Stocks were mostly unchanged last week as political developments, both at home and abroad, preoccupied investors’ attention. Former FBI Director James Comey’s testimony to the Senate Intelligence Committee provided a back story of the events surrounding his dismissal in May. However, investors seemed to collectively shrug at the latest White House drama. In the U.K., Prime Minister Theresa May’s Conservative party unexpectedly lost its parliamentary majority; for the Tories to remain in power, they will need to negotiate a deal with a junior party. Some analysts are hopeful that the defeat at the polls will soften the government’s position in negotiating the terms of Brexit with the European Union. In both the Comey affair and the British elections, the market’s muted reaction indicates that, for now, investors are not overly concerned about these latest developments.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

The market’s relative quiet also reflected the lack of economic data. Even so, following these political events, small caps, led by stocks in the Energy and Financials sectors, outperformed; the technology-heavy NASDAQ, which has already closed at record highs 38 times this year, lagged. The selloff in Technology stocks was particularly noteworthy as the sector has significantly outperformed all others in the S&P 500® Index this year. Several reports this week suggest that Technology stocks have become overvalued and, consequently, susceptible to a correction. In contrast, Financials and Energy have lagged year-to-date. The sustainability of this rotation is not yet clear; nevertheless, the market’s sudden change of direction serves as a reminder of the impact of changes in investor sentiment.

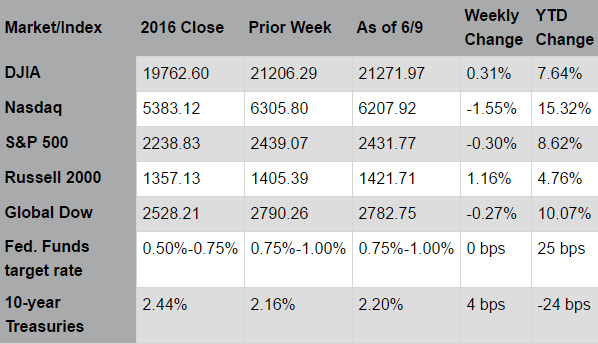

This week’s Federal Reserve meeting is not expected to provide much drama; the current forecast sees a nearly 100% probability of a 25 basis point hike in the Fed Funds rate. Still, investors will focus on Fed Chair Janet Yellen’s commentary regarding the state of the economy, as well as the outlook for further rate hikes and monetary policy decisions. Economic data since the last Fed meeting in May have been somewhat mixed. First quarter GDP was revised higher; unemployment has fallen to new post-recession lows; wages and inflation are on the rise; manufacturing activity is increasing; and consumer confidence remains strong. Job creations, retail sales, the housing market, and services sector growth have been lower than expected. The mixed data suggest that the Fed will be circumspect in its interest rate expectations. Indeed, for the remainder of 2017, analysts currently anticipate just one more rate hike, possibly not until the final meeting in December.

The recent outperformance of Technology stocks may be an example of herd mentality; that is, investors drive stocks higher until an event triggers a sudden reversal. Many high-performing companies in other sectors remain undervalued as investors focused on NASDAQ stocks. As we near the end of June, the focus will shift to second quarter earnings; these updates could highlight other sectors and overlooked stocks.

*Source: Pacific Global Investment Management Company

Last Week's Headlines

- Activity has slowed in the non-manufacturing sector in May, according to the Institute for Supply Management. The Non-Manufacturing Index registered 56.9%, which is 0.6 percentage point lower than the April reading of 57.5%. The non-manufacturing sector, which includes such industries as real estate, accommodations, food, arts and entertainment, and health care, grew for the 89th consecutive month (a reading of 50% or higher indicates growth), but at a slower pace than the prior month.

- According to the Non-Manufacturing ISM® Report On Business®, new orders, business activity, and prices all showed a slower rate of growth compared to April. Only employment grew at a faster pace.According to the Job Openings and Labor Turnover (JOLTS) report, there were 6.0 million job openings in April. Job openings increased in a number of industries, with the largest increase occurring in accommodation and food services (+118,000). Job openings decreased in durable goods manufacturing (-30,000). The number of job openings increased in the Midwest and Northeast regions. The number of job hires decreased by 253,000 to 5.1 million. Hires decreased in health care and social assistance (-68,000) and real estate and rental and leasing (-23,000). The number of hires decreased in the West region. Total separations (turnover) edged down 225,000 to 5.0 million in April. Total separations increased in state and local government education (+17,000) but decreased in retail trade (-100,000). Over the 12 months ended in April, hires totaled 62.9 million and separations totaled 60.7 million, yielding a net employment gain of 2.2 million.

- Following last week's election, the UK's ruling Conservative Party lost its parliamentary majority. How this development will impact the Brexit remains to be seen, but indications are that negotiations will push ahead even though the political strength of Prime Minister May has been weakened.

- In the week ended June 3, the advance figure for seasonally adjusted initial claims for unemployment insurance was 245,000, a decrease of 10,000 from the previous week's revised level. The advance seasonally adjusted insured unemployment rate remained at 1.4% for the eighth consecutive week. For the week ended May 27, there were 1,917,000 receiving unemployment benefits, a decrease of 2,000 from the previous week's level, which was revised up 4,000.

Eye on the Week Ahead

The big news this week surrounds the FOMC meeting and whether interest rates will be increased. The Committee held off on an interest rate hike in May and appeared primed to jack up rates in June. However, major economic indicators, such as consumer prices, consumer spending, the GDP, and the employment sector, have not been especially strong, leading to speculation that at least some members of the Committee may be inclined to hold rates as is until steadier economic progress is evident.