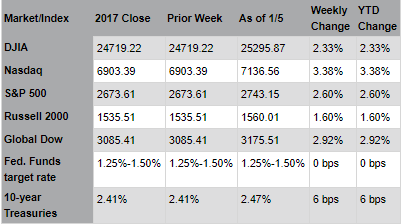

Markets continued their strong start to the New Year with another 500+ point advance in the Dow Jones Industrial Average last week breaking through DOW 26k today. Improving fundamentals for the global economy, and corporations, are buoying investor confidence; weekly inflows into global equity markets hit a six-month high. Small cap value stocks outpaced large cap growth stocks; the market?s preference for small caps indicates that investors are starting to look for returns outside of popular areas such as the ?FAANG? stocks. And, sectors that are more sensitive to the economy, including Energyand Industrials, continued to outperform Utilities and other, more conservative areas. This trend reflects growing confidence in the economy and an associated willingness by many investors to accept additional risk. Indeed, in only nine trading days, the PHLX Oil Service Sector Index has returned nearly 10% in 2018. West Texas Intermediate crude oil, the North American benchmark, closed above $64 per barrel for the first time since December 2014; current prices may support deepwater offshore projects, such as those in the Gulf of Mexico, which had been on hold for the past several years. Meanwhile, both Treasury yields and inflation rose. The recently announced increase in the minimum wage, and rising transportation costs, will place further upward pressure on prices. The long-delayed increase in inflation is consistent with broad economic expansion; higher inflation is typically neutral-to-positive for stocks, but negative for bonds.

The earnings season started with JPMorgan Chase and Wells Fargofalling short of estimates due to write-downs related to the lower corporate tax rate. The longer-term impact of tax reform, though, will be generally positive for the U.S. economy. Jamie Dimon, CEO of JPMorgan Chase, noted that, ?The enactment of tax reform in Q4 is a significant positive outcome for the country. U.S. companies will be more competitive globally, which will ultimately benefit all Americans. The cumulative effect of retained and reinvested capital in the U.S. will help grow the economy, ultimately growing jobs and wages.? This week, 25 companies in the S&P 500? Index report results; overall, sales are expected to grow 6.7% while earnings are expected to grow 10.5%. This would mark the third time in last four quarters that the Index will have posted double-digit earnings growth; earnings grew 14.0% in Q1, 10.3% in Q2, and 6.4% in hurricane-impacted Q3. Companies have started to provide details on the likely impact of tax reform; several, including Wal-Mart and Delta Airlines, have announced wage increases and bonuses. Likewise, analysts are also beginning to adjust financial models to account for the lower tax rate; some expect earnings for domestically-focused industries, such as retailers and transportation, to benefit as much as 20%.

The strong start to 2018 is a positive sign for the remainder of the year. The 3.7% month-to-date gain in the Russell 2000? Index of small companies contrasts sharply to the slow starts over the past several years: the Index rose 0.4% in January 2017, and fell -8.9% in January 2016, -3.3% in January 2015, and -2.8% in January 2014. The last time the markets started off as strongly was in 2013 when the Index gained 6.2% in January; that year, small cap stocks soared 37.0%. Notably, 2013 was characterized by a shift in investor sentiment that may be similar to today; then, investors? appetite for risk following the European debt crisis provided a catalyst that drove the market?s advance. Today, tax reform and global economic growth are providing a boost to investor confidence that, at least in the early going, is prompting a rally in small cap stocks.

* Pacific Global Management

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Last Week's Headlines

- Consumer prices have remained relatively stable through 2017, according to the Consumer Price Index. The price increase was driven primarily by an increase in housing and medical care costs. For the last month of the year, the CPI increased a marginal 0.1%. Over the year, the index rose 2.1%. Core prices, less food and energy, increased 0.3% in December — the largest increase since last January. For 2017, core prices have increased 1.8%.

- In yet another sign that price inflationary pressures are stagnant, the Producer Price Index for December fell 0.1% after advancing 0.4% in both October and November. This drop in prices is the first such decline since August 2016. Most of the decline is attributable to a 0.2% decline in the prices for services. Core prices (less food, energy, and trade services) edged up 0.1% in December. For the 12 months ended in December, the PPI rose 2.6% after advancing 1.7% in 2016. Core prices increased 2.3% in 2017, after climbing 1.8% the prior year.

- With prices remaining consistent, it isn't surprising that retail sales picked up in December, particularly during the holiday shopping season. Advance estimates of U.S. retail and food services sales for December 2017 increased 0.4% from the previous month, and 5.4% from December 2016. Total sales for 2017 were up 4.2%.

- There were 5.9 million job openings on the last business day of November, according to the Job Openings and Labor Turnover report from the Bureau of Labor Statistics. There were 5.5 million hires and 5.2 million separations. The quits rate was 2.2%, while the rate of layoffs and discharges was 1.1%. Job openings increased in retail trade (+88,000), but decreased in other services (-64,000); transportation, warehousing, and utilities (-60,000); and real estate and rental and leasing (-39,000). Over the 12 months ended in November, hires totaled 64.6 million and separations totaled 62.4 million, yielding a net employment gain of 2.1 million.

- The federal deficit was $23.2 billion in December. Over the first three months of fiscal 2018, the total deficit sits at $224.9 billion. For December, government receipts were $325.8 billion, while the government spent about $349 billion.

- Prices for U.S. imports ticked up 0.1% in December, following an 0.8% rise the previous month. Higher fuel prices more than offset a decline in the price index for nonfuel prices in December. In contrast, U.S. export prices edged down 0.1% in December, after advancing 0.5% in November. Nevertheless, export prices rose 2.6% in 2017 following a 1.3% rise in 2016. The 2017 advance was the largest calendar-year increase since 2011, when the index rose 3.6%.

- In the week ended January 6, initial claims for unemployment insurance was 261,000, an increase of 11,000 from the previous week's level. The advance insured unemployment rate dipped to 1.3%. The advance number of those receiving unemployment insurance benefits during the week ended December 30 was 1,867,000, a decrease of 35,000 from the prior week's level, which was revised down by 12,000. This is the lowest level for insured unemployment since December 29, 1973, when it was 1,805,000.

Eye on the Week Ahead

The holiday (Martin Luther King Jr. Day) week offers little in terms of economic reports. However, the latest report on new residential construction for December is out this week. Applications for building permits and housing completions were down in November, although housing starts were up. Frigid temperatures and some inclement weather may put a further damper on new home building in December.