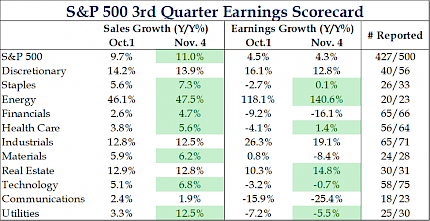

With earnings season more than 80% complete, EPS growth is expected to be 4.3% which is just below expectations at the beginning of the reporting season. On sector basis the data was mixed with 7 of the 11 sectors exceeding initial growth estimates led by energy. Turning to sales, the estimate growth rate is expected to be 11% which is ahead of the initial estimates of 9.7% on Oct. 1st.

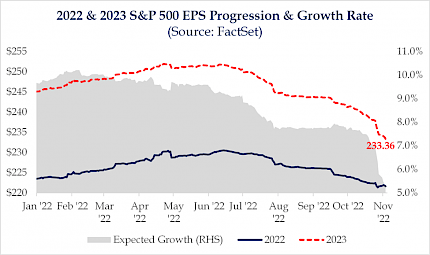

2023 EPS Estimate Down To $233, Growth Expected To Be 5.3%

The biggest story from our perspective has been the lowering of 2023 outlooks. Currently, the aggregate EPS estimate sits just above $233 which is down from a high of $252 back in June. Growth for next year is now expected to be 5.3% which is still well above expectations should a recession come into play. One item worth noting is that a 2023 recession is pretty much becoming the base case scenario but it’s possible that the strength of the labor market pushes it out further.

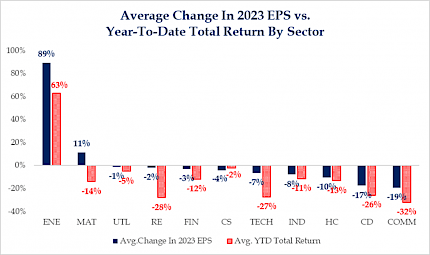

Only Two Sectors Have Seen EPS Revised Higher On Average For 2023

Looking at the 2023 EPS change for each company in the S&P 500, shows that on average the energy and materials sectors are the only two that have seen their 2023 EPS move higher. Furthermore, when comparing this to the year-to-date performance for the sectors, energy is the only one of the two that is positive. The bottom line, is that the normalization of interest rates is creating an environment where active managers should be able to thrive.

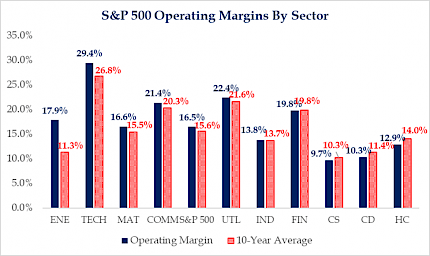

Energy’s Profits Keeping S&P Margins Elevated

Breaking down operating margins by sectors shows that Energy and Technology are two sectors punching above their 10-year historical average. Technology makes sense to us given the asset light operating models, but energy is more a function of elevated commodity prices. If companies remain disciplined with capex, their margins will likely remain higher than the historical averages for longer as they have made technological investments to become more profitable at lower oil & gas prices.

Investment & Economic Outlook (Abridged)

Bullet Point Base Case

- Recession odds are about 50% in each of the next two years ~ 75% within the next two years.

- Earnings estimates are likely too high for 2023; in a typical recession, earnings fall 30%.

- No “Fed Put” for foreseeable future. Talk of “pivot” is premature.

- Inflation is “sticky” due to wages, rents, and energy prices. 60% of government spending indexed to inflation.

- Still too many signs of financial excess. e.g. Kim Kardashian starting a private equity firm.

- Higher inflation for longer = shorter duration equities; cash flows paramount.

- Market bottoms are usually associated with lower earnings multiples, a higher VIX, and a blowout in high yield spreads. Have not seen that yet.

- Favor domestic over international, value over growth, and high-quality small (S&P 600 vs. RUT) over large.

- Overweight Energy, Consumer Staples, and Health Care.

- Major themes are deglobalization, Fed tightening & QT, “sticky” inflation, and economic slowdown.

- The greatest risk to the economy and markets may be the Fed’s need to tighten more than risk markets anticipate.

Bullet Point Base Case

THE BULL CASE:

- M2 has grown by ~40% since Feb. 2020. The Fed has increased the amount of assets on its balance sheet by more than 100% since January 2020. Money growth works with a lag.

- Meaningful price declines in growth stocks have already occurred.

- Consumer balance sheets strong – personal savings rate 3.1% as a percentage of disposable income (12-month average).

- Companies are currently carrying high levels of cash on their balance sheets.

- Equity Risk Premium suggests that equities still have some interest rate support but it is weakening.

THE BEAR CASE:

- The Fed is behind the curve on inflation and may need to tighten more than anticipated. Includes Q.T.

- “Fed Put” is kaput: Fed likely to tighten until the Fed Funds rate is above the rate of inflation.

- M2 growing at 2.6%.

- The Treasury yield curve (2s-10s) is inverted.

- Rise in prices of food and energy are likely to put Europe in recession.

- Levels of inflation above >4% put meaningful pressure on earnings multiples.

- Higher input costs such as labor and commodities may negatively impact profit margins and slow earnings growth.

- Little evidence Administration is backing off aggressive regulatory stance toward Financials, Energy, and Health Care.

- Venture capital, crypto, and NFT activity suggest zero percent interest rates have led to too much investment in speculative assets.

6 of 8 Items on Recession Checklist Checked Off

Reasons Inflation Likely to be Structural

- Globalization - major source of disinflation – is waning in influence

- Step-function higher in stock of money (M2) – up 40% since February 2020.

- More than 10.7 million job openings will continue to put pressure on wages

- 60% of Federal Budget is Indexed to Inflation: Makes Fed’s Job More Difficult

- Housing prices up ~ 13% y/y generally lead rents; rents large % of CPI

- Environmental policies increase energy prices and the cost of doing business

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Elevated Inflation Looms as Risk to U.S. Economy, Fed Rep...

Central bank identified near-term threats in its Financial Stability Report.

The Wall Street Journal

More Workers Get Side Hustles to Keep Up With Rising Costs

As full-time workers feel pinched by inflation, some are turning to second part-time jobs to supplement their incomes.

The Wall Street Journal

Facebook parent Meta is preparing large-scale layoffs thi...

(Reuters) - Meta Platforms Inc is planning to begin large-scale layoffs this week that will affect thousands of employees, the Wall Street Journal reported on Sunday citing people familia...

InvestmentNews