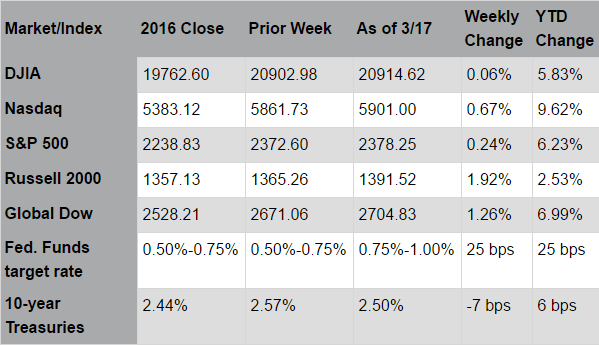

Stocks rose this week following the Federal Reserve announcement on Wednesday to increase interest rates for a second time in three months. Fed Chair Janet Yellen, in communicating the rate decision, noted: “We have confidence in the robustness of the economy and its resilience to shocks”; and, “Many more people feel optimistic about their prospects in the labor market.” The favorable assessment buoyed investor sentiment, especially for shares of small and mid-sized companies which outpaced large cap stocks. At the same time, Treasury yields declined as the Fed remained committed to a “gradual” pace of future rate hikes; the “dot plot,” which captures the Fed’s interest rate outlook, was largely unchanged from the December meeting. Broadly positive economic data further bolstered investor confidence; robust housing starts, in particular, signal accelerating strength in the economy and bode well for the construction, transportation, and building materials industries. Meanwhile, measures of consumer confidence are near post-recession highs; as a sign that consumers are responding to the improved economic outlook, retail sales rose for a sixth consecutive month.

Since the financial crisis, the Fed has been the primary driver of market action. Yet, this week’s monetary policy meeting was notably uneventful. Even as Fed officials raised rates for only the third time in a decade, the market’s response was remarkably subdued; indeed, this week, in sharp contrast to the market’s anxiety over the December 2015 rate hike, stocks rose and bonds fell. Why the seeming disregard for the central bank? Investors have apparently shifted focus from monetary policy to fiscal policy, that is, to Congress and the new administration’s pro-growth agenda. These developments will likely dominate market action in 2017; healthcare, tax reform, regulations, infrastructure spending, trade, and immigration all present investment opportunities, as well as risks. Certainly, with so many items on President Trump’s agenda, the main question is the extent to which the administration will be able to deliver on its many promises. Nevertheless, the return to a market environment in which momentum will be determined mainly by developments in the real economy, rather than monetary policy, is yet another milestone in the economy’s long road to recovery since the Great Recession.

Over the last few weeks, growth-oriented stocks in areas such as transportation, industrials and energy, have sold off. The recent action is most likely a pause after the significant post-election rally. The Fed’s decision to increase interest rates, and the market’s reaction to that decision, provides confirmation of the economy’s strength. Despite short-term negative movements in the markets, this positive outlook should provide a boost to these sectors over time irrespective of other benefits which may result from legislative action.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

- Not unexpectedly, the FOMC raised the target range for the federal funds rate by 25 basis points to 0.75%-1.00%. The Committee judged that a modest increase in the federal funds rate is appropriate in light of the economy's solid progress toward the Committee's goals of maximum employment and price stability. The decision to increase interest rates reflects the Committee's view that waiting too long to scale back some accommodation could potentially require raising rates rapidly sometime down the road, which, in turn, could risk disrupting financial markets and push the economy into recession. Anticipating continued labor strengthening and inflation inching toward the Fed's longer-range target of 2.0%, two more rate increases are still in the offing over the remainder of 2017. Interestingly, in Chair Janet Yellen's prepared comments, she noted the Committee's economic projections as follows: the growth of the GDP is expected to be 2.1% this year and next and edge down to 1.9% in 2019; the unemployment rate would stand at 4.5% in the fourth quarter of this year and remain at that level over the next two years; and the median inflation projection remains at 1.9% this year, rising to 2.0% in 2018 and 2019.

- In a sign of continuing inflationary pressure, consumer prices, retail sales, and producer prices each increased in February. Consumer prices edged up 0.1% in February, according to the latest report from the Bureau of Labor Statistics. Over the last 12 months, the CPI has risen 2.7%. The index was held down by declining energy prices (-1.0%), which partially offset increases in several indexes, including food, shelter, and recreation. The index less food and energy rose 0.2% in February, and has increased 2.2% for the 12 months ended February 2017. This was the fifteenth straight month the 12-month change remained in the range of 2.1% to 2.3%, which is in line with the Fed's longer-range target of 2.0% inflation.

- Advance estimates of U.S. retail and food services sales for February 2017 were $474.0 billion, an increase of 0.1% from the previous month and 5.7% ahead of February 2016. Retail sales increased 0.1% from January, and are up 5.9% from last February. Gasoline stations sales were up 19.6% from February 2016, while nonstore (internet) retailers' sales jumped 13.0% over last year. Conversely, restaurant and bar sales fell 0.1% for the month.

- Producer prices for goods and services increased 0.3% in February, following a 0.6% increase in January. The price index climbed 2.2% for the 12 months ended February 2017 — the largest advance since a 2.4% increase in the 12 months ended March 2012. Prices less foods, energy, and trade services rose 0.3% in February, the largest increase since a 0.3% advance in April 2016. For the 12 months ended in February, the index less foods, energy, and trade services climbed 1.8%.

- New construction in the housing market picked up in February. Housing starts rose 3.0% for the month compared to January, and are 6.2% above the February 2016 rate. Single-family housing starts in February were 6.5% above the revised January figure. Housing completions also surged in February, climbing 5.4% above the revised January estimate and 8.7% ahead of the February 2016 pace. On the other hand, permits for new residential construction were off, down 6.2% in February from January but still 4.4% ahead of the February 2016 estimate.

- The Job Openings and Labor Turnover Survey(JOLTS) offers information on monthly changes in the number of job openings, hires, and quits. The latest information for January reveals that there were 5.6 million job openings on the last day of January — about 87,000 more openings than December. There were 5.4 million hires in January, roughly 137,000 more than December. The number of total separations, including quits, layoffs, and discharges, (otherwise known as "turnover") increased by 174,000 in January compared with December. Over the 12 months ended in January, hires totaled 63.1 million and separations totaled 60.7 million, yielding a net employment gain of 2.4 million.

- The Federal Reserve's index of industrial production shows how much factories, mines, and utilities are producing. Industrial production was unchanged in February following a 0.1% decrease in January. However on a positive note, manufacturing output moved up 0.5% for its sixth consecutive monthly increase. Manufacturing gains occurred in business equipment and auto production. Mining output jumped 2.7%, but the index for utilities fell 5.7%, as continued unseasonably warm weather further reduced demand for heating. Capacity utilization for the industrial sector declined 0.1 percentage point in February to 75.4%.

- In the week ended March 11, the advance figure for seasonally adjusted initial unemployment insurance claims was 241,000, a decrease of 2,000 from the previous week's revised level. The advance seasonally adjusted insured unemployment rate remained at 1.5%. The advance number for seasonally adjusted insured unemployment during the week ended March 4 was 2,030,000, a decrease of 30,000 from the previous week's revised level.

Eye on the Week Ahead

This week should see equities markets settle following the Fed's decision last week to increase interest rates for the first time this year. February's figures on sales of existing and new homes are available this week. Orders for durable goods have been volatile at best. Not much change is expected in the manufacturing sector when February's numbers are released at the close of this week.