It’s always tempting to prognosticate how a headline event – geopolitical conflict, Fed action, etc. – may change the complexion of the market, but it’s been our experience that exogenous inputs do more to reinforce trends already in place rather than change the game. We’re not sure anyone has a real edge on Russia / Ukraine, and if they did, it doesn’t mean they’ll get the market’s reaction function correct as well. Prior to the acceleration of this conflict over recent weeks, the market was sending a pretty clear message on a number of fronts...

- Gold has been quietly improving, and last week’s breakout confirms the trend change. Consolidations from short-term overbought conditions should be used to add to positions.

- Globally, Metals & Mining remains one of the stronger groups in our work and is exhibiting leadership in a very split tape. The Materials sector (equal weight) traded to multi-month relative highs on Friday.

- Growth vs. Value was weakening well before the market priced in an aggressive 2022 FOMC or a major Russia/Ukraine event… that weakness has only continued.

- The equally-weighted S&P has been turning up vs. the cap-weighted S&P since early December… this has also only continued over recent weeks. We’re overweight “the average stock” vs. the top of the market.

- Yields are overbought and consolidating, but the trend is higher globally… there’s meaningful support for U.S. 10’s in the 1.70% to 1.75% zone. It’s also curious that Banks have continued to outperform Utilities in this environment (likely a rate message).

- ARK and the speculative corners of the tape went into 2022 in bear markets and remain in bear markets today. The same goes for Bitcoin, which has behaved more like a risk on / risk off instrument than any useful hedge.

Our sense is sentiment is getting pretty negative out there right now, but we’re watching put/call ratios to get a sense if negative thinking translates into negative doing.

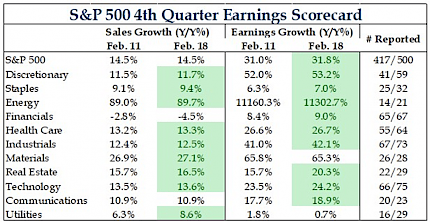

4Q EARNINGS GROWTH STRONG

With the fourth-quarter reporting season more than 80% completed, earnings growth is estimated to be close to 32%. This was a sizeable increase from January 1st, when it was expected to be just 22%. The sector with the most notable improvement has been discretionary. On the other hand, while seeing an improvement to 14.5%, revenue growth is only up 2.5% from January 1st.

2022 EPS GROWTH RATE IS STILL EXPECTED TO BE ABOUT 8%

The 2022 S&P 500 EPS growth rate currently stands at 8.1%, which is approximately the same level it has been since the beginning of November 2021. With 2021 reported earnings growth much stronger than originally anticipated, it’s apparent there was a pull-forward of earnings. What is less obvious is what will drive the next leg of earnings growth. Inflation will help in some areas but likely hinder others.

ANALYSTS CONTINUING TO LOWER PRICE TARGETS

Analysts are lowering price targets at the fastest rate since March/April of 2020, when governments worldwide implemented business restrictions. A big difference between 2020 and today is analysts are citing different reasons. We had seen increasing the discount rate, higher wage expense, & higher input costs as the most prominent reason when in 2020 it was simply declining sales.

A CLEAR HOOK LOWER IN FORWARD OPERATING MARGINS

The fourth-quarter reporting season is approaching an end, and on conference calls, management teams are focused on rising expenses for 2022. This is problematic for operating margins and is showing up in the latest data with a clear hook lower. We have noted the market doesn’t get into too much trouble while margins are rising, but the hook lower is a change and warrants attention.

SOME ADDITIONAL THOUGHTS ON INFLATION

This cycle has been odd. Typically, business cycles are driven by durable goods & financial crises. Durables are where you can build up unwanted inventories. With inventories high, firms cut production. When you cut production, you cut jobs. When you cut jobs, you cut income. Income declining leads to leveraged players suffering, and if it cascades, then a financial crisis. That’s a typical recession (ie, a financial contagion event).

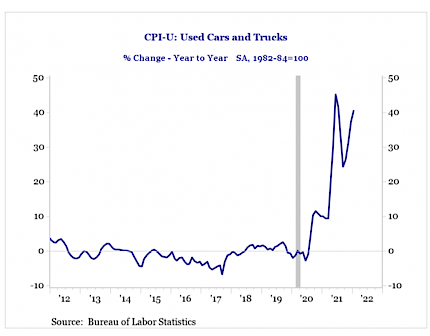

That’s not what happened in the past 2 years. The contagion was health-related vs. financial. Income was preserved by aggressive fiscal & monetary policy responses as the pandemic hit. Services (which are usually stable) suffered, but that meant income flowed to goods. Really, it overflowed. We overwhelmed the global supply chain, as bottlenecks developed & core goods inflation skyrocketed in 2021 (used cars being an illustrative example).

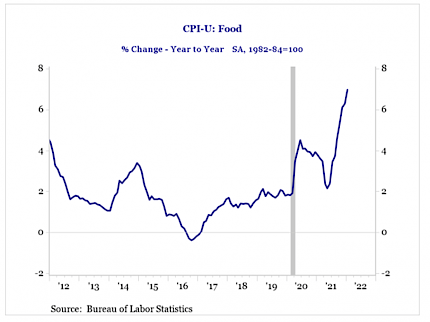

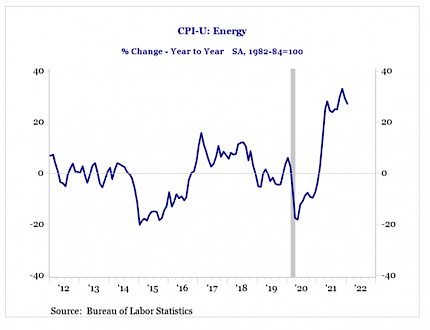

There have also been surges in food & energy prices during the past year, and while these may not drive policy decisions much (since “core” inflation measures are favored), they have boosted headline inflation rates considerably. Consumers have taken notice.

Additionally, in the U.S. there have been considerable disruptions in the labor market. There is labor market slack after a typical recession. Not this time. There appear to have been excess retirements, and U.S. job openings & quits have surged in the past year.

A recent NBER paper (Domash & Summers, 2022)1 has noted that vacancy & quit rates have predictive power for wages. Wages are downward sticky.

As such, the inflation shock that started out with bottlenecked goods is now seeping into stickier components in 2022 (wages, rents, future expectations), as firms and consumers have experienced inflation against the backdrop of the U.S. labor market that is basically overheating. The Fed will tighten to stop inflation from becoming entrenched in future expectations, but they probably cannot bring inflation down by themselves without tightening aggressively & risking a hard landing.

So where do we go from here? A more normal goods/services balance (as health concerns fade) can help clear supply chains. There’s a pathway to a soft landing in the economy if the private sector helps the Fed get inflation under control in 2022 (limited China factory interruptions, bottlenecks clear, U.S. labor supply shows up). But it’s going to have to be a joint effort. The message of the U.S. yield curve still seems to be that the second most likely outcome is that continued inflation surprises drive the Fed to overdo tightening (as they try to be nimble), and growth falters. The curve is not inverted yet, but we continue to pay close attention to this key indicator.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Metals Stocks: Gold rallies to highs not seen in more tha...

Gold jumps toward highs not seen in more than a year on Monday evening, as Russian President Vladimir Putin orders troop deployments to pro-Moscow, breakaway regions of Ukraine.

MarketWatch

JPMorgan now sees Fed hiking interest rates 9 times to co...

JPMorgan Chase economists now see the Federal Reserve hiking interest rates nine consecutive times as central bank policymakers look to tackle hotter-than-expected inflation.

Fox Business

You're already paying more for groceries and gas. Here'...

S&P Global Ratings says shoppers continue to purchase despite inflation now, but later in the year there will be belt-tightening

MarketWatch