US and global leaders have faced difficult decisions over the last month or so. As Covid-19 gained momentum, the US and much of the rest of the world began “sheltering in place,” effectively shutting down significant portions the global economy. There was sound logic in sheltering at home; it would help flatten the contagion curve of the Coronavirus, and with this being a NEW virus, it was the most likely way to flatten the curve within weeks. We needed to protect our healthcare systems and… View More

April 2020

Post 1 to 6 of 6

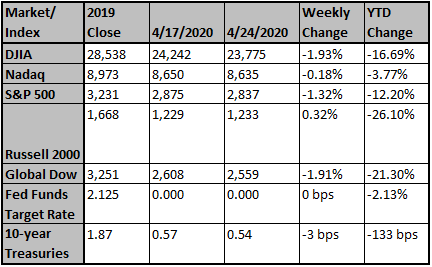

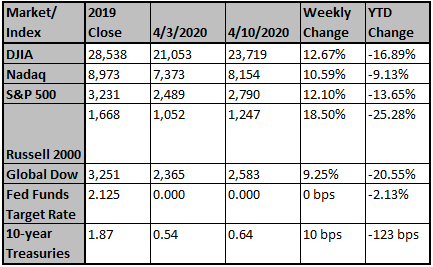

Markets were up again last week as we are making our way out the other side of the Pandemic. Every day that goes by is another day we are closer to getting back to our normal lives. You may have noticed a pickup in protests from Americans wanting to go back to work. As we watched the curve flatten and numbers come down for new cases and and new breakouts of the Coronavirus, the federal government rolled out its plan to reopen the economy in phases. The plan looks like it is comprehensive and wil… View More

The shelter-in-place orders in the U.S. are showing signs that the Coronavirus curve is flattening, and our country is now looking forward to when and how to reopen the U.S. economy. Here is a link to review the White House's plan: https://www.whitehouse.gov/openingamerica/ Sincerely, Fortem Financialwww.fortemfin.com(760) 206-8500 … View More

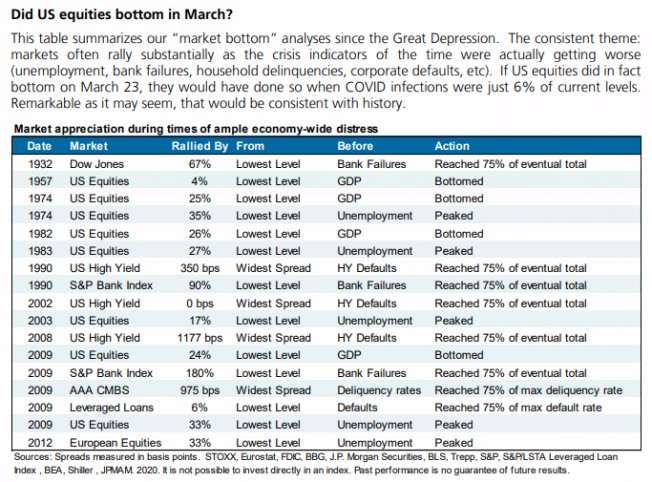

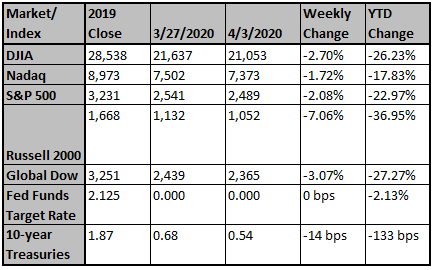

The Wuhan Coronavirus shock to the economy looks to be one of the worst on record. It remains possible that nearly all economic data series will show record weakness now. The Wuhan Coronavirus (with no vaccine/effective drugs) has left one option: shutting down economic activity to slow the spread & buy time for doctors. This strategy resulted in 6.6 million U.S. initial jobless claims last week, on top of a revised 6.9 million the week before, and 3.3 million claims the week before that. Th… View More

Following the collapse of Bear Stearns in March 2008, Oaktree Capital Management Chairman Howard Marks wrote in a memo that mark-to-market accounting was the “accelerant” to the financial crisis. The basis of Mr. Marks’ argument was that Sarbanes-Oxley imposed mark-to-market accounting rules, which increased the volatility of bank portfolios. Marks noted that Citibank would not have survived a previous crisis if mark-to-market accounting rules were in place during the 1980s. We read Marks�… View More

The CARES Act essentially suspended required minimum distributions (RMDs) for 2020 across the board. However, there have been a lot of questions about what this means for those who already took out distributions, and the impact on taxes and inherited accounts. It is important to remember that the CARES Act is a relief bill, and by suspending 2020 RMDs, the government is giving up short-term tax revenue to provide relief to retirees. Additionally, markets have been very volatile, and suspending … View More