Stocks finished higher again last week (S&P 500 +1.8%). The biggest story discussed was the hawkish Fed policy shift (lots of discussion around 50bp Fed hikes), pushing bonds lower and stocks higher. Earnings discussions were generally upbeat. Best sectors were energy (+7.4%) and materials (+4.1%); worst sectors were healthcare (-0.2%) and REITs (+0.4%). SOME PERSPECTIVE ON FOSSIL FUELS With the standard of living we enjoy in the U.S., it may be difficult to imagine that there are currentl… View More

March 2022

Post 1 to 6 of 6

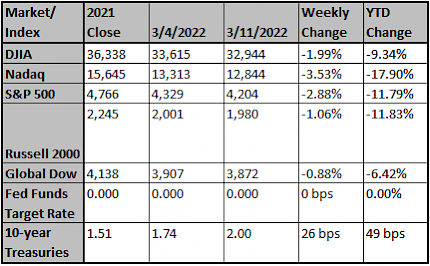

Rumors of War Negotiations, Lower Oil Prices, and Predictable Fed Lift Stocks U.S. stocks had their best week since November 2020, with the S&P 500 +6.2%. Oil fell for the second week in a row. The themes cited included oversold conditions, depressed sentiment, cooling commodities, overstated recession fears, and China’s statements about market support. The best sectors were consumer discretionary (+9.3%), technology (+7.9%), and financials (+7.1%); the only sector closing down was energy… View More

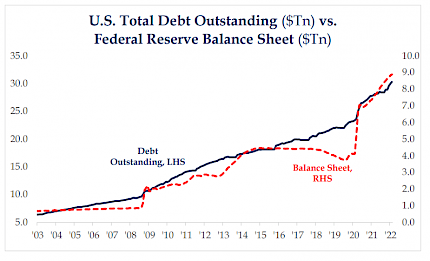

For econometricians and other expensive experts, it remained a mystery why a quintupling of the assets on the Fed's balance sheet between 2008 and 2014 led to ever greater securities prices and no appreciable increase in the prices of goods and services. In a classic case of a remedy being the hair of the dog that bit you, the solution for many central bankers was to double down on policies that did not work as intended. Other central banks, like the Bank of Japan, went a step further by adoptin… View More

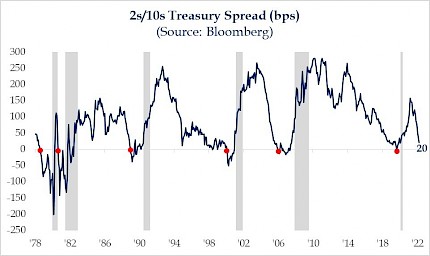

As expected, the Federal Reserve raised short-term rates by one quarter of a percentage point (25 basis points) earlier today, the first rate hike since the end of 2018. Even more important, the Fed signaled a new level of hawkishness in terms of future rate hikes as well as Quantitative Tightening. The "dot plot," which show the pace of rate hikes anticipated by policymakers, suggests the median Fed official thinks short-term rates will go up 1.75 percentage points this year, which would be co… View More

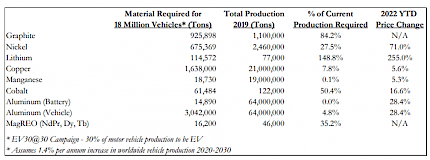

Higher interest rates plus higher commodity prices (energy + metals + food) indicate that we are likely headed for a period of below-trend economic growth. Central banks seem intent on moving to a more neutral policy setting (against the backdrop of continued global supply shocks). The ECB may delay rate hikes, but is looking to accelerate the end of asset purchases. In the U.S., the CPI surged +0.8% month over month and 7.9% year over year in February. The core (ex food & energy) CPI rose… View More

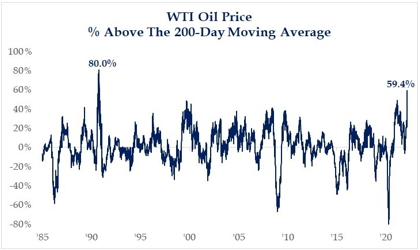

Price Of Oil Most Stretched Since 1990 It’s no secret that the price of oil has skyrocketed over the last week and now stands at roughly 60% above its 200-day moving average. This is the most stretched it has been since the 1990 oil price shock when Iraq invaded Kuwait. During that period, the price of oil more than doubled in 3 months and stayed elevated for nearly six months. 1990 Saw A 20% Correction & A U.S. Recession During the 1990 oil shock, the S&P 500 corrected 20% and th… View More