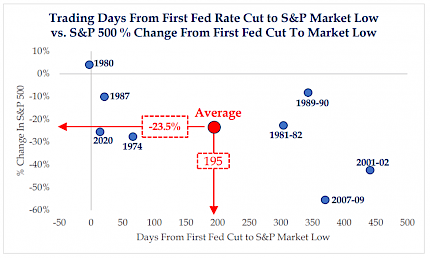

Among the sad legacies of the prolonged use of quantitative easing to wash away the sins of the world is the difficulty among investors, businessmen, and labor alike to think of business cycles as anything other than “V-shaped” affairs. Unfilled job openings and excess savings may be enough to believe in the possibility of a soft landing in the economy in 2023. It may not be enough, in our view, to justify a market trading at 18x trailing earnings. Believe it or not, domestic equity mutual funds and ETFs have seen net inflows of $35 billion this year. And, even though it has declined 62% YTD, the Ark Innovation Fund has seen net inflows of $1.6 bn. These are not typically the stuff of which bottoms are made. In many instances, the hopes of a recovery in stock prices lie with the expectation of a Fed “pivot” in monetary policy. For some, this means, simply, a decline in the size of Fed rate hikes. For others, it means a cessation of tightening altogether. And yet for others still, it means a transition from tightening monetary policy to easing. History has shown, however, that investors should be careful what they wish for. A true pivot to accommodative monetary policy often means, as the chart below indicates, that the pain is not yet over for the broader Index. On average the market bottoms 195 days and 23% lower after the first rate cut in a series. While a case can be made that higher rates and higher inflation have been priced into equities, it is more difficult to say that the potential for a decline in earnings has been.

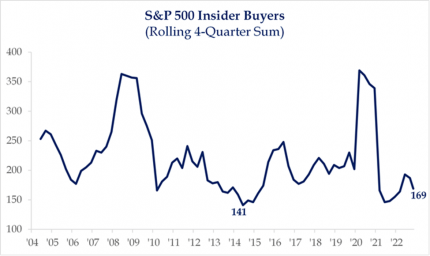

Insider Purchases Remain Lackluster

After a recent uptick, albeit off depressed levels in 2021, insider transaction data shows that the number of insiders purchasing their stock continues to fall with 169 buyers in the S&P 500 over the last four quarters. With insider transactions providing an indication of when management believes their stock is cheap enough to buy, the lack of confidence behind the latest uptick in equities is not a vote of confidence from insiders in our view.

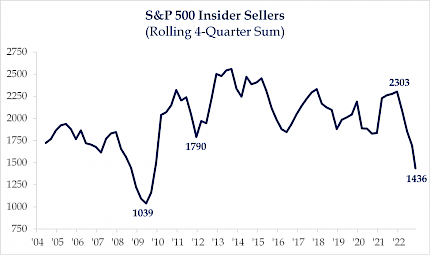

S&P 500 Insider Sellers Falling As Well

After the market ultimately topped earlier this year, the sum of S&P 500 insider sellers peaked at 2303 transactions on a trailing four quarter basis, coming close to the levels that were seen in 2018 and 2013. Today, the number of sellers continues to decline as an uncertain macro environment and recession fears persist. With insider sellers at the lowest levels since the GFC, the contrarian might say this is welcomed news. We still think it’s too early.

Bottom 50% Of Individuals Have Seen Wealth Expand Rapidly

Over the last two years, the net worth of the bottom 50% of Americans has expanded by nearly $2.5 trillion and while the bottom 50% only accounts for 3.2% of total net worth the impact this has on prolonging a cycle will only be evident in hindsight. Perhaps what’s most interesting is that during the first half of the year, net worth has grown by nearly 20% for the bottom 50% while for the top wealth groups it has fallen.

Falling Equity Prices Have A Greater Impact On Affluent Individuals

The major contributing factor to the increase in net worth of the bottom 50% is due to the rise in real estate. As you can see from the chart below nearly 60% of assets for the bottom 50% is tied up in real estate. This compares to about 10% for the wealthiest individuals. Furthermore, the bottom 50% holds just 2% of their assets in corporate equities and mutual fund shares compared to more than 40% for more affluent cohorts. Going forward, rising unemployment, and falling home prices would be a challenging for further economic strength.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

China might not make major changes to its Covid policy an...

Groups of people in China took to the streets over the weekend to vent their frustration, built up over nearly three years of stringent Covid controls.

CNBC

The Week in Business: Shoppers Open Their Wallets

A shake-up at Disney. Scrutiny of Ticketmaster in the wake of chaos in Taylor Swift concert ticket sales. And coming up: Is hiring slowing?

The New York Times

Year-end rally? Bullish stock-market pattern set to colli...

The prospect of stagflation, or the worst-of-all-possible economic outcomes, is poised to weigh on investors even if U.S. stocks rally into year-end.

Morning Brew