The nearly 14 years of financial repression that allowed politicians to escape the economic consequences of their actions without fear of retribution from the frontier justice of free markets appears to be ending. The ever-expanding balance sheets of the world’s largest central banks effectively monetized the profligate spending of wayward fiscal policies in the aftermath of the Global Financial Crisis (GFC). Until recently, the unintended consequences of these policies were hidden from an elite and wealthy political class who designed them. The global economy grew, albeit unspectacularly, while inflation was relegated to financial assets rather than goods and services. The wealthy prospered beyond their wildest dreams while the middle class muddled through. Unfortunately for all concerned, the “unconventional monetary policy” that came to be called quantitative easing is no longer tenable in the face of persistently-high rates of inflation. The bill has come due. The significant increase in U.K. gilt yields and the political chaos that has ensued within the country is the most significant indication yet that politicians can no longer pursue “bread and circuses” fiscal policies that allow them to spend without any concept of constraint. Such signs have not been confined to the U.K. The Bank of Japan’s intervention to support the Yen at nearly 146 to the dollar three weeks ago has failed. The Yen rests at nearly 149 today. The decline in the value of the Euro versus the dollar and the increase in Treasury yields across the U.S. curve are also indications that spending one’s way out of economic and financial difficulties will not be as cost free in the years to come as it was in the years following the GFC. In this environment, investors should expect greater economic and financial market volatility, slower economic growth, a rationing of investment capital, and more modest returns from financial assets.

Time to look forward instead of looking back

We think it’s time to start focusing your attention on looking forward again instead of looking back. It seems most everyone’s attention is focused on what cannot be changed, rather than on the significant opportunity that will come in the upcoming years – it actually looks like it’s already happening in some sectors. We keep hearing the question of “what happens if the lights go out in Europe and if they go into recession”?, maybe this time they pull us down with them. We don’t think a lot of news coverage is discussing the significant effort Europe is putting in to change where it sources its energy from. We also don’t think people understand that once Europe brings back online all that infrastructure they closed up in the holy name of “Climate Change”, it’s incredibly unlikely they stop using it. Maybe something like this can help the current Administration in Washington see the significant opportunity for long-term growth in US exports (especially energy).

If one stops to consider how weak Russia’s economy was before Europe started buying all its energy from Russia, that might help change perspective. In 1998, Russia fell into default on its debt and their economy crumbled. Twenty-three years later they built enough wealth from selling energy to Europe to invade Ukraine. Being that we are essentially Western Europe’s strongest ally, and because we have most of the world’s least expensive natural gas (we essentially create it as a biproduct of our oil drilling in many cases and burn it off because we don’t have anywhere left to store it) this can be a huge economic win for the US. It can also assist dramatically in easing the current problem with persistently high inflation.

Time to start focusing on the long-term wealth that market dislocations like this one create. Energy is the easiest to see at this time and others will emerge in the near future. We have been overweight energy for the last two years, and we increased our overweight in January and June of this year. We are also overweight Materials and Manufacturing at this time as well.

Just like after the tech bubble in 2001 – 2002, you saw those most beaten up tech companies not only survive but thrive. Investors had the “once-in-a-lifetime” opportunity to buy great growth and tech companies at prices no one could have imagined before the tech bubble burst, and for the next 20 years, the investors who participated did fantastically well. Companies like Amazon, Microsoft and Google would have been life changing buys. The housing crash did the same thing for investors willing to get into financials and real estate. The amount of wealth created for Americans who were willing to buy commercial and residential real estate in between 2009 and 2017 was astronomical. There will soon be that same opportunity to invest in sectors of the market that have sold off well more than the market has, and when things turn around these companies' stock will do very well once again. We are keeping an eye out as to when to start investing in these sectors and will keep you posted as we move forward.

It looks like energy is now getting its day in the sun. We think manufacturing and materials will too. The way China has handled the pandemic and recession, the new acceptance of geo-political risk and the possibility of war, etc. are creating a new way to analyze where the next factory should be built, and over the last couple of years, a lot of the contracts have landed on US soil. It is time for us to stop looking at the last 10 months and start looking at the next 5 years. We believe there is going to be a lot of money made in the next 5 years for those who take advantage of what’s to come.

As the energy crisis in Europe continues to unfold, it appears that the US may see long-term benefits from the current upheaval. Over the last 6 years, the US lobbied with Western Europe to become a significant supplier of Energy to Europe. Our efforts were unsuccessful because Russia, thanks to its proximity, could provide energy to Europe at a lower price than we could. The conflict between Russia and Ukraine has changed the way Western Europe is conducting their analysis of where to source its energy from, and it appears this will be a benefit to US energy producers. In October, a top executive at Chevron shared with Reuters that it expects high European prices for liquefied natural gas (LNG) to attract a majority of U.S. LNG exports in the short term. Europe is determined to wean itself off Russian gas imports following its invasion of Ukraine, a move that has thrown open the door to U.S. suppliers. Its commitment to building import terminals and regasification facilities shows the region's demand for U.S. exports could last. "We have seen a big uptick in demand from European customers, so we are adjusting to that," said Colin Parfitt, who oversees the company's shipping, pipeline, supply and trading operations. Europe will not "go back to the same flows from Russia as it did before," he said during an interview in London. "Gas demand in the United States is roughly flat". "What's growing in the United States is demand for exports," he said. Parfitt said Chevron's oil and gas production in the Permian Basin, the top U.S. oilfield, increased 7% in the first half of 2022 from the same period a year ago, and is expected to grow by 15% in the full year.

The increase in demand for US natural gas in Europe will require expansion of current LNG export facilities and very likely the creation of new facilities. The high price of natural gas in the global market because of Russia’s actions will provide the capital to pay for these projects, which will create new jobs in the US and help buffer the economic slowdown seen in other sectors, like technology.

Early 3Q Reports Surprising To The Upside

Since October 1st, there have been 19 S&P 500 companies that have reported earnings, with only 3 having a negative earnings surprise. The average relative performance is positive, 1.2%, with the median at 2.7%. We would caution against extrapolating this for the remainder of the earnings season, but it may show that the bar has already been lowered significantly for companies. We continue to believe that effects from the Fed tightening are still ahead of us but wouldn’t be surprised to see a decent quarter for companies as unemployment remains lower and consumers are spending on credit…

Source: Strategas

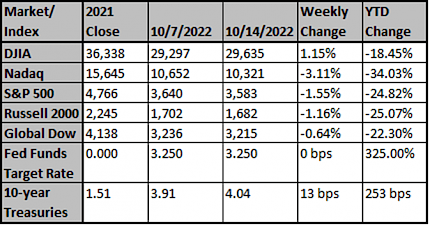

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economists Now Expect a Recession, Job Losses by Next Year

The majority of surveyed economists think the Federal Reserve will start cutting rates in late 2023 or early 2024.

The Wall Street Journal

Housing market first-timer? From contingency to foreclosu...

Contingency? Fixed-rate mortgage? Foreclosure? The housing market practically speaks a language all its own. Here are the terms you should understand.

USA TODAY

Why isn't inflation slowing?

Here are five reasons why inflation keeps rising even as the economy slows.

News Nation