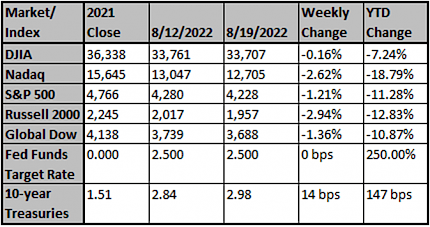

Equities declined last week (S&P 500 -1.2%) with the bulk of the decline coming toward the end of the week. The decline came after four straight weeks of gain. Downside occurred due to Fed commentary indicating determination to fight inflation and therefore more rate increases. Downward earnings revisions and stretched valuations were also of concern. Best sectors were consumer staples (+2.0%), utilities (+1.3%) and energy (+1.3%). Biggest decliners included communication services (-3.3%), materials (-2.4%) and REITS (-1.9%).

Second Quarter “22 Reporting Season 95% Complete

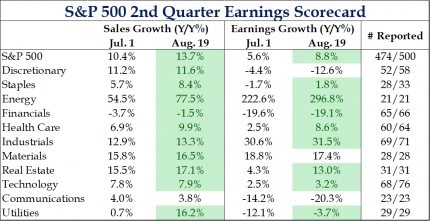

After the reporting of some notable retailers last week, the EPS growth rate for 2Q ticked lower to 8.8%, which is still better than expected at the beginning of this earnings season. However, now that the earnings season is largely complete, we can say that earnings growth should continue to slow over the coming quarters, cracks are emerging in various corners, and supply chain constraints are beginning to ease. Guidance for next year has been soft, which aligns with our expectations.

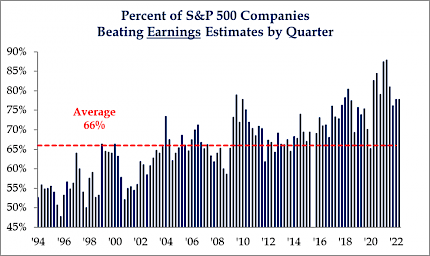

78% Of Companies Beating Estimates

During the second quarter, 78% of companies beat analyst estimates which continues to be well ahead of the long-term average. This is now the 3rd quarter in a row where companies beating estimates was in the mid-70% range and remain down from the highs seen following the covid shutdowns. We would continue to expect this figure to normalize.

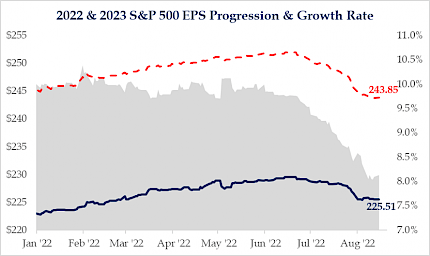

2023 Earnings Per Share (EPS) Softening Lowering Growth Expectations

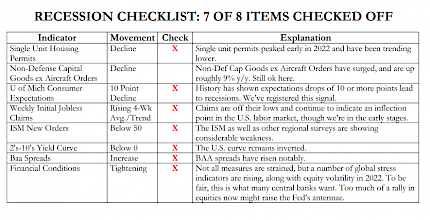

As previously mentioned, 2023 guidance has been underwhelming, and analysts have lowered EPS expectations by roughly $10 thus far. With 2022 stabilizing at about $225, earnings growth for next year will continue to come in. What had been approximately 10% at the beginning of the quarter now sits at 8.1%. Should the economic outlook continue to weaken with the Fed still on a rate hiking trajectory, we expect 2023 to come in further. As a reminder, earnings decline on average about -30% during recessions.

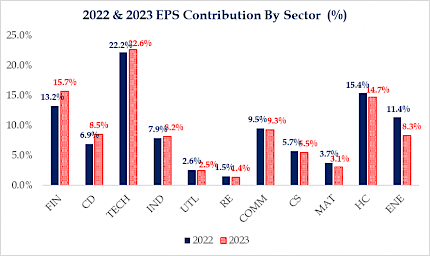

Energy Contribution To Decline Next Year

Expectations for next year show that energy’s contribution is expected to fall from roughly 11% to 8%. The consensus believes that the Financials and Discretionary sectors will garner a larger share of earnings in 2023, which in our view is a disconnect between the market thinking there will be a growth slowdown in 2023 and two cyclical industries gaining share of earnings at a time when unemployment would be rising, and consumers are cutting back.

If one believes that the recent rally in stocks from the June low is a bear market rally, as we do, it would seem that most indicators are a long way off from the levels seen at other bear market bottoms. There is, of course, a case to be made that we have entered a new bull market, making current levels of these indicators irrelevant. We remain cautious to the extent to which we believe the odds favor a recession in the next 12 months. There has never been a recession in which earnings have not fallen meaningfully. We are sticking with high-quality companies that can weather any potential storm.

DIVIDENDS/SHORTER DURATION USES OF CASH ARE OUTPERFORMERS

During a period of high inflation, it is not surprising that long-duration equities whose present value is tied only to the terminal value of the stock and long-term interest rates take on the characteristics of zero-coupon bonds. While a good case can be made the rate of inflation has peaked, there are components of inflation – like wages, rents, and the price of oil – that we believe are structural. The cash flows to investors from shorter-duration equities, on the other hand, allow investors to partially hedge the impact of inflation via reinvestment. In such an environment, it might not be surprising that the market is rewarding companies who are making shorter-duration capital allocation decisions, like retained earnings, dividends, and balance sheet repair over those who are making longer-term investments like capital expenditures. We believe companies who have the ability to fund their own growth without a reliance on the capital markets are likely to continue to outperform.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economy Week Ahead: Household Spending and Federal Reserv...

Economists surveyed by The Wall Street Journal expect surveys of purchasing managers to point to a steadying of the U.S. services sector in August after it contracted in July.

The Wall Street Journal

Forecast for Powell's mountain resort trip: High inflatio...

(Reuters) - For workers hoping to hold onto wage gains and investors hoping to hang onto profits, Federal Reserve Chair Jerome Powell's remarks this

InvestmentNews

Got an extra $11,500? You'll need it to keep up with 2022...

It's difficult to grasp what an extra dollar here or several dollars there mean over the course of several weeks, months or an entire year.

News Nation