US and global leaders have faced difficult decisions over the last month or so. As Covid-19 gained momentum, the US and much of the rest of the world began “sheltering in place,” effectively shutting down significant portions the global economy.

There was sound logic in sheltering at home; it would help flatten the contagion curve of the Coronavirus, and with this being a NEW virus, it was the most likely way to flatten the curve within weeks. We needed to protect our healthcare systems and workers from being overrun to maintain an edge in fighting this silent enemy. In many places, it appears as though the peak has come. We have successfully flattened the contagion curve, and we have had a chance to review the data we have collected over the last seven weeks from around the world.

Now that we have flattened the contagion curve and developed a better understanding of the Coronavirus, our leaders must tackle the more elusive goal of reopening the economy without spurring a resurgence in the number of new Coronavirus cases. As we heard anecdotally early on about the Coronavirus, data suggests that 85% of the population SHOULD NOT expect a severe reaction to the virus. Now we need a plan to allow those at lower risk to go back to work while protecting those most at risk.

Absent an unexpected breakthrough in Coronavirus treatment, however, we don’t expect economic activity to restart consistently. Rather, we anticipate a combination of confusion and false starts, as well as periods of relief and disappointment. Politicians are caught between two difficult positions; do they endorse reopening the economy (favoring economic health) or do they endorse continued sheltering in place (favoring reduced numbers of Coronavirus). We have seen divergent opinions among state governors, and given each state’s differences, we do not expect to see a clear national answer emerging.

Many American want and need to go back to work, and the current data suggests this is indeed possible over the next few weeks. Further, as Americans digest the terms of our lockdown, questions are emerging. Who determines what is “essential” and what is not? As an example, many of our hardware stores have been deemed “essential” business, but do they not also sell many “non-essential” goods that their competitors who have been deemed “non-essential” also sell (art, patio furniture, home decorations)? Does this cause unfair competition among retailers? Will prolonged closure of non-essential businesses hurt future investment initiatives in “non-essential” business? How long can state budgets endure without sales tax revenue, fuel tax revenue, and a significant decline in payroll tax revenue? Are there negative costs to sheltering in place? To name a couple we have read about, there has been an increase in domestic violence (https://www.nytimes.com/2020/04/06/world/coronavirus-domestic-violence.html) and some cancer patients have seen their appointments cancelled (https://www.usatoday.com/story/news/health/2020/03/23/cancer-patients-chemo-during-coronavirus-outbreak-canceled-appointments/2897880001/). The rapid response to flatten the contagion curve didn’t leave much time for assessing the side effects of a lock down, but now we must.

If the economy can get on track more quickly, that would obviously be an economic positive for all Americans, corporations, states and local governments, and more particularly, stocks. Conversely, if the economy reopens too quickly, we could trigger a fresh wave of infections and panic. Data from places like Asia and Sweden seem to suggest it should be possible to begin reopening without things getting out of control. Our health professionals at the CDC, FDA and NAIH say they can monitor the situation very closely and can extinguish hot spots as they arise, and technology will very likely help them do it.

Investor sentiment has improved since the end of March, thanks to massive monetary and fiscal policy stimulus.Stocks have now recouped more than half of the losses suffered between the February 19 high and March 23 low. At this point, we think further gains in stock prices will depend on whether global economic activity can restart sufficiently, which would boost the odds of better corporate profits in the coming quarters.

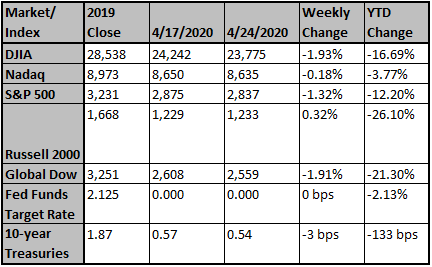

Following several weeks of strong gains, equity markets sank last week, with the S&P 500 Index falling 1.3%.Extreme volatility in the oil markets rattled investors, but much of the loss seemed to be a result of consolidation following a sharp rally. Only the energy sector experienced positive results, even as oil prices dropped 32% for their largest one-week decline in history. Defensive sectors such as REITs and utilities put in the worst performance.

Looking ahead, we think the next few months will be bumpy, as the economic data turn more grim and reopening plans lack clarity. Despite open-ended fiscal and monetary support, we expect more downside volatile action in stock prices in the weeks ahead. At the same time, though, we think the low of 2,192 for the S&P 500 on March 23 will remain the low for this bear market. That suggests buying opportunities for investors with long-term time horizons who can handle near-term risks.

Sources: Bob Doll, Nuveen Asset Management

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

The Lock Downs Were the Black Swan

To some the coronavirus is a supporting actor in a drama titled "The Iniquities of Donald Trump." Those of more balanced mind wonder whether Mr. Trump's failings can be distinguished from the predictable and expected failings of the U.S. government. But it's unlikely Mr. Trump will seem important...

Mnuchin Sees Third-Quarter Rebound for U.S. Economy

Business reopenings should lead to a demand boost, the Treasury secretary says.

Coronavirus brought China's travel industry to a standsti...

After the coronavirus brought it to a standstill