2020 will be a year we will all remember. Not only was it the year the global economy was abruptly shut down for the Covid-19 Pandemic, but it was also the year we saw the biggest (by a very large margin) fiscal and monetary stimulus ever. So far, it looks like 2021 is another year we will never forget. The fiscal and monetary stimulus numbers in 2020 are bigger than they were in 2021, and the proposed tax increase to pay for it all will be the biggest tax increase since 1968.

On March 31, 2021, President Biden announced the first part of his infrastructure plan, which focuses on building out the nation’s physical infrastructure. Between both the physical and social infrastructure plans, Biden is aiming to spend $4 trillion over 8-10 years while raising $3 trillion in taxes. The headline number suggests there will be more fiscal stimulus and more net Treasury issuance. However, in its current form, we believe the short-term impact may lead to a net fiscal drag in 2022 and 2023 as the tax increases are immediate and the spending is lagged. Infrastructure and climate change spending by nature takes years to get out the door. Congress could alter this by phasing in the tax increases to negate some of this effect, and the legislative process will matter. But still, the massive COVID-19 fiscal spigot is closing, and we anticipate a net fiscal tightening in 2022. Investors need to begin pricing in higher corporate, capital gains, and dividend taxes.

This fiscal tightening will be occurring at the same time the previous stimulus is wearing off. We would normally view this as very damaging to the economy, but fiscal drag may matter less in 2022 than in normal times due to the reopening (the US could be creating 1 million jobs per month in the coming months) and due to the massive build-up in personal savings (Americans hold more than $2 trillion in savings currently). We believe there is a significant amount of pent-up demand.

EVEN WITH LOOMING TAX INCREASES, THE RE-OPENING IS GOING TO BE MASSIVE

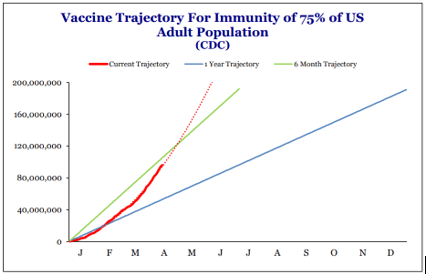

We know there are still risks associated with Covid-19 and its new variants. However, we also know that the current vaccines have proven effective against the new variants and early research indicates they will continue to be effective against them. Also, the rate of vaccines given per day is climbing; as of March 30, 2021, CNBC reported the 7 day average was 2.8 million vaccinations given per day in the US, and 75 percent of Americans aged 65 and over have already been vaccinated. Further, early data shows the vaccine results in younger Americans are nearly perfect. So while we understand there are risks, it appears we are headed in the right direction, and many Americans are ready to move forward with their lives after being locked down for over a year. Below we have included a chart of the vaccine trajectory in the US.

NEXT ROUND OF FISCAL POLICY LOOKS LIKE FISCAL TIGHTENING FOR 2022 AND POSSIBLY 2023

The next part of Biden's initiatives will be more spending on social policy items. Both proposals are expected to be included in Biden’s initial budget documents to be released on April 1, 2021. In total, Biden is expected to announce $4 trillion of new spending over the next 10 years, which will be offset by $3 trillion of tax increases over the next 10 years.

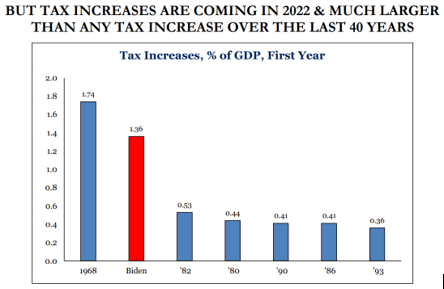

To put this tax increase in perspective, it will be the largest tax increase (by far) in the last 40 years. As a point of reference, it will be over three times larger than President Clinton’s tax increase. Below we have included a chart of tax increases as a percent of GDP going back to 1968.

Biden’s Infrastructure & Climate Plan Is Roughly $2.25 Trillion Of Spending Over Eight Years: So where will the money be spent? We expect $600bn over eight years for traditional infrastructures such as highways, bridges, ports, and rails. Nearly $200bn of this funding will be dedicated to the electric vehicle market as Biden aims to establish 500k charging stations. Another $300bn will be dedicated to supporting domestic manufacturing, $200bn for housing infrastructure, $100bn for broadband, $100bn to modernize the electric power grid, $137bn for schools and child care centers, $111bn for safe drinking water, and $400bn for elderly and disabled housing. The plan also seeks to replace 50k diesel transit vehicles and electrify 20 percent of school buses.

Temporary Infrastructure Spending To Be Paid For With Permanent Corporate Tax Rate Increases:

Biden’s plan will propose raising the corporate tax rate from 21 to 28 percent, raising the minimum tax on US multinational income overseas from 10 to 21 percent, and imposing a 15 percent minimum book tax on companies that make capital investments (often termed the Amazon tax). Notably, Biden is likely to propose that companies have to pay the global minimum tax on a country-by-country basis rather than a worldwide basis. This tax increase actually raises more revenue than increasing the corporate tax rate. Additionally, Biden will propose ending existing tax deductions for US fossil fuel companies. While the dollar amount is small, $20bn over 10 years, removing the intangible drilling credit is a major policy change that will make it more expensive to get oil and gas out of the ground.

How is this a net fiscal drag in the short run? Infrastructure spending operates with a lag and just 25 percent of allocated dollars get spent in the first year. As such, the tax increases hit immediately, but the infrastructure spending takes 18 months to really ramp up. Because of this timing process, the size of tax increases in 2022 will likely be much greater than the spending authorized, leading to a fiscal drag.

FISCAL RATHER THAN MONETARY TIGHTENING

Tax Increase Proposal Will Be The Largest Tax Increase Since 1968: We don’t believe Biden will be able to get all of his tax increases enacted. But his total tax increase proposal will be $3 trillion over 10 years, which is the equivalent of $300bn per year, or 1.5 percent of GDP. To place this in context, the Clinton tax increase in 1993 was 0.4 percent of GDP. The Biden proposal will be the largest tax increase since 1968 and will be only partially offset with new spending. Also similar to 1968, the new measures target capital formation, and those tax increases are viewed as counterproductive to economic growth. Some policymakers believed the 1968 tax increases would slow the growth of inflation. Fiscal policy was effective at slowing economic growth but did not slow inflation.

The Current Plan Looks Like Fiscal Tightening Over Monetary Tightening: Federal Reserve Chairman Jay Powell is adamant that he is not raising interest rates even as the economy re-opens and the unemployment rate comes down in his forecast. Many believe this position is unsustainable. But is it? The current stance of Biden, Yellen, and Powell looks like the first year of the Clinton Administration when Greenspan agreed to keep interest rates low while Clinton raised taxes on the wealthy. The idea being that tax increases on the wealthy slow growth (and reduce demand for dollars) while interest rates remain low for low and moderate-income borrowers. We would note that, despite the fiscal tightening, in early 1994 Greenspan was forced to raise interest rates more abruptly than initially believed, and some large investors were caught offsides and equities struggled.

The tax increases of 0.4 percent of GDP in 1993 did not stop the Fed from having to abruptly raise interest rates in 1994. Stocks struggled as interest rates moved higher in early 1994.

HIGHER CORPORATE TAX RATE & WORLDWIDE TAX ON US MULTINATIONAL INCOME TAKES $12 OFF S&P 500 EPS

Although we don’t believe the full Biden tax proposal will go through (as stated above), for illustrative purposes we took the two main corporate tax proposals in the Biden plan and looked at how they would impact EPS. The two tax increases eat up $11.82 per share of S&P 500 earnings. This is a crude analysis based on the limited information we have, and when we get Biden’s budget on Thursday we can get a more accurate estimate.

BIDEN PROPOSES MOVING THE US BACK TO A WORLDWIDE TAX ON US MULTINATIONAL INCOME

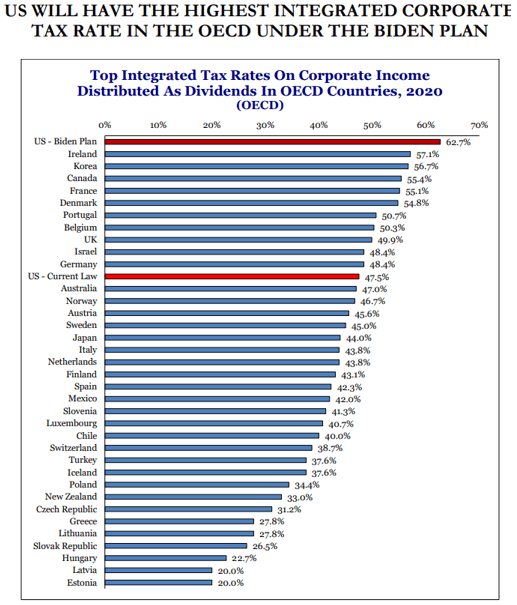

The Trump corporate tax reform made two very important changes. First, the US corporate tax rate, which was the highest in the industrialized world, was lowered from 35 to 21 percent. Second, the US moved closer to a territorial tax system. Before 2018, the US was one of just six countries that double taxed foreign source profits, which placed US companies at a competitive disadvantage. The combination of the high tax rate and onerous international tax law led to a surge of corporate inversions.

The 2017 tax bill imposed a one-time tax on companies’ income overseas and allowed that money to be repatriated back to the US. And companies have been bringing the cash home. The idea that all of this money was used for buybacks does not bear itself out in reality. Companies will have less cash to bring home since the minimum tax will be raised on these earnings.

All of this still needs to get through Congress and we will keep you posted on how things develop. Please call or email with any questions you may have.

There is a lot of uncertainty about how the stimulus spending, reopening of the US and global economy, and tax increases will affect the jobs, savings, the stock, and the bond market. There are many who argue the proposed corporate tax burden will bring corporate taxes higher than they were before Trump's tax cuts (higher than 35%). They also point to the period of corporate inversions before 2017 when many corporations moved their headquarters out of the US. To support their statement, they point to the fact that between 2018 and 2020 US corporations repatriated $1.6 trillion whereas in the three years before 2018 they had only repatriated $495 billion. Proponents of Biden's plan say the raising the minimum tax on US multinational income overseas to 21% will prevent the inversions from happening again. They also argue that "global minimum tax on a country by country basis will prevent corporate inversions. Those against the plan content such a dramatic increase in taxes will lead to higher prices for finished goods and services, thus raising inflation, and potentially stifling growth. Adversaries of the plan also claim the"minimum books tax" on companies (often termed the Amazon tax), will reduce capital investments slowing economic growth, whereas proponents of the plan argue it will make all companies pay their fair share in taxes. Dan Clifton of Strategas, who we follow, suggests if the full plan were to pass, it would increase the total overall tax burden on corporate income to 62.7%, making it the highest in the Organization for Economic Cooperation and Development. Mr. Clifton also suggests that it is NOT LIKELY that the full plan will be approved, suggesting rather that it is a starting point to begin negotiations.

Source: Strategas

While we cannot predict the future, we believe it is safe to assume that with plans as dramatic as those presented for monetary, fiscal, and tax policies, volatility will continue to rise and the public debate over what should or should not be done will carry on. If nothing else, 2021 promises to be very interesting.

Please call or email us with any questions.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com