As the markets’ muted reaction to higher-than-expected inflation rates has indicated, the Fed appears to have done a great job in convincing investors, and perhaps themselves, that signs of persistently higher inflation will be fleeting, or in the Fed’s current parlance that has the feel of being a potential punchline in economic history, “transitory.” (One can’t help but wonder whether the “WIN” buttons from the 1970s (Whip Inflation Now) may somehow be reincarnated.) To the extent to which inflation is always and everywhere a monetary phenomenon, Chairman Powell is up for reappointment by the Biden Administration early in 2022, and God put politicians on Earth to give things away, it strikes me as overly confident to ignore incipient signs of inflation as due solely to base effects. After all, the value of M2 is up 30% since the start of 2020 while the value of the assets on the Fed’s balance sheet are up 90%. Year-over-year M2 growth slowed to 18% but it seems a bit premature to take any victory lap.

This isn’t to question the motives of central bankers and fiscal policymakers to ease the economic pain of the global pandemic, simply a recognition that human beings in general, and Americans in particular, tend to do the right thing only after all other options have been exhausted. Whether inflation turns out to be transitory or not will largely wind up being a political decision. Are Republicans and Democrats really prepared for the potential fallout of a fiscal cliff after the general price level has increased markedly? The need to engage in social engineering, and the impatience to let free markets allocate capital properly, has become an increasingly bipartisan affliction. And as Hayek so brilliantly pointed out in The Road to Serfdom, central planning in economic matters tends to lead to poor outcomes, which then, in turn, lead to a greater need for government control and, of course, even greater efforts aimed at central planning, even worse outcomes, etc. On and on it goes until one approaches a Hotel California approach to economic policy “you can check out anytime you want, but you can never really leave.”

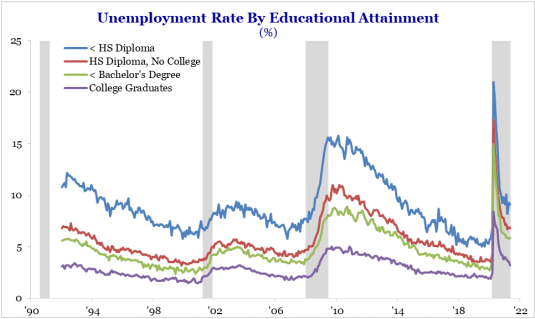

Believe it or not, the betting odds are now greater than 50% that any new infrastructure package will be passed with no new taxes – a development that, should it occur, would certainly be seen as bearish for the dollar and bullish for inflation. The Fed for its part has assured market participants that it has all the tools needed to fight inflation should it become more endemic than previously anticipated. This is, no doubt, true. What is less certain is whether there will be the political will to use those tools if the country is still far away from full employment. The potential for a new structural unemployment problem is becoming a greater worry as the level of GDP and corporate profits are poised to reach new highs with seven and a half million fewer people on nonfarm payrolls today than there were before the pandemic (144.9 million versus 152.5 million.) It seems safe to assume that many American companies were forced to learn how to do more with less labor than they thought possible. A boon for corporate profits and productivity, such a development would also likely carry with it even greater attempts to ease the economic pain of those displaced in the new post-pandemic economy and more permanent needs to increase transfer payments. As the charts below indicate, there is some evidence to suggest that the unemployment rate will remain elevated for those without higher education.

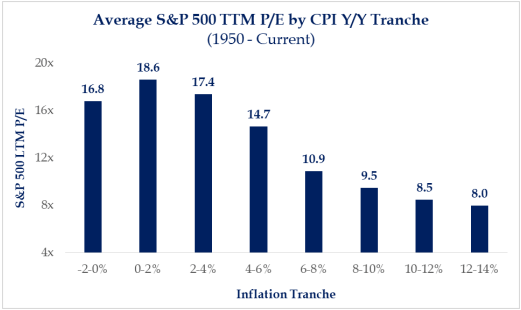

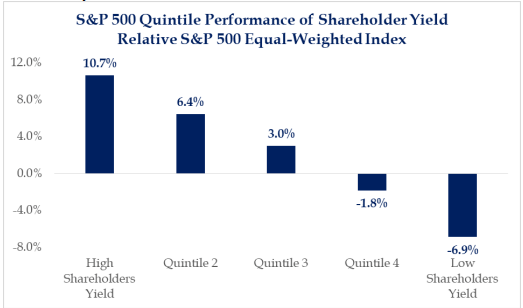

In the last week, we have received a notable increase in questions from equity investors about the proper way to structure portfolios if inflation turns out to be a more permanent affliction than we think. In this regard, we believe investors should start to think about their equity portfolio in terms of duration, in much the same way they might think about their holdings of fixed income. That is to say, higher inflation accompanied by higher long-term interest rates should prompt investors to seek out equities with shorter durations where cash flows are returned to investors – through dividends or share repurchases – more quickly. This strategy is far less risky than holding stocks whose values are tied largely to their terminal values where an increase in the discount rate has a direct and immediate impact on a company’s present value. In this way, greater shareholder yield partially offsets the multiple compression that accompanies higher inflation.

Ryan Grabinski and I used shareholder yield to determine the relative duration of stocks in the S&P 500. As one can see, shorter duration equities have outperformed long duration stocks recently.

While all of this makes intuitive sense, the greatest present problem with the strategy of favoring shorter duration stocks is that long-term interest rates remain extraordinarily low and negative in real terms. Should this condition continue the long duration equities in the Technology and Biotech industries are likely going to continue to trade at extraordinarily high multiples. Should the ultimate Hotel California approach to economic policy of yield curve control and modern monetary policy be employed, the current flirtation with higher-yielding stocks will fade and a new silly season of speculation will emerge. Until such a time, we feel confident in our bias toward value overgrowth.

Jason De Sena Trennert