DEMOCRATIC DIVISIONS OVER THE SPENDING PACKAGE EXPLODED OVER THE WEEKEND

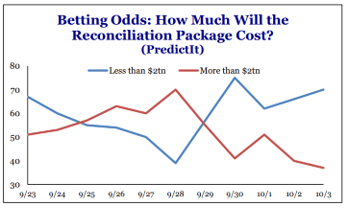

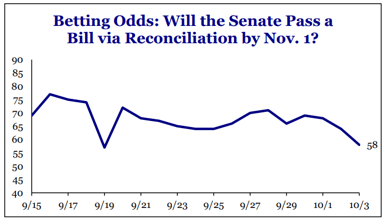

Last Thursday Strategas (one of our research partners) outlined all of the troubles Democrats were having in moving their agenda forward and that the infrastructure vote was likely to be delayed. The delay of the infrastructure package did materialize but during that process, we saw a level of optimism emanating from Congressional leadership that a deal could take place on Friday. Senator Manchin put out his price tag Thursday afternoon, giving the process a bookend for potential outcomes. In a Strategas research update on Friday, they noted a deal could happen quickly if both sides were ready to compromise. They could not have been more wrong. Instead, we are back where we started with Democratic leadership pushing more spending than moderates are willing to accept, President Biden telling Democrats that infrastructure is again linked to the larger spending package, Pelosi delaying the timeline by a month, and activists pushing Senator Sinema to support Build Back Better. In the span of three days, the progress made towards a resolution seems to have stalled out entirely.

The consensus is now lowering both the odds of a spending package going through and the size of that package if it goes through. For a deal to happen we need to see: 1) An agreement on the topline spending number with Pelosi/Biden at $2.1 trillion and Manchin at $1.5 trillion; 2) An agreement on how to fit $3.5 trillion of spending into a $1.7 trillion package; 3) Smaller tax increases and pharma cuts and 4) President Biden to engage and communicate.

ONE PARTY NEEDS TO CAVE TO SOLVE THE DEBT CEILING

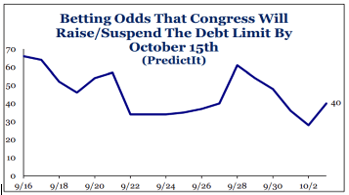

The debt ceiling remains the short-term risk from Washington. The only way it gets solved is if one party caves, which is never easy to do. The debt ceiling can be raised at any time regardless of the larger spending package. There is a tendency to conflate the debt ceiling with the spending package because of the timing and the use of reconciliation. Still, the absence of a spending deal last week further complicates the need to raise the debt ceiling. We expect this week’s vote on the debt ceiling to fail in the Senate. This will create an inflection point when Senate Democrats need to make a decision on whether to raise the debt ceiling through reconciliation or push it to the brink by challenging Republicans to vote for the debt ceiling.

If Democrats choose the reconciliation route later this week, the risk from the debt ceiling collapses. But if the reconciliation route is not taken, Republicans and Democrats will be engaged in a game of chicken as the deadline approaches. As such, the level of risk from the debt ceiling will be determined by the path taken.

Two paths for Congress to raise the debt ceiling:

- Regular Order: Requires 60 votes in the Senate and thus requires 10 Republicans to vote in favor. We will have a vote this week under regular order and the vote will fail. Republicans have little interest in voting for the debt ceiling when Democrats can do it without Republican votes through reconciliation and have already started the reconciliation process to spend trillions of dollars

- Budget Reconciliation: Reconciliation requires just 51 votes in the Senate, meaning the Democrats can raise the debt ceiling without Republican votes. Last week the Senate Parliamentarian ruled that the Democrats can use reconciliation to raise the debt ceiling and can do it separately from the larger spending package. Democrats do not want to go this route because: 1) They want cover from Republicans before voting for the debt increase; 2) They are worried the debt ceiling amendment process will cut their spending package even if it is a nonbinding vote; 3) It’s time consuming (takes about a week); and 4) It distracts from the larger spending negotiations.

THE LEVEL OF RISK AROUND THE DEBT CEILING WILL BE DETERMINED BY THE PATH TAKEN BY THE SENATE

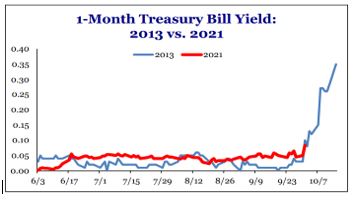

Short-term yields are rising as the market sees less possibility of the debt ceiling being raised in the first half of October. A spending deal last week would have made it easier for Democrats to get the debt ceiling higher, but with the spending deal delayed, the debt ceiling now sits in in the middle of those negotiations. Ultimately, the path chosen this week will determine the level of risk. Democrats have the votes to raise the debt ceiling without Republicans, which is why the reconciliation route is less risky.

WE DISAGREE WITH THE MARKET: FAILURE OF THE SPENDING PACKAGE IS A BULLISH EVENT

We get the sense that financial markets are welcoming the large $3.5 trillion spending package from a macro perspective. We disagree as we see the tax increases as immediate, the spending delayed, and the tax increases much more negative for growth than the spending. Of course, the final details will matter. But there seems to be a complacency that tax increases won’t matter much and the spending is a cushion for future growth. Still, earnings pressure is rising and the tax bill shaves 5% off 2022 earnings. This does not include the pharma cuts or the tobacco tax increases. Nearly every company will get an earnings hit. Only a few companies get the benefit from spending.

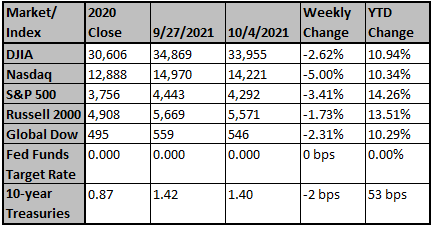

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Evergrande Shares Halted Amid Report of Unit Stake Sale

China Evergrande Group and its property-services arm were halted in Hong Kong stock trading amid a report that the developer agreed to sell a

Bloomberg

Oct 3, 2021

OPEC and its allies will meet to decide whether to raise ...

Some analysts expect the group, known as OPEC Plus, to sign off on a plan to increase production by a modest 400,000 barrels a day next month, under a deal reached in July.

New York Times

Oct 4, 2021

Broader Inflation Pressures Are Beginning to Show

Some indexes that strip away price changes due to idiosyncratic swings in supply and demand show inflation running ahead of the Fed's 2% target.

Wall Street Journal

Oct 4, 2021