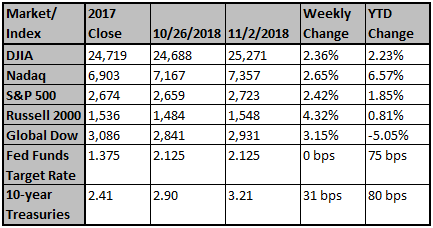

The major indices rose last week despite declines on Friday. Investment sentiment improved as the Russell 2000® Index led all the major indices (+4.33%) followed by the Nasdaq (+2.65%), S&P 500® Index (+2.42%) and the Dow Jones Industrial Average (+2.36%). Several factors, including strong corporate earnings and job gains, influenced the upturn. Disappointing earnings reports tended to be company-specific; for example, Apple reported better-than-expected earnings even though iPhone shipments were lower than estimates. The stock declined 6.6% as the company announced changes in reporting structure to shift investor focus to the growing application and services revenues rather than new sales. Conversely, Starbucks rose 9.7% on positive earnings trends in the U.S. and China, and new growth initiatives. In earnings conference calls, business executives have voiced mixed reactions to the impact and uncertainties related to trade tariffs. Trade issues with China took center stage on Friday after President Trump and Chinese President Xi Jinping spoke by phone on Thursday; apparently, the leaders may hold a ‘side’ meeting at the G20 meeting later this month. President Trump has reportedly asked key U.S. officials to begin drafting potential terms to stop the escalating conflict. The process may be similar to the truce negated in July with European Commission President Jean-Claude Junker. However, President Trump’s economic adviser Larry Kudlow stated, “There’s no massive movement to deal with China.” . . . “We’re not on the cusp of a deal.”

It has become more clear that China trade issues are moving equity markets. Our belief is that investors became too bearish in October over the idea of a cold war. Yes, China geopolitical tensions are building and will continue to grow in the coming years, but this is not a binary event. There is room for a future China trade agreement within the larger geopolitical tensions given that the President wants to win re-election in 2020 and he is acknowledging that trade tensions are impacting stocks and possibly growth.

China Trade Issues:

Around July 3rd, President Trump made a very important decision to ring fence the three different trade fights the US was engaged in: 1) NAFTA; 2) EU Autos; and 3) China. The President understood he could not win three trade wars and decided to deliver results on the first two trade matters with allies so he could focus on China. Immediately, NAFTA talks were resurrected despite the Mexican election, and four weeks ago Canada, Mexico, and the United States came to an agreement. In mid-July President Trump and European Commission President Juncker agreed to negotiate over possible zero tariffs on industrial goods. While a deal may or may not happen, as long as negotiators are talking, the prospect of auto tariffs on EU autos remains low. This strategy has started to produce dividends. Last week Germany announced the country will build an LNG import terminal.

Progress on the NAFTA and EU fronts isolated the China dispute. Investors will give Trump wide latitude on China if they believe the final result will lower tariffs and non-tariff barriers. Trump was imposing tariffs on China in September and stocks were moving higher with the belief a post-election deal was coming.

Taken altogether, the S&P 500 rallied nearly 8 percent from July through September, the VIX fell from 17 to 12, and there was no + or – 1 percent move in stocks for the three-month period.

Bullish sentiment on a China trade deal began to crumble on October 4th when Vice President Pence delivered a speech about the growing geopolitical threat of China. In light of these remarks, we saw investors downgrade the prospect of a China trade deal. This forces the models to assume existing tariffs will be in place for 2019, the proposed higher 25 percent rate will kick in January 1st, and a higher probability of an additional $267bn of goods getting hit with tariffs. Hence, the models for earnings and growth were revised down in 2019 while the Fed maintained a hawkish view of rates.

Longer term, the belief among analysts is that the prospect of a new cold war lowers multiples of stocks. In fact, we have shown that stocks traded at lower multiples prior to the Berlin Wall coming down. But once the Wall went down, the world globalized, inflation was restrained, and multiples expanded on stocks. In a new cold war, the world will de-globalize which leads to higher costs and ultimately lower multiples for stocks.

We believe the cold war thesis is being viewed as too binary of an option by investors. Trump wants to get reelected more than anything else. Is he really going to tank the economy before his reelection? Likely not. So why is he doing this now? Because it is a midterm election year and he is trying to ramp up his base. He also goes all in on his opponent before cutting the deal. Our guess is that Trump can cut a trade deal post-midterms and then ramp up the geopolitical pressure after his reelection.

For Trump, the largest middle class tax relief he can provide is to end the tariffs through a deal. And this will cost the Treasury not one penny.

The key takeaway from this week’s developments is not when or how a China deal will happen, but that the Pence speech is not the wall that investors believed would block a trade deal from happening, which led to recent equity market weakness. Directionally, trade is likely to improve post-midterm election even if a deal is not imminent.

Post-midterm election, the possibility of a trade deal will come down to the Chinese. If the Chinese offer soybean purchases, Trump walks. But if there is a meaningful move to lower tariffs and phase out joint venture requirements, that is a recipe for a deal Trump can take. The Chinese are already moving to the US position by lowering tariffs on non-US goods and ending the JV requirements for automakers. In our view, a deal involving lower tariffs and eliminating JV requirements is no longer making a special concession to the US but agreeing to US parity to what other countries already have. The off-ramp is there.

We don’t want to make this sound easy. It is not. But the prospects for a future deal are greater than what stocks are pricing in at the current time.

Our Economy is right on Track

The creation of 250,000 new jobs in October easily exceeded the estimates of 208,000. Unemployment remained at 3.7%, wages rose at a 3.1% annual rate and more people are re-entering the workforce. Last week several auto and truck dealers said manufacturers and suppliers have expressed a positive sentiment although many decried their low stock prices; some announced an increase in their corporate stock buyback program to take advantage of significantly undervalued prices. The resumption of stock buybacks has no doubt contributed to this week’s market recovery.

This week, all eyes will carefully watch the election results for potential leadership changes in Congress. Elsewhere, the technology sector seems to be forming a bottom following the sector’s decline into correction territory; also, both Amazon and Netflix fell into bear market territory. Overall, investors seem more worried about the tech selloff and trade tensions rather than other factors such as rising interest rates and an increasingly strong dollar. Importantly, continued economic growth could benefit balanced portfolios (that is, those without heavy overweighting in technology). Continued improvement in the geopolitical landscape over the next few months could increase investor confidence.

Source: (1) Strategas and (2) Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Related Articles

China's Xi Again Talks Up Commitment to 'Free Trade'

Chinese President Xi Jinping took to the global stage to repeat his rhetoric against protectionism and promote his country as an advocate for international openness and cooperation.

To Control Health Care Costs, U.S. Employers Should Form...

A hot labor market is limiting employers' ability to shift more costs to their workers.

3 Things IBM Sees In Red Hat That Others Missed

IBM sees in Red Hat the world's largest portfolio of open source technology, their innovative hybrid cloud platform, and a cast open source developer community.