Unemployment has surged. There were 152.5 million people on U.S. non-farm payrolls at the peak. The surge in jobless filings during the past 2 months have left U.S. continuing claims at roughly 18 million as of April 18th, up from under 2 million a year ago. Private payroll data (ADP) indicate that roughly half of U.S. workers are employed in small & medium size business – this is where we see continued solvency issues in addition to liquidity issues. Workers can be called back from furloughs only if their company still exists.

The economy & stock market have been disconnected. The equity bull case rests on central bank easing, fiscal stimulus, momentum, and contrarian sentiment. The bear case centers on lingering economic damage (ie, we’ve avoided a Depression but the recession is still ahead of us), elevated valuations, and an economic re-open that’s still theoretical. Now we know bear markets associated with a recession usually last more than four weeks (2/19/20 high vs. 3/23/30 low) and five mega-companies account for nearly 20% of the stock market. The high-yield bond market is lagging equities. Caution remains warranted.

Many traditional economic data series are registering their worst readings ever. This is a global phenomenon. Borders are closed in some cases. Globalization is taking a hit. The “sharing economy” remains under significant pressure.

Until there is a medical solution (vaccine/drug) to the medical problem (virus), the economy cannot function as it did previously. Scientists are also hopeful – but not sure – that prior infection confers immunity against future COVID-19 illness (or for how long). The recent breakthroughs in testing and therapeutics (Remdesiver approved by the FDA last week) are very encouraging as is the quick evolution on several vaccine candidates currently in advanced clinical trials. There are concerns about a second wave of the virus, which would fit with some historical examples. As such, this is likely to be a slow and frustrating global re-opening.

As the New York Times noted “in Sydney, schools are reopening in phases, holding classes one day a week for a quarter of the students from each grade … In Taiwan, where classes have been in session since late February, schools have canceled assemblies and ordered students to wear masks and wash their hands regularly. They have asked students to refrain from speaking while they eat and discouraged popular games like Jenga that bring students elbow to elbow. Graduation ceremonies at many schools are moving online.”

As we’ve noted previously, the framework the education sector establishes will likely inform many other service-sector activities (day care, camps, sports, nanny agencies, etc). A lack of child-care options will continue to make it tough for workers to fully return to their jobs (roughly 40% of U.S. family households have a minor child at home). Getting the schools opened quickly and safely is a priority that must be addressed sooner than later.

Social distancing, and a combination of testing plus contact-tracing apps remain health tools of choice. We have to ask ourselves what is the most important testing at this point? Is it the testing that we have been doing that will show if you have the virus or not (are you infected) or the antibody tests (have you already been infected). It is believed that people that have developed antibody’s to the virus have already been infected and do not represent a risk of transmitting the virus to others. The FDA is currently reviewing many of the antibody tests and approving them as quickly as possible. There are currently more 4 antibody tests approved by the FDA.

If we continue to rely on the test to see if you are infected, that tells us you are currently infected or healthy but it does not tell us if you will be infected tomorrow. You could leave work and get infected and bring that infection back into your workplace. However, if we can test for antibodies, it would assure us that you have already been exposed to the virus and that your chances of bringing the virus back into your workplace again are much less. Testing is great but it needs to be the correct testing.

Bottom line: this is a very tough balancing act between the health issues to virus spread mounting economic concerns. Things will not be normal for quite some time, but we believe we will get there. The fact that the disease spreads through asymptomatic individuals means antibody testing & contact tracing (likely thru new tech) would be necessary for a confident economic re-open. Tech companies (which faced concerns about privacy a year ago) now seem ready to move into this role. From our observations, it appears that many have taken the attitude that if privacy needs to be sacrificed to get the economy moving again, this looks to be socially acceptable (in many places).

We want to be careful not to interpret an uptick from a low base as a true “V”-shaped recovery for the economy. We estimate U.S. real GDP at -33% q/q annualized in 2Q and +20% in 3Q. But we are still forecasting levels of economic activity below the prior peak. This will almost certainly be a start-and-stop process.

Policy has bought some time for a “great economic workout.” Developed economies have been aggressive. Money supply growth is accelerating dramatically (eg, U.S. M1 up 30.1% and M2 up 19.2% annualized over the past 13 weeks), as financial conditions ease. Yet this case is well known at this point, and probably in the market. We’re staying tuned.

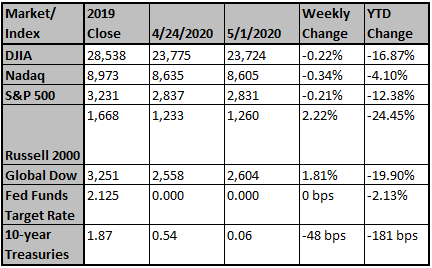

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

4 Different Ways to Think About Investment Risk

More than ever, investors want to account for stock-market dangers. But what's the right metric to evaluate?

J.Crew Bankruptcy Filing May Not Be The Last For Retailer...

The clothing retailer's troubles predate the health crisis. Other stores, like J.C. Penney and Neiman Marcus, are also struggling to survive extended closures.

Goldman Sachs says it remains bullish on oil prices in 2021

The bank hiked its estimate for U.S. West Texas Intermediate crude to $51.38