Despite some challenges, 2Q economic growth looks solid. 3Q is more of a question mark.

The rise in inflation is pushing down real (inflation-adjusted) spending & GDP growth (the core CPI rose at an 8.1% q/q annualized rate in 2Q). Rents are starting to rise. Supply-chain bottlenecks could last longer than expected, especially given uneven global vaccine distribution & effectiveness. If there is hesitation to re-open schools for the next academic year, labor force participation could remain under downward pressure.

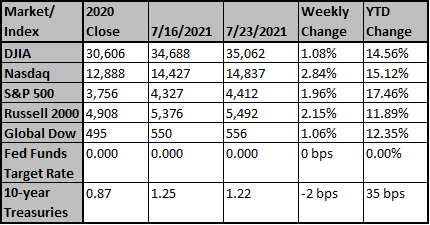

The U.S. bond market was choppy last week, but in general has been reflecting concerns about global growth, which can spill over to the U.S. either thru the demand channel (less global demand) or the supply channel (an inability to produce and ship goods & services as quickly as they can be sold).

Central bankers have trained themselves to look through supply shocks, but this is easier said than done in real time. The academic definition of “transitory” pricing is quite broad. As we noted last week, Kenneth Rogoff wrote in the FT: “maybe after a decade of below-target inflation, a few years of it being mildly above target, say 3 percent, might be positively a good thing.” That’s a lot of overshoot (and a lot more than many market participants expected earlier this year).

Inflation is starting to register on the D.C. political radar, but a wait-and-see approach is still favored. “My administration understands that if we were to ever experience unchecked inflation over the long term, that would pose real challenges to our economy. So while we’re confident that isn’t what we are seeing today, we’re going to remain vigilant about any response that is needed,” [U.S. President] Biden said in July 19 remarks. (Bloomberg)

The Fed has provided considerable monetary stimulus, and the U.S. single-unit housing market has been robust. But there’s still little consensus on what action to take. From the last meeting: “various Fed participants offered their views on the Committee's agency MBS purchases. Several Fed participants saw benefits to reducing the pace of these purchases more quickly or earlier than Treasury purchases in light of valuation pressures in housing markets. Several other participants, however, commented that reducing the pace of Treasury and MBS purchases commensurately was preferable because this approach would be well aligned with the Committee's previous communications or because purchases of Treasury securities and MBS both provide accommodation through their influence on broader financial conditions. In coming meetings, participants agreed to continue assessing the economy's progress toward the Committee's goals and to begin to discuss their plans for adjusting the path and composition of asset purchases.” (FOMC Minutes, 6/16/21).

Perhaps, given the disagreement, the most likely outcome is to do … nothing (yet).

This whole debate is happening as Dr. Anthony Fauci noted that the U.S. is moving in the “wrong direction” on COVID-19, just in time for the back-to-school season. “Pfizer Inc.’s Covid-19 vaccine was just 39% effective in keeping people from getting infected by the contagious delta variant in Israel in recent weeks … but provided a strong shield against hospitalization and more severe forms of the virus. In Los Angeles County, those vaccinated made up one in five of the new infections in June.” (BBG)

We continue to watch U.S. consumer confidence closely. If confidence were to make a new low, the yield curve (2yr/10yr) came close to inverting, or schools were to close in the fall, the chance of a more dramatic downturn (not just a “second-derivative” slowdown issue) would intensify.

Momentum Continues During Week 2 Of Earnings Season

The strong earnings momentum continued last week as almost 25% of S&P 500 companies have now reported. Both earnings and revenue growth moved higher for the quarter, with earnings growth now expected to be 78.1% and revenue growth expected to be 19.8%. Every sector saw an improvement with earnings from the prior week; however, the same story did not hold for revenues. Financials, Real Estate, & Utilities saw revenue growth shrink compared to the preceding week.

2021 EPS Of $200 In Reach

With first-quarter earnings finalized at $49.13 and second-quarter earnings up more than $2 from the beginning of the reporting season, $200 is not out of reach for the full-year estimate. With the current 2021 estimate just north of $195, the market is trading at about 22x the full-year earnings.

De Minimis Revisions Higher For 2022 Thus Far

What is more noteworthy and a bit concerning for 2022 is the fact that revisions to the quarterly estimates have been non-existent thus far. Thus, we wonder if the strong activity we are seeing in 2021 is borrowing from 2022 activity or if analysts are hesitant to upgrade earnings with concerns about higher taxes, fading fiscal stimulus, weaker economic growth, or even rising covid cases weighing on optimism.

Another High For Next Twelve Months S&P Operating Margins

The next twelve-month operating margins for the S&P 500 reached another new higher on Friday at 16.7%. This upcoming earning week is pivotal for the index as Facebook, Apple, Amazon, Microsoft, & Alphabet all report. Any missteps from those five companies could slow the progress of many of these data series, highlighting just another way these companies are impacting the markets.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Dow futures fall more than 100 points ahead of a huge wee...

Stock futures slipped ahead of a busy week of earnings reports from technology's heaviest hitters.

cnbc

Jul 25, 2021

Economy Week Ahead: The Fed, U.S. GDP, Eurozone GDP

The Federal Reserve's policy meeting and U.S. economic-growth figures are the focus this week.

Wall Street Journal

Jul 25, 2021

Capital Gains Tax Rates

The need for tax planning is becoming more important for high income filers. US budget discussions involve continued deficit spending and increased taxes to offset the proposed spending. ...

Jul 26, 2021