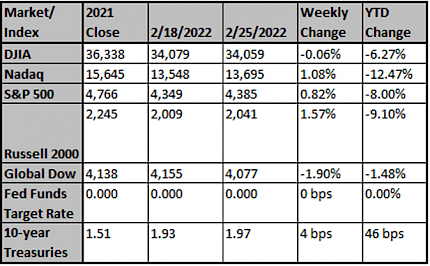

Volatility Picks Up but Markets were higher last week as war breaks out in Ukraine

U.S. equities were higher last week (S&P 500 +0.8%) thanks to big rallies on Thursday and Friday after big losses earlier in the week resulting from Russia’s invasion of Ukraine. The rally came as new sanctions on Russia were seen as less severe than expected. Oil prices briefly exceeded $100 per barrel. Best performers included REITs (+2.7%) and utilities (+2.0%); worst performers were consumer discretionary (-2.2%) and consumer staples (-0.3%).

Clearly, fluid geopolitical events are continuing to dominate the news flow. Economic sanctions on Russia including banking & SWIFT restrictions are creating significant volatility in currency markets. Recession risk has increased substantially in Europe, as energy prices have surged. Germany already looks to be in recession. European growth matters for multi-national company earnings, which are at increased risk (even if a U.S. recession is not our base case).

But a European recession is unlikely to stop the more-hawkish Fed. Lost in the recent headlines, U.S. initial jobless claims declined w/w to 232,000 last week, indicating a tight labor market. The Fed’s monetary policy report noted that “tight labor supply, in conjunction with a continued surge in labor demand, has resulted in strong nominal wage growth, especially for low-wage workers. Supply bottlenecks also continued to significantly limit activity throughout the second half, while the Delta and Omicron waves led to notable, but apparently temporary, slowdowns in activity.” (Fed MPR, 2/2022)

The U.S. economy looks robust enough on the demand side to recent interruptions. We remain much more concerned about supply shocks (labor + product).

The University of Michigan survey has shown U.S. consumer sentiment weak, including a reading of 62.8 in Feb. Consumer expectations declining has been a good leading indicator of slowing growth (eg, Blanchflower, Bryson 2021). But, as we noted last week, this cycle has been odd. U.S. real consumer spending rose +1.5% m/m in Jan … even with the depressed sentiment.

This cycle was health-related vs. driven by durable goods & financials. Income was preserved by aggressive fiscal & monetary policy responses. Services (which are usually stable – think haircuts, education, health care) suffered. But that meant (preserved) income flowed to goods. Really, it overflowed. We overwhelmed the global supply chain, as bottlenecks developed & core goods inflation skyrocketed in 2021. Put another way, U.S. consumer spending is back to trend, but with an odd goods > svc mix.

This consumer mix can normalize over time, especially if health-related restrictions are eased (as we are seeing, eg, CDC). But the most important domestic issue on the supply-side continues to be the disruptions in the U.S. labor market, which is basically overheating. There appear to have been excess retirements, and U.S. job openings & quits have surged in the past year. We refer back to a recent NBER paper (Domash & Summers, 2022) that has noted that vacancy & quit rates have predictive power for wages.

As such, the inflation shock that started out with bottlenecked goods is lingering due to another global energy shock and is now seeping into stickier U.S. components in 2022 (wages, rents, future expectations).

The message of the U.S. yield curve (flattening but not inverted) still seems to be that a soft landing is possible. But it’s going to have to be a joint effort (Fed + private sector). The Fed cannot bring inflation down by itself without tightening substantially. As we’ve noted previously, macro models (eg, FRB/US) indicate the Fed would have to act very aggressively to address ~6-7% inflation, given the 2% target.

Bottom line: with supply & demand not yet balanced (and another energy shock last week), inflation continues to hinder real growth. The U.S. economy remains in a “full-employment” position. The Fed will tighten to stop inflation from becoming entrenched broadly in future expectations. Even if just some of the inflation we’re seeing lasts, simple Taylor Rule models indicate interest rates should move higher (ie, the Fed is behind the curve).

We expect March, May, and June hikes (+25 bps each) to start the cycle, before settling into a 1 hike-per-quarter pattern into 2023. It’s possible we see a dissent for +50bp in March, though our base case remains these are all +25bp moves. Quantitative Tightening (QT) should follow several meetings after liftoff. In this environment, it’s tough to rely on bonds to hedge stocks like they did for the past several decades.

Wage data (especially the U.S. Employment Cost Index) also remain key for our outlook.

Our base case remains a 2023 mid-cycle slowdown (50% odds). If the Fed overdoes tightening, growth would falter (30% odds). An upside surprise case would involve productivity increasing and growth proving robust (20% odds).

4Q Earnings Season Turns Out To Be Another Strong Quarter

The fourth quarter reporting season wrapped up last week for the S&P 500 and all things considered, it turned out to be a strong quarter. Earnings growth came in north of 30% and revenue growth approached 15%. 2022 is going to be a much different strong as companies deal with various macro events.

“Inflation” Widely Cited In Company Transcripts

It doesn’t come as much of a surprise, but “inflation” continues to be widely cited in company transcripts through the end of February. In fact, the rolling 3-month sum reached a new high. It’s abundantly clear that inflation is on everyone’s mind and is not yet showing any signs of slowing down.

Mentions of “Shortages” On The Decline

During the 4Q reporting season, the mentions of shortages have continued its move lower. This should be welcome news for companies that are dealing with shortages and ultimately should bode well for sales as companies have also mentioned missing out because they lacked items to sell. Declining shortages may also help to provide some relief on inflation as well.

“High Costs” Off The Highs As Well

Perhaps related to some easing on the shortages front, those mentioning higher costs have also begun to slow. It’s possible that costs pressures are beginning to slow but that is only just beginning to be reflected in the income statement. Earnings growth is expected to slow in 2022, particularly in the first half. We wouldn’t be surprised if it spilled over into the 2nd half as well.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

NerdWallet: 3 simple rules for cushioning yourself agains...

With inflation chipping away at your spending power, here's how can you protect yourself, and one way to earn more interest on your savings.

MarketWatch

European markets set to plummet at the open as new sancti...

LONDON - European stocks are expected to open sharply lower on Monday as global markets track developments in the Russia-Ukraine crisis. The U.K.'s

CNBC

Oil Prices Surge as Traders Fear Supply Disruption From R...

The exclusion of Russian banks from the Swift cross-border payments system threatens to complicate commodity transactions.

Barrons