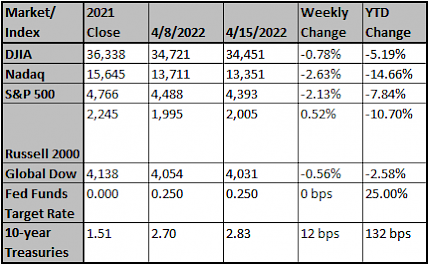

U.S. equities were lower last week, with the S&P 500 down 2.1%. (Small-cap stocks were modestly higher.) Some bullish talking points didn’t get much market traction, including peak inflation, better supply chain trends, and consumer resilience. These positions were overshadowed by fear around inflation, supply chains, and geopolitics. Best performing sectors (and the only ones positive) were materials (+0.7%), industrials (+0.4%), energy (+0.3%), and consumer staples (+0.2%); worst performers were technology (-3.8%), communication services (-2.9%) and healthcare (-2.9%).

1Q Earnings Season Kicks Off, Early Reporters Show Mixed Results

With the early reporters setting the tone last week, this earnings season could be underwhelming as we did not witness the outsized beats we have become accustomed to over the last year. Sales growth is still expected to be double-digits (10.9%) with earnings growth in the mid-single digits (6.3%). Ex-Energy these figures look less robust.

Cost Growth Still Elevated, But Down From January Peak

While earnings growth is slowing, the focus for many investors is on the cost side of the equation. With S&P 500 costs growth peaking at 13.4% in January it should come as welcomed news that the current reading is 11.7%. This may look like a relief for companies on the surface, much of this is simply base effects.

A Notable Fall In Next 12 Month Operating Margin

The next 12-month operating margin turned noticeably lower last week which should garner investors’ attention. As we have written many times over the last 18 months, markets are generally able to hold in as long as margins are stable. The extent to which they begin to decline is when attention needs to be paid. Now is that time.

Recession Discussions Ramping Up

A quick look at the Bloomberg story count for “Recession” shows the count is charging higher. More and more media outlets are writing about the topic with the latest reading even surpassing the baseline levels from 2013 - 2019. The spike during 2019 occurred when the yield curve inverted and the spike in 2020 was during the shutdowns. We expect more questions about slowing growth to come up during earnings season.

The Goldman Sachs economics team says that there is now a 35% chance of a U.S recession over the next two years, with the labor market a particular problem for the Federal Reserve. The large gap between jobs and workers, which keeps wage growth elevated, has historically only declined during periods of economic contraction, chief economist Jan Hatzius and team wrote in a note out on Sunday. Predictions for a recession have been growing as the Fed tries to negotiate a soft landing for the economy at a time when inflation is at a level not seen in four decades.

Deutsche Bank was the first big Wall Street bank to forecast a recession, saying in the first week of April a recession in late 2023 is now their base case.

Quotes: “Taken at face value, these historical patterns suggest the Fed faces a hard path to a soft landing,” Hatzius said, according to Bloomberg. But other strategists are more cautious.

Wells Fargo stock strategist Chris Harvey said in a note last week that despite "daily calls for a recession from anyone with a megaphone, we do not expect one in the next 12 months. Rather, stagflation (high inflation/slower growth) likely will prevail."

Credit Suisse says it is not underweight equities (SPY) (QQQ) because: "i) equities are fair value (not overvalued) with equities being an inflation hedge compared to bonds; ii) monetary conditions are very loose; iii) we only tend to get recessions 9 months after 3-month money inverts relative to 10-year."

Go deeper on yields: The Fed's hawkish signaling, with 50-basis-point rate hikes expected over the next few meetings has sent Treasury yields sharply higher. An inversion in the 2-year and 10-year Treasury yield curve was pointed to as a signal of an upcoming recession. But the inversion was short-lived and that curve has started steepening again.

Yields are up again and the 2s/10s are steepening again this morning. The 10-year Treasury yield (TBT) (TLT) is up 6 basis points to 2.87% and the 2-year (SHY) is up 5 basis points to 2.49%. Real rates, which the Fed also wants to see rise, are climbing as well, with the 10-year inflation-protected yield about 10 basis points away from positive territory.

Source: Brian S. Wesbury, Chief Economist, Robert Stein, Deputy Chief Economist First Trust

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

China's Economy Grew 4.8% in First Quarter, Beating Expec...

GDP accelerated even as lockdowns closed factories and kept tens of millions confined to their homes. However, Beijing faces a major test this year to keep the economy firing.

The Wall Street Journal

Peak inflation may be upon us: Market expert

UBS managing director and senior portfolio manager Jason Katz discusses inflation in the US as our country turns the corner on the pandemic

Fox Business

Hot Economy, Rising Inflation: The Fed Has Never Successf...

Central bank says it is possible, but many factors are out of its control; "they are strikingly behind."

The Wall Street Journal