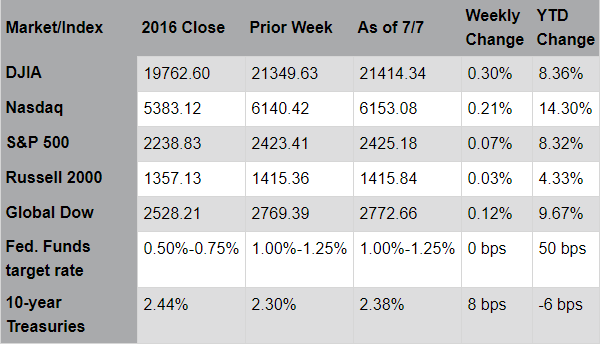

Markets were mixed during the holiday-shortened week; the Financials sector outperformed as investors responded to rising bond yields. Energy stocks, though, remained volatile. Crude oil prices declined even as inventories in the U.S. fell to the lowest levels since January; continuing production increases in the U.S. and overseas are reportedly prompting OPEC to consider imposing production caps on previously-exempted Nigeria and Libya. Central banks were in focus as policymakers acknowledge improvements in the global economy; the European Central Bank and the Bank of England each indicated they may consider easing monetary stimulus. The shift corresponds with the release of minutes from the Federal Reserve’s June meeting which pointed to further interest rate hikes despite the recent softening in inflation. Economic data supported expectations for improving global economic growth. In the U.S., the ISM Manufacturing Index for June reached its highest level since August 2014; fifteen of the eighteen industries surveyed reported growth. The ISM non-manufacturing index similarly pointed to improving conditions, with sixteen of seventeen service industries reporting growth. Meanwhile, Europe’s economic recovery appears well underway. Industrial production increased for the fifth consecutive month in Germany, and also expanded in both France and Spain.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

Looking ahead, the global central banks are more likely to raise interest rates or otherwise tighten monetary policy as economies improve. The most recent cycle of rising rates in the U.S. occurred from May 2004 to June 2006; many investors, with limited recollection of this period, may view a series of interest rate increases with uncertainty. Historically, rising rate cycles, which typically last between two to four years, correspond with improving economic conditions; they are often accompanied by bull markets. The current cycle began in December 2015 when the Fed Funds rate rose from 0.25% to 0.5%. We believe that, given its low starting point, the slow pace of rate hikes since then, and accelerating economic growth trends around the world, the cycle may continue for an extended duration; therefore, we remain optimistic regarding the longer-term outlook for stocks. The upcoming second quarter earnings period may provide a catalyst. Reports next week from JPMorgan Chase, Wells Fargo, Delta Air Lines, and PepsiCo will help determine the market’s near-term direction as companies provide updated outlooks for the final six months of the year.

Last Week's Headlines

- The job situation rebounded in a big way in June as 222,000 new jobs were added during the month, well above the 152,000 (revised) new jobs added in May. The unemployment rate inched up 0.1 percentage point to 4.4%. Noteworthy job gains occurred in health care, social assistance, financial activities, and mining. Since January, the unemployment rate and the number of unemployed are down by 0.4 percentage point and 658,000, respectively. The average workweek for all employees on private nonfarm payrolls rose by 0.1 hour to 34.5 hours in June. For the month, average hourly earnings for all employees on private nonfarm payrolls rose by $0.04 to $26.25. Over the year, average hourly earnings have risen by $0.63, or 2.5%.

- The IHS Markit final US Manufacturing Purchasing Managers' Index™ (PMI™) indicated that manufacturing slowed in June. According to the report, manufacturing output, new orders, and employment weakened compared to May. Price inflation was the slowest since late 2016.

- On the other hand, the Manufacturing ISM® Report On Business® suggested that the manufacturing sector expanded in June. The overall purchasing managers' index registered 57.8%, an increase of 2.9 percentage points over the May reading. New orders, production, and employment climbed in June. However, inventories and prices decreased for the month. While the Markit and ISM® reports offer conflicting information, historically, the Markit PMI™ tends to align more closely with government data.

- The non-manufacturing, or services, sector expanded in June, according to the latest Non-Manufacturing ISM® Report On Business®. Non-manufacturing industries include agriculture; accommodation and food services; transportation; mining; utilities; real estate; finance and insurance. The June non-manufacturing index registered 57.4%, 0.5 percentage point higher than the May reading. Expansion in the non-manufacturing sector occurred in business activity, new orders, and prices. Employment grew in the non-manufacturing sector, but at a slower pace compared to May.

- The international trade deficit shrunk in May, according to the Census Bureau. The goods and services deficit was $46.5 billion in May, down $1.1 billion from $47.6 billion in April, revised. May exports were $192.0 billion, $0.9 billion more than April exports. May imports were $238.5 billion, $0.2 billion less than April imports. Year-to-date, the trade deficit increased $27.0 billion, or 13.1%, from the same period in 2016. Exports increased $54.3 billion, or 6.0%. Imports increased $81.4 billion, or 7.3%.

- In the week ended July 1, the advance figure for seasonally adjusted initial claims for unemployment insurance was 248,000, an increase of 4,000 from the previous week's unrevised level. The advance seasonally adjusted insured unemployment rate remained 1.4% for the week ended June 24, unchanged from the previous week's unrevised rate. During the week ended June 24, there were 1,956,000 receiving unemployment insurance benefits, an increase of 11,000 from the previous week's revised level. The previous week's level was revised down by 3,000 from 1,948,000 to 1,945,000.

Eye on the Week Ahead

Trading is expected to pick up following the holiday-shortened week. Last week's favorable employment report should quell investors' concerns about a slowdown in job growth. This week, reports focusing on consumer spending and inflationary trends are out with the Producer Price Index, retail sales report, and The Consumer Price Index.