ANSWERS TO OUR FREQUENTLY ASKED CLIENT QUESTIONS ABOUT RUSSIA

1. With inflation running hot, the Fed likely to tighten, and Russia’s invasion of Ukraine leading to a spike in the price of oil, how worried are you about a recession in the U.S.?

We think the chances of a recession are relatively low in the U.S. over the next 12 to 18 months. The labor market is tight, job openings are plentiful, monetary policy remains accommodative, and there remains a large reservoir of personal and corporate savings. Our base case remains a 2023 mid-cycle slowdown (50% odds).

2. What would change your mind?

After a mid-cycle slowdown, we believe a recession is the second most-likely outcome due to the potential for an overly aggressive Fed. (30% odds). We're watching the yield curve closely to see if these odds need to be updated. An upside surprise case would involve productivity increasing and growth proving robust (20% odds).

3. Could a recession in Europe lead to a worldwide recession?

It is unlikely. Generally speaking, it is the U.S. with its high consumption levels and large current account deficit that tends to lead the rest of the world into recession, not the other way around.

4. If one assumes that the most effective sanction against Russia would be to flood the market with oil, what are the chances that the Biden Administration reverses course on its environmental policies (e.g. Keystone pipeline, drilling on federal lands, etc.)?

The White House indicated that it was willing to increase incentives to drill for oil in the U.S. but industry leaders and our Washington team did not interpret them as particularly meaningful. Resuming work on the Keystone pipeline appears to be off the table for now. The ESG movement itself is likely to continue to put pressure on companies to return capital to shareholders as opposed to new capital investment.

5. Will the developments in Ukraine alter the Fed’s plans to tighten monetary policy?

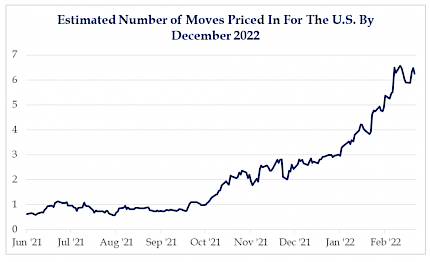

Without data that suggests a significant slowdown in economic activity, the Fed would appear to have little choice but to start its tightening campaign in three weeks. The CPI is up 7.5% year over year while the Fed’s preferred measure of inflation, the Core PCE, is up 4.9% year over year. Even if all of our prayers were answered and inflation drifted back down to 2%, it would be difficult to argue that a zero percent Fed Funds rate would be appropriate. The Fed will start with an increase in interest on excess reserves and eventually start the process of quantitative tightening passively. (Allowing bonds to mature and not reinvesting the proceeds.) We are forecasting five Fed rate hikes in 2022.

6. Where do you see the biggest risk to the consensus view?

While our surveys of clients in towns across the country suggest that most investors are bearish on bonds, the average estimate of the 10-year Treasury note at the end of 2022 rests at a relatively low level of 2.3%. In the days before QE, a decent heuristic for the level of the 10-year was nominal GDP growth. While this rule of thumb has been irrevocably broken, it would seem overly optimistic to think that investors will continue to accept significantly negative real rates of return from the long end of the curve. Higher nominal interest rates would likely continue to have the biggest impact on stocks trading on a multiple of sales as opposed to a multiple of earnings or cash flows.

7. Would you favor gold or Bitcoin as a hedge against fiat currencies?

We have no doubt that cryptocurrencies are here to stay, but we remain very skeptical that government authorities in developed economies will give up the seigniorage they exert over fiat money. Ultimately, the wisdom of investing in such products will be greatly linked to the interest of governments to regulate them. To the extent to which some members of the global economic policymaking club like Ken Rogoff want to abolish cash, it seems rather unlikely that these same people will accept the consequences of a completely opaque and unregulated currency system. Recent events in Canada, as well as in Russia and Ukraine, may provide the impetus for people to keep a certain amount of their savings in physical form. Gold has a 5,000 year old brand and a fairly stable value. Bitcoin was first used in 2009 and remains highly volatile.

8. Are the conditions for an interim low in place?

There’s been a clear shift in sentiment over recent weeks, and most price indicators look sufficiently flushed to support a rally. But with trends having deteriorated across the board, many stocks / groups / sectors have sufficient resistance above to now contend with. Bounces that lack the potency of a breadth surge or are not accompanied by credit improvement should be viewed with skepticism. Resistance for the QQQ hovers around $370, and 4,500 for the S&P. While there is the potential for mean reversion in the short-term, ultimately we continue to like the long S&P / short QQQ pair, and the long Value / short Growth pair.

9. What do you make of the dollar rally yesterday?

To see the dollar rally significantly yesterday wasn’t all that surprising considering the risk-off nature of the events. After touching the highest levels since June of 2020, the DXY began to retreat but the reversal was not nearly as stark as for other assets. Equities reversed from their lows to finish the day positive and bonds ended the day virtually unchanged. The consensus was for the USD to weaken considerably but the question remains against what currency if investors are concerned about knock-on effects from Russia/Ukraine across Europe.

10. What do you believe are the sector implications?

Even though the Energy sector was down yesterday, it would appear to be the biggest beneficiary as oil prices spiked continuing a trend that was already in place. Performance showed that technology continues to have some defensive characteristics given their large cash positions. It also solidified the idea that inflation is going to be stickier and bottlenecks are likely to remain for 2022. This means consumer staples will likely do better than consumer discretionary.

11. You recently released your updated earnings estimates for 2022 and 2023. Do the recent events regarding Russia/Ukraine alter your thinking?

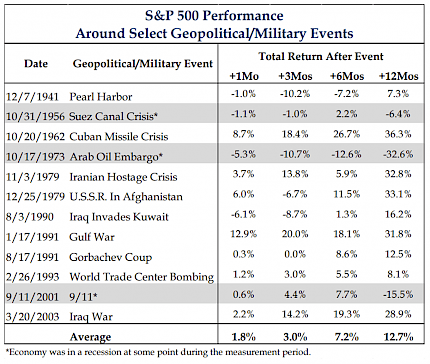

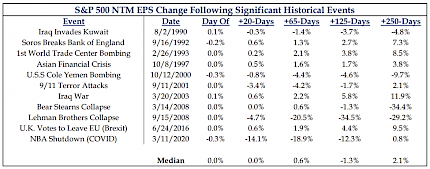

Looking at notable geopolitical and macro events historically, it is no secret that equity markets can be quite reactive as investors work to quickly digest the potential headwinds. However, the same cannot be said for corporate profits. Typically the day and month after these events occur, NTM estimates for the S&P 500 hardly budge. However, as analysts take more time to handicap these events as fundamental drivers develop, earnings estimates begin to move. Until we can learn of any lingering fundamental changes from today’s recent events, we remain comfortable with our CY22 estimate of $228.25 and our CY’23 estimate of $233.75.

Energy Policy Matters

We thought it would be interesting to look at what has changed in the last year to invite such aggression from Russia. Here are a few articles out today that outline how we got here and how we can turn things around and push back Russia. Unfortunately, we do not believe today's leaders are focused on the right crisis, the one unfolding right in front of them and costing Ukrainian lives with the breakout of war, or the crisis that has become a mantra of today's globalist view that Climate Change is the true crisis and the world, and more particularly the U.S energy policy must not change to confront Russia’s inconvenient declaration of War.

Please look at the articles we have included below for more information.

Source: Strategas

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

John Kerry's Ukraine Emissions

He frets that Russian brutality will distract from climate change.

The Wall Street Journal

A Hardheaded Guide to Deterring Russia and China

Shore up alliances by holding allies accountable, helping key partners, and showing energy leadership.

The Wall Street Journal