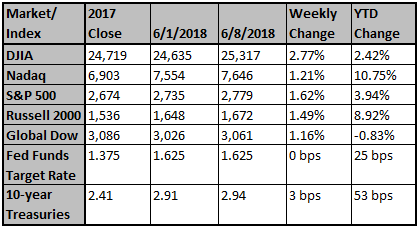

Markets were mixed last week as macroeconomic and geopolitical developments continued to dominate headlines. On Wednesday, the Federal Reserve raised interest rates and plotted a slightly more aggressive timeline for future rate hikes. In doing so, the committee noted that “economic activity has been rising at a solid rate.” On Thursday, the European Central Bank announced plans to end its bond-buying program in December. The move signaled the beginning of the end of extraordinary… View More

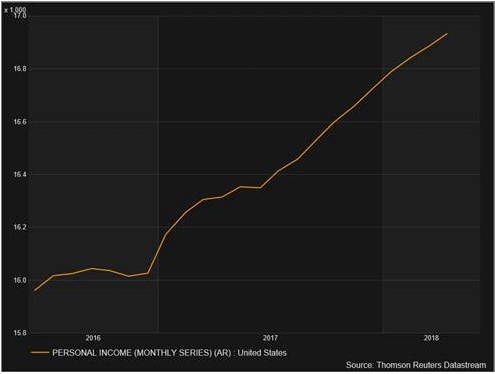

There has been a lot of talk as to whether the latest tax reform from Washington is having an effect on our economy. You hear “this tax cut was only for the rich and does nothing for the average working man”. We hear how “this tax plan is the worst thing that has ever happened to us” and how some in congress have vowed to repeal it because “it is pure evil and only benefits the one percenters”. We here at Fortem are not in that camp because all the economic data we rely on says ot… View More

To little surprise, the Federal Reserve hiked interest rates by 25 basis points following yesterday’s meeting. Of much greater note are the hawkish changes made to the text of the Fed's statement (and with no dissents), as well as changes in the forecast materials. While these changes are clearly in line with the continued improvement in economic data over recent months, it's a positive development from a Fed that has been exceedingly cautious over recent years in upgrading its outlook on… View More

Anxiety has heightened among investors and the wall of worry seems higher today than it was at the February market lows. Trade continues to be a prominent brick in the wall of worry and while it is a risk, it is manageable in our view. Even though it may seem like the US had a tough G7 meeting over the weekend. Data points (CEO Confidence, capex, unemployment, wage growth, PMIs, consumer confidence) still signal that there is time left in this business cycle and that the economy and markets can … View More

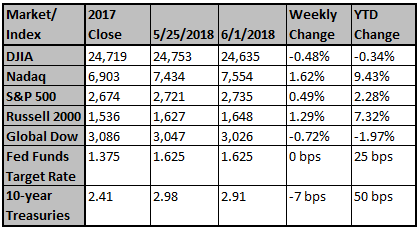

May Market Update In our January 2018 commentary, we stated that, "the S&P 500 is well above its historical average, but high valuations do not mean bear markets." We further stated, "while these (years when the market is above its historical average) were not the market's highest returning years, compared to the 10-year Treasury, currently at 2.48%, it still looks attractive." Reviewing the year to date numbers, as of May 31, 2018 the S&P 500 was up 2.0% whereas the Barclay's Aggre… View More

We note that the big story clients are concerned about remains the US trade policy, but the rapid acceleration of economic growth and the declining poll numbers for Democrats suggest that economic fundamentals are outweighing trade policy, at least for the time being. Fiscal policy (Tax Cuts) of $800bn this year dwarfs trade policy and most of the trade retaliation tariffs (Currently estimated at $80bn) are rounding errors in a $20 trillion economy. NAFTA remains the real risk and investors are … View More