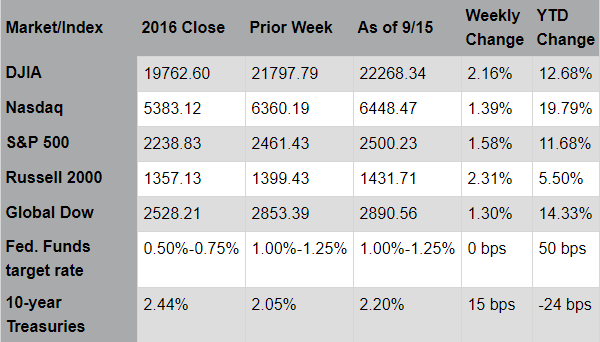

Markets rose last week as Hurricane Irma caused less damage than feared and tax reform efforts took center stage. Prices for both U.S. Treasuries and gold fell following steady increases since early July; an apparent easing of geopolitical tensions with North Korea (notwithstanding Friday’s early morning launch of a missile over Japan) relaxed demand for these “safe haven” assets. The price of West Texas Intermediate crude, the North American benchmark, briefly surpassed $50 per barrel for the first time in six weeks. The Paris-based International Energy Agency reported a higher-than-expected (2.3 million barrels per day) growth in global oil demand in the second quarter. Energy stocks also rallied in anticipation of higher project activity; the PHLX Oil Service Sector index gained 6% for the week. Economic data, meanwhile, were mixed: industrial production declined 0.9% in August; retail sales declined 0.2% in September; and, the preliminary reading on consumer sentiment dropped from 96.8 last month to 95.3. Hurricanes Harvey and Irma weighed on the economy; but activity should rebound as rebuilding efforts begin. There is a lot of work to do from the storms that should provide a longer term lift to the economies that were most devastated by the storms.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

The Dow Jones Industrial Average, with a gain of 470 points, posted its best week of the year. And, overall, major market indices continue to reach new highs despite concerns over the duration of the bull market and elevated stock valuations. The impressive resilience is a function of a favorable economy and an absence of disruptive geopolitical events. Recall in years past when events threatened to undermine the global economy; this year, the market views even the latest conflict with North Korea as a sideshow. Moreover, investor skepticism of the market’s advance is helping to avoid the type of enthusiasm that typically signals the end of a bull market. So far this year, the main cause for concern revolves around President Trump and his ability to deliver on his ambitious pro-growth agenda. This week’s focus on tax reform, as well as last week’s debt ceiling deal with Democratic leadership, suggest that the administration recognizes the need for a legislative “win.” For now, global economic growth and low interest rates continue to support market conditions. Third quarter earnings season, which begins in October, and the three remaining Federal Reserve meetings should plot the course for markets through the remainder of the year.

Source: Pacific Global Investment Management Company

Last Week's Headlines

- The lack of inflationary price pressure in the economy has persisted throughout the summer months. According to the Consumer Price Index, consumer prices rose 0.4% in August and are up 1.9% over the past 12 months. However, much of the monthly increase is attributable to a spike in energy prices, particularly gasoline, which increased 6.3% in August and has increased 10.4% over the past 12 months. The index less food and energy rose a more modest 0.2% for the month and is up 1.7% over the past 12 months. According to the report, Hurricane Harvey had a very small effect on survey response rates in August.

- The prices producers received for goods and services increased 0.2% in August compared to July's 0.1% decrease. For the last 12 months ended in August, producer prices have increased 2.4%. The index for producer prices less foods, energy, and trade services also increased 0.2% in August following no change in July. Over the last 12 months, producer prices less foods, energy, and trade services rose 1.9%.

- Retail sales to consumers scaled back in August, decreasing 0.2% from the previous month. In-store sales were down 0.3%, while nonstore (online) sales were down 1.1% for the month, but are up 8.4% over the prior 12 months.

- The federal deficit was $107.7 billion in August, an increase of $65 billion from July. Through 11 months of fiscal 2017, the total deficit sits at $674 billion — up from $619 billion over the same period last year. Compared to last year, total expenditures are up 3.1% while total receipts are ahead 1.9%.

- Hurricane Harvey impacted industrial production in August, according to the Federal Reserve's Industrial Production and Capacity Utilization report. Industrial production declined 0.9% in August following six consecutive monthly gains. The index for manufacturing decreased 0.3%. The manufacturing industries with the largest estimated storm-related effects were petroleum refining, organic chemicals, and plastics materials and resins. The output of mining fell 0.8% in August, as Hurricane Harvey temporarily curtailed drilling, servicing, and extraction activity for oil and natural gas. The output of utilities dropped 5.5%, as unseasonably mild temperatures, particularly on the East Coast, reduced the demand for air conditioning.

- The Job Openings and Labor Turnover Summary for July revealed the number of job openings increased from 6.12 million in June to 6.17 million in July. The number of hires and total separations in July were little changed from the prior month. Some of the areas seeing notable job increases include transportation, warehousing, and utilities and educational services. Job openings decreased in health care and social assistance and state and local government. Over the 12 months ended in July, hires totaled 63.6 million and separations totaled 61.5 million, yielding a net employment gain of 2.1 million.

- In the week ended September 9, the advance figure for initial claims for unemployment insurance was 284,000, a decrease of 14,000 from the previous week's unrevised level. Hurricanes Harvey and Irma impacted this week's initial claims. The advance insured unemployment rate remained at 1.4%. The advance number of those receiving unemployment insurance during the week ended September 2 was 1,944,000, a decrease of 7,000 from the previous week's revised level.

Eye on the Week Ahead

The Federal Open Market Committee meets this week following a break in August. Committee members will cull a mixed bag of economic information, with job growth steady but little inflationary pressure. The FOMC may opt to leave interest rates as they are for the time being, with a possible increase in October in anticipation of more noticeable economic growth during the fall months.