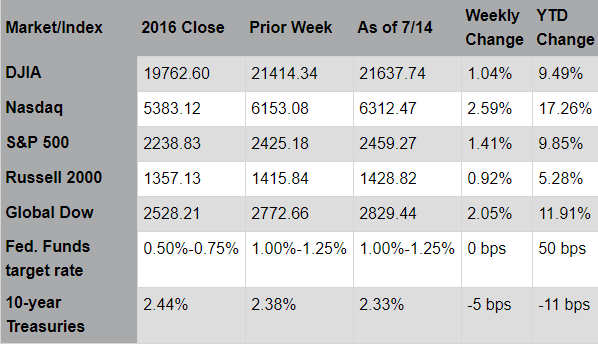

Markets rose last week with the launch of the second quarter earnings season. Technology stocks led the way with the popular “FAANG” group of companies regaining momentum. Energy stocks also rallied as oil prices continued to recover; West Texas Intermediate crude, the North American benchmark, has gained nearly 10% since hitting a low of $42.53 three weeks ago. Also, this week’s decline in crude oil inventories, which fell by the largest amount since September 2016, supported the price rebound. Financials, though, lagged despite better-than-expected earnings results (more on this below). A decline in interest rates and soft inflation readings overshadowed the sector’s favorable outlook; the consumer price index fell to 1.6% in June, down from 1.9% in May, for the slowest pace in nine months. The G20 meeting and ongoing Republican efforts around healthcare legislation dominated the week’s political headlines. Yet, in general, these events have had little impact on markets; investors have seemingly put aside any expectations with respect to legislative action until more concrete developments emerge.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

Thus far, 30 companies in the S&P 500® Index have reported results; 87% have met or exceeded analysts’ earnings expectations. Banks were in focus this week; JPMorgan Chase, Wells Fargo, and Citigroup all outpaced their earnings forecasts. Jamie Dimon, CEO of JPMorgan Chase, expressed his optimism for the U.S. economy. He stated that: “since the Great Recession, which is now eight years old, [the U.S. economy has] been growing at 1.5% to 2% in spite of … political gridlock because the American business sector is powerful and strong and is going to grow regardless.” He added that lending activity has been hampered by onerous regulations. Specifically, Mr. Dimon identified residential mortgages and small business loans as areas that could benefit from more flexible rules. Meanwhile, investment-related trading activity declined throughout the industry, in part, due to historically low market volatility. This week, 63 companies in the S&P 500® Index, including Netflix, American Express, General Electric, and Microsoft report earnings results; their updated business outlooks will likely drive the market’s near-term direction. We believe earnings announcements this week will still be ahead of projections and support the current market strength.

Last Week's Headlines

- In a sign that inflation is weakening, the prices consumers pay for goods and services, as measured by the Consumer Price Index, were unchanged in June compared to May. Over the last 12 months, consumer prices have increased 1.6%. The core CPI, less volatile food and energy prices, managed a subtle 0.1% bump for the month, while increasing 1.7% since June 2016. If expanding inflation is one of the key justifications used by the Fed in raising interest rates, this report makes it likely that rates will not be increased when the FOMC next meets at the end of July.

- The prices producers received for their goods and services (as measured by the Producer Price Index) increased by 0.1% in June. Producer prices were unchanged in May and rose 0.5% in April. Over the 12 months ended in June, producer prices have advanced 2.0%. Almost 80% of the June rise in prices was attributable to a 0.2% increase in prices for services. Food prices rose 0.6%, while energy prices dipped 0.5%. Producer prices less the volatile food, energy, and trade services components increased 0.2% for the month, and 2.0% for the 12 months ended in June. Since increases in prices at the producer level are usually passed on to consumers, investors may seek to monitor the Producer Price Index to get a potential read on inflationary trends. Theoretically, with no real increase in prices, more money should be available for investment.

- Retail sales fell 0.2% in June following a 0.1% decline in May, indicating consumers have apparently curtailed their spending. Sales at food and beverage stores fell 0.4%, restaurant sales dropped 0.6%, department store sales were down 0.7%, and gasoline sales plummeted 1.3% — a reflection of weakening prices at the pumps.

- The federal deficit expanded in June to $90.23 billion compared to May's monthly deficit of $88.42 billion. For the fiscal year, which began in October, the deficit sits at $523.08 billion. Over the same nine months last fiscal year, the deficit was $399.16 billion. An expanding deficit has a direct impact on the yields on government securities, which the government sells to provide necessary funds to meet its expenses. The more government notes and bonds that are issued, the lower the price and higher the yield. The yield on government securities can impact other interest bearing securities as well.

- According to the Federal Reserve's monthly report, industrial production rose 0.4% in June for its fifth consecutive monthly increase. Manufacturing output moved up 0.2%. The index for mining posted a gain of 1.6% in June, just slightly below its pace in May. The index for utilities, however, remained unchanged. For the second quarter as a whole, industrial production advanced at an annual rate of 4.7%, primarily as a result of strong increases for mining and utilities. Manufacturing output rose at an annual rate of 1.4%, a slightly slower increase than in the first quarter.

- According to the latest Job Openings and Labor Turnover report from the Bureau of Labor Statistics, the number of job openings decreased to 5.7 million (-301,000) on the last business day of May. Over the month, hires increased to 5.5 million (+429,000) and separations increased to 5.3 million (+251,000). Within separations, the quits rate increased 0.1 percentage point to 2.2% and the layoffs and discharges rate was unchanged at 1.1%. Over the 12 months ended in May, hires totaled 63.2 million and separations totaled 60.9 million, yielding a net employment gain of 2.4 million. The JOLTS report differs from the more current employment situation report by providing specific information on job openings, hires, and separations.

- In the week ended July 8, the advance figure for seasonally adjusted initial claims for unemployment insurance was 247,000, a decrease of 3,000 from the previous week's revised level. The previous week's level was revised up by 2,000 from 248,000 to 250,000. The advance seasonally adjusted insured unemployment rate remained 1.4% for the week ended July 1, unchanged from the previous week's unrevised rate. During the week ended July 1, there were 1,945,000 receiving unemployment insurance benefits, a decrease of 20,000 from the previous week's revised level. The previous week's level was revised up by 9,000 from 1,956,000 to 1,965,000.

Eye on the Week Ahead

There isn't much available in terms of economic indicators this week. One report worth noting focuses on import and export prices in June. An indicator of inflation in products traded globally, the Import and Export Price Indexes impacts bond prices and equity markets, particularly when importing inflation rises, which often leads to bond and stock prices decreasing.