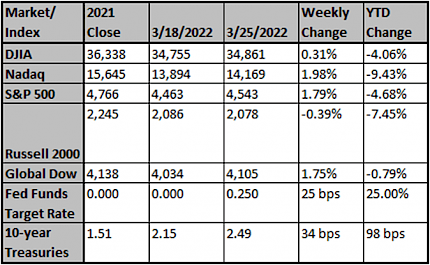

Stocks finished higher again last week (S&P 500 +1.8%). The biggest story discussed was the hawkish Fed policy shift (lots of discussion around 50bp Fed hikes), pushing bonds lower and stocks higher. Earnings discussions were generally upbeat. Best sectors were energy (+7.4%) and materials (+4.1%); worst sectors were healthcare (-0.2%) and REITs (+0.4%).

SOME PERSPECTIVE ON FOSSIL FUELS

With the standard of living we enjoy in the U.S., it may be difficult to imagine that there are currently 850 million people on planet Earth who have no reliable access at all to electricity, regardless of the source. Few of us in the developed world know people so poor but it seems like a decent bet that if we could poll them, the vast majority would be much more focused on surviving tomorrow rather than what may happen 50 years in the future. The "really" poor face an existential crisis every day.

With the current geopolitical crisis between Russia and Ukraine, it is speculated that even much of developed Europe may be facing a crisis. The question is will Russia shut down the pipelines feeding Europe's energy. If a European energy crisis becomes a reality, we expect we will see that even for those who are not as unfortunate as the "really" poor, the vast majority of Europe will seek to get from one day to the next. They will likely have to put their plans of looking 50 years into the future on hold.

One of the great casualties of a 24-hour news cycle, news you choose, and social media, is that while it appears as if we have access to more information than ever before, our ability to discuss the benefits and the costs of various public policy prescriptions have devolved to the point where no real robust debate is possible. We found this data according to a Pew Research poll very interesting. While about 25% of American adults use Twitter, 25% of that group is responsible for over 97% of all Tweets. “Journalists” more than any other group of professionals are particularly fond of the forum as some indicator of their influence. This effectively means that 6% of our population is responsible for over 97% of all tweets! Looking at this data this way, at least for us, puts the data derived from Twitter in a new light.

Why is this important? Because the tweets of the few may be affecting the lives of the many. As one example, anyone on an investment committee has probably spent untold amounts of time on the climate change question without anyone ever asking whether the various schemes to reduce carbon emissions via portfolio management, while well-intentioned, are effective. We find value in reviewing history and its lessons to try and better understand our current challenges. One lesson that stands out is that seemingly simple accomplishments can have a dramatic impact on the future, and they are often not expected until they happen.

Specifically, we are referencing the time when the widespread exploration of fossil fuels began. The exploration of fossil fuels in Titusville, PA began a mere 170 years ago, and it has changed the course of history forever. One could even argue that the endeavor has done more to benefit the lives of ordinary people than perhaps any other single technological advance in history. (For reference, the Earth is estimated to be about 4 ½ billion years old.) The original alternatives to fossil fuels before the advent of industrialization, like timber, manure, and other biomass sources, it turns out, were far less efficient sources of energy and a much greater detriment to the environment than fossil fuels could ever hope to have been if used on the same scale.

In addition to providing a cleaner and more sustainable world than previous fuel sources offered, access to efficient and abundant sources of fuel allowed people to more easily feed themselves and stay warm while also allowing a largely agrarian population to easily see parts of the world more than 5 miles away from their homes, an unfathomable dream up until two centuries ago. Fossil fuels are also an essential element in the production of fertilizers that greatly increase the yield from farming. Unsurprisingly, there has, and still remains, a strong correlation between the use of fossil fuels and life expectancy. History shows us that it is far easier to see the faults in our current systems than to correctly identify the improved systems of the future.

It has become generally accepted that the world has become complacent and has done nothing to reduce its dependence on fossil fuels. We find this argument historically inaccurate. In 1931 the German Engineer Bruno Lange developed a solar cell using silver selenide. In the 1980s some of the first commercial concentrated power plants were built. Wind has been used to generate energy since 5000 BC. By the late 1800s, small wind-electric generators were becoming more common. In 1951, the first nuclear power plant produced usable electricity through atomic fission. By the late 1800s, there were over 50 hydroelectric power plants in use in the US and Canada. We have been trying to use and develop "clean energy" for as long as we've been using oil.

The challenge is that many of the technologies were not commercially viable (too expensive or no efficient way to store electricity) or they created additional risks (i.e. nuclear meltdowns) that were deemed too risky. Ironically, the progress that we have made in manufacturing and science (greatly supported by fossil fuels) has made it possible for us to create more efficient solar panels and windmills. It has also made it more efficient for us to mine the metals needed to create more batteries and electric vehicles. In essence, our use of fossil fuels has allowed us to move much further into other sources of energy.

So while we are not yet confident that the world has absolutely found the right "energy" path forward, we are confident we will continue to adapt and improve, as people have been doing for thousands of years. Research, development, and exploration continue as they did over 170 years ago in Titusville, PA, and we are fully confident the next 170 years will bring with them as significant change and improvement as oil did 170 years ago. The media constantly reminds us of the challenges we face today. Unfortunately, they do not give equal coverage to the research being done to solve the problems of tomorrow.

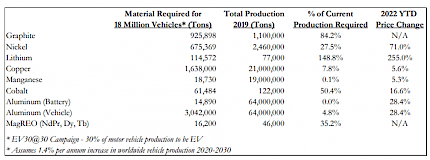

Perhaps the path forward will be electric vehicles, but there is a lot of data that causes us to question this path forward. We say this because one would be hard pressed to find another product more dependent upon resources from extractive materials than an electric vehicle. Electric vehicles use four times as much copper as an automobile powered by an internal combustion engine. As the table below shows, the widely accepted goal of having 30% of the world’s vehicles be electric vehicles by the year 2030 will require enormous investments in mining industries that are decidedly not eco-friendly.

Sadly, as stated above, in the information age when we have access to the 24-hour news cycle, news we choose, and social media our ability as a people to discuss the benefits and the costs of various public policy prescriptions appears to have devolved to the point where no real robust debate is possible. From an investment perspective, this is important, because there are few signs from world leaders that (despite the current lack of renewable energy sources) their commitment to the use of renewable energy is waning regardless of the costs that must be borne by their citizens.

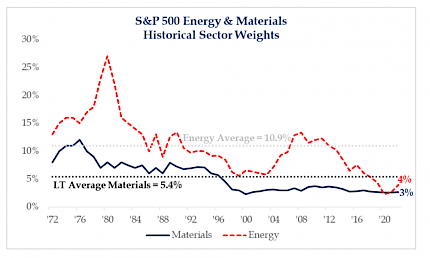

If and until these policies change or until we have developed enough alternative energy sources that we are not dependent upon oil (which will take many years), the world is facing a policy driven shortage of fossil fuels, which is, in turn, contributing to an artificially high demand for industrial metals like copper, lithium, and manganese. The irony in this is that Energy and Basic Materials sectors have become legitimately good investments. Our research indicates that these sectors are still decidedly under-owned in the United States. We continue to recommend that our clients overweight them.

If the last two years have taught us anything, it is that no amount of trade and international cooperation will instill what are generally considered to be Western values in other civilizations who have no real desire to adopt them. Trusting China to do anything other than what is directly in its own best interests, especially when comes to the tradeoffs between economic development and climate issues, would seem to be in direct conflict with history. Further, given current events, the sanctions that would have the most impact on the barbarism of Putin’s Russia would be to flood the global market with America’s own oil and natural gas, driving prices down and depriving a rogue state of resources to fund an illegitimate war.

There are signs that the Biden Administration is about to ease the rules on developing and exporting liquefied natural gas (LNG) to ease the economic burden on Europe but as of yet, we've heard very little suggesting that America will move to fully access its considerable fossil fuel reserves any time soon. Somewhat ironically, this will be to the benefit of oil, gas, and basic materials companies in the West.

History has shown that free markets produce incredible leaps in human ingenuity. To the extent to which Savings equals Investment, we should all be confident that economic growth will solve the issue of climate change naturally. Adopting an, all of the above, approach in our use of various sources of energy will greatly accelerate the discovery of new technologies that are more environmentally friendly. Although it may not be an idea that is accepted by all, there are many who believe rationing fossil fuels in an effort to rid the world of the negative externalities associated with their use will only retard the process of decreasing carbon emissions.

Source: Jason De Sena Trennert, Strategas Research

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economy Week Ahead: Key Inflation, Jobs Numbers Highlight...

This week's economic data are expected to underscore both the highest inflation since the 1980s and a historically tight labor market.

The Wall Street Journal

Stocks Waver as Bond Yields Surge With Inflation in Focus

New Covid-19 restrictions in China, including lockdowns in Shanghai, helped oil prices move lower.

Barrons

Oil Prices Stay High as Russian Crude Shortage Hits Market

The de facto buyers' strike on Russian crude that began a month ago propelled oil prices to their highest levels in years. Now the real effects are starting to create a second wave of imp...

The Wall Street Journal