At the end of October, we will get our first look at real GDP growth for the third quarter, and it looks like it was solid. We’ll have a more exact estimate a week from now– after this week’s reports on retail sales, industrial production, and home building – but it looks like the economy grew at about a 4.5% annual rate.

Even if that turns out right, however, the underlying pace of growth is much slower than what happened in Q3. From the end of 2019 through the third quarter, the average rate of growth would be 1.9%.1 Our concern is growth will continue to slow, bringing the US into recession. We believe we may soon enter the next phase of the last twenty years' ongoing Monetary Policy experiment, and the data looks concerning.

Since the 2008 Financial Crisis, Government Deficits have not only remained above historical trends but have been growing at an accelerated rate. In the wake of the 2008 Financial Crisis, Central Banks pumped trillions of dollars into global financial systems to hold up the economy. The good news is it worked (in the short term). The bad news is that upon seeing their success, many economists and central bankers began to believe that the amount of money in supply had limited or no effect on inflation. Because of this view, the deficits that ran up during the 2008 Financial Crisis were not paid back. Worse yet, government leaders (from both parties) continued spending at a deficit until Covid-19. Because the deficit spending from 2008 to 2020 had not resulted in high inflation, many central bankers, economists, and government leaders were comfortable pumping trillions more into the economy during the COVID-19 outbreak. The most concerning data came post-COVID, when, yet again, central bankers and government leaders chose to increase deficits rather than pay them down.

Without reaching the Fed’s target inflation rate (2%), inflation started to climb again three months ago. Some would like to dismiss this rise in inflation as an anomaly, claiming that we are still in a disinflationary environment, meaning they believe the Fed has reached its goal and all we have to do is wait for inflation to fall back to 2%. Because they believe the Fed has already stemmed inflationary pressures, they believe the Fed will begin lowering interest rates next year, the economy will have a soft landing without a recession, and growth will resume in 2024. We are not so sure they are correct.

The Fed keeps repeating that rates will be “higher for longer.” We take their statements at face value. Higher for longer alludes to their belief that inflation will NOT come down any time soon. If inflation does not come down, it will put the Federal Reserve in a difficult position. Growth will be slowing, yet they cannot cut interest rates or increase the money supply because those actions are inflationary. This leads to another problem. Since 2008, the Fed has issued a significant amount of short-term debt (31.2% of the Fed’s outstanding debt matures in less than 12 months). Another 20.4% matures in the next one to three years. If (and we believe it is “when”) this debt rolls over at current rates, the interest expense of our debt will be greater than our defense budget. Worse yet, considering the present geo-political risks (Israel & Hamas, Russia & Ukraine, North Korea/China & USA), we expect an increase in our defense budget. It looks impractical to expect anything less.

It appears that the government is ignoring the facts they themselves are reporting. According to the Congressional Budget Office, federal spending should total $6.131 trillion in the fiscal year ending September 30.1 We estimate that would translate to 23.0% of GDP when the jobless rate averaged 3.6%. Let’s put that in historical perspective. In FY 2019, the last year before COVID, the jobless rate averaged 3.7%, and federal spending was 21.0% of GDP. In 2000, at the peak of the first internet boom, federal spending was 17.7% of GDP. Some of this increase is due to higher interest costs, but most is not, and the trend is not good.

This simultaneously puts the US in the unenviable position of facing rising interest rate expenses, rising defense budgets, and increasing entitlement spending (social security, Medicare, etc.). We’ve already seen one downgrade of US credit quality, and multiple credit rating agencies have alluded to the fact that there may be additional downgrades coming. We understand why.

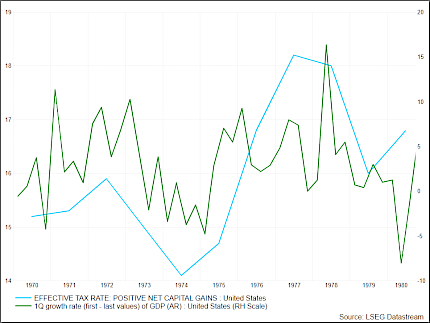

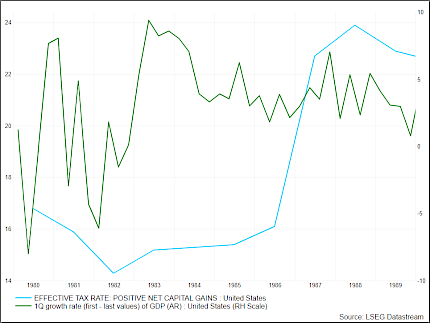

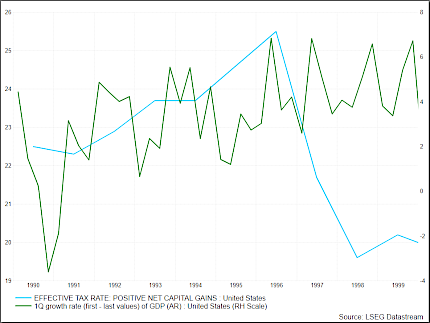

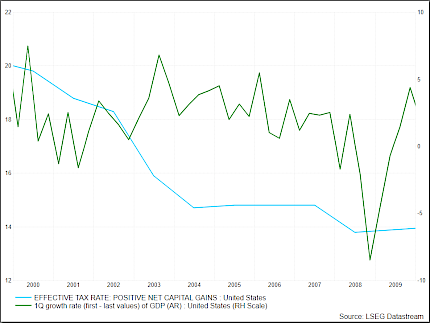

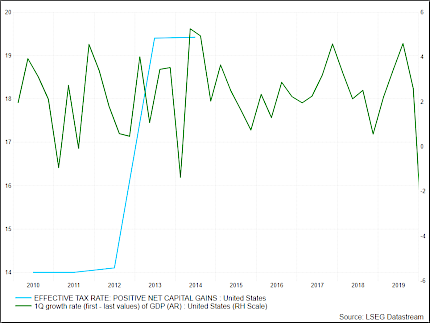

With government expenses on the rise, many view the simplest solution as raising tax rates. This will, after all, increase our government’s income (at least in the short term), allowing us to continue to pay our debts. However, looking at the last 50 years of data, the cost of raising taxes usually comes at the expense of lower GD Growth. To help see this, we’ve run the charts below for 10-year periods, beginning in 1970. In the series of charts below, you can see that as the Effective Tax Rate climbs, the GDP growth rate generally falls, and as the Effective Tax Rate falls, the GDP growth rate typically accelerates.

Effective Tax Rates and GDP: 1970 to 1980

Effective Tax Rates and GDP: 1980 to 1990

Effective Tax Rates and GDP: 1990 to 2000

Effective Tax Rates and GDP: 2000 to 2010

Effective Tax Rates and GDP: 2010 to 2020

Our long-term concern is that slowing GDP growth translates into less taxable income for the government to tax. With higher expenses and lower income, tax rates will need to be raised again. We have a name for periods that look like this, it’s stagflation. For those who remember the 1970s, it was NOT a great time economically speaking. Because of this, our view is that raising the long-term growth rate of the US economy ought to be a key focus of policymakers.

How this can be achieved:

- Increased labor productivity is disinflationary and leads to higher economic growth.

- Reduced regulation may also be disinflationary and can stimulate economic growth.

- Tax-based incentives can motivate corporations to increase capital expenditures (even when other factors do not), contributing to higher growth.

These are just a few of the many potential things we’d like to see the government focus on because higher economic growth would increase the amount of total taxable income, potentially creating a better path forward. This, combined with restraint in deficit spending, would allow us to reduce our deficit. We believe effective measures to stimulate growth combined with cost controls will help our economy manage its current challenges better.

Unfortunately, we don’t see a lot of evidence that government leaders are focused on these issues. We may be in for a bumpy ride if they do not. An increase in capital expenditures with a decrease in government spending would allow for continuing levels of relatively low unemployment, more stable inflation data, deficit reduction, and higher labor productivity levels.

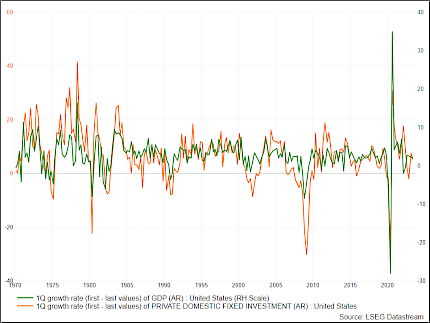

Capital Expenditures and GDP tend to move in the same direction simultaneously.

Because Federal, State, and Local spending is already roughly 42% of GDP, we hope they realize this sooner rather than later. If not, we expect tax rates will eventually go much higher, further reducing capital expenditures, leading to less innovation, fewer productivity improvements, less investment in and maintenance of capital, and, ultimately, less economic growth.

Source: 1. Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist First Trust

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Fed's Powell faces 'what, me worry?' moment of spiking bond yields, war, political stalemate

Federal Reserve officials may not raise interest rates when they meet in two weeks but neither will they say their 19-month drive to hike borrowing costs is over, a difficult messaging challenge U.S. central bank chief Jerome Powell will take on this week.

Reuters

Insight: As global debt worries mount, is another crisis brewing?

Record debts, high interest rates, the costs of climate change, health and pension spending as populations age and fractious politics are stoking fears of a financial market crisis in big developed economies.

Reuters