If 2003 is any guide, we don’t believe investors should overthink the short-term impact of tax cut in 2018. The 10-year rose from 3.1% to 4.6% in six weeks after the 2003 tax cut was passed, GDP surged in 2004, and those companies with vast amounts of cash overseas outperformed. From a longer term point of view, the efficacy of the tax cut will rest with one question – will companies actually use their cash to invest in capital projects? If so, productivity should rise, real GDP will grow, and the length of the current expansion in the economy will be extended. If not, nominal GDP will rise along with interest rates and the long-term effects will be disappointing. If the last nine years are any guide, some predictability on the regulatory environment will be crucial in getting companies to invest for the long-term.

* Pacific Global Management

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

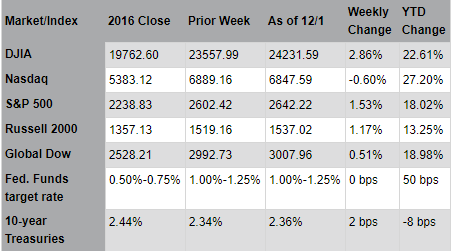

Markets were mostly higher last week as a strong start to the holiday shopping season and substantial progress on tax reform underpinned expectations of an acceleration in economic growth. The Dow Jones Industrial Average added over 650 points (+2.86%) to surpass 24,000 for the first time; the S&P 500® Index rose approximately 1.5% while the NASDAQ declined as technology stocks lagged. Many of the tax benefits used by the multinational technology companies, such as Alphabet (formerly Google) and Facebook, would be disallowed under the tax reform proposal. By Friday afternoon, Republicans reported that the Senate tax reform bill had enough votes to pass. There are still several differences between the House and Senate versions that have to be reconciled before the President could sign the legislation. Small cap and retail stocks outperformed as they are expected to be the largest beneficiaries of the proposed tax legislation. A strong start to the holiday shopping season helped retailers as the shift from brick-and-mortar to online continued. “Cyber Monday” online sales rose 17% to a record $6.6 billion; mobile shopping grew 22% and accounted for one-third of total online sales.

Incoming Federal Reserve Chair Jerome Powell’s Senate confirmation hearing buoyed Financials stocks; Mr. Powell reaffirmed the current monetary policy framework of gradually increasing rates, with the next rate hike likely occurring at the upcoming December 12-13 meeting. Higher interest rates, combined with the leadership change at the CFPB, could set the stage for improved earnings in the sector. Energy stocks also rose as OPEC and non-OPEC producers agreed to extend their production freeze agreement by nine months to the end of 2018. Crude oil prices have gained nearly 30% since the end of June. Notably, Royal Dutch Shell announced a resumption of full-cash dividend payments, eliminating an option for shareholders to instead receive discounted stock; the move is another indication of the increasing confidence of major oil companies in the global energy market outlook. Meanwhile, tensions with North Korea rose again with the test launch of a missile that could purportedly reach the continental U.S. To date, though, the geopolitical drama has not impacted markets or investor confidence. Stocks, however, sold off on Friday following reports that former National Security Advisor Michael Flynn pled guilty to lying to the FBI and agreed to cooperate with investigators on special counsel Robert Mueller’s Russian probe.

Thus far in 2017, growth strategies have significantly outperformed value strategies; the Russell 3000® Growth Index (28.7%) is significantly outpacing the Russell 3000® Value Index (11.8%). The gap, almost 17%, is the largest since 1999 when the dot-com boom elevated growth stock valuations while leaving traditional value stocks behind. Today’s differential similarly underscores a valuation gap between growth and value stocks; this year, investors have gravitated towards large cap growth stocks, particularly in technology, for returns during a period of low interest rates and sluggish economic growth. And yet, gradual interest rate increases, improving global economic growth, and the prospects for tax reform and deregulation, may change the outlook; investors may begin shifting away from expensive growth stocks into cheaper value-oriented areas such as Financials, Industrials, and Energy.

Source: Pacific Global Investment Management Company

Last Week's Headlines

- The second estimate of the third-quarter gross domestic product was more favorable than the first reading. The GDP increased at an annual rate of 3.3% in the third quarter ahead of the first estimate's growth rate of 3.0%. In the second quarter, the GDP increased 3.1%. Gross domestic income (the sum of various incomes earned and costs incurred in the production of GDP) increased 2.5% in the third quarter, compared with an increase of 2.3% (revised) in the second. The increase in the second estimate of the GDP is due to an increase in nonresidential (business) investment and inventory growth, while residential investment and net exports (imports less exports) subtracted less than initially estimated.

- Consumer price inflation continues to slowly expand. Consumers increased their spending by 0.3% in spite of an increase in income. Personal (pre-tax) income increased 0.4% in October, while disposable personal (after-tax) income jumped 0.5% for the month. Core personal consumption expenditures, excluding food and energy, increased 0.2% over September. The personal consumption price index, a measure of the prices consumers are paying for consumer goods and services, increased a mere 0.1% in October.

- New home sales continued to increase in October, according to the Census Bureau. Sales of new single family homes were at an annual rate of 685,000 in October, up 6.2% from September's rate. The sales rate in October is 18.7% above the October 2016 estimate. The median new-home price in October was $312,800, while the average sales price was $400,200. The estimate of new houses for sale at the end of October was 282,000, representing a supply of 4.9 months at the current sales rate.

- The Census Bureau announced that the trade deficit in October, the first month of the 2018 fiscal year, was $68.3 billion, up $4.2 billion from September. Exports were $129.1 billion, $1.3 billion less than September exports, while imports increased $2.9 billion in October from the prior month.

- According to the IHS Markit final U.S. Manufacturing Purchasing Managers' Index™ (PMI™), the manufacturing sector grew in November, but at a slightly slower pace than the previous month. Goods output slowed as well, while new orders received by manufacturers rose at the second-fastest pace since March.

- The Conference Board Consumer Confidence Index®, which had improved in October, increased further in November. The index now stands at 129.5, up from 126.2 in October. The Present Situation Index increased from 152.0 to 153.9, while the Expectations Index rose from 109.0 last month to 113.3. Average prices charged by manufacturers in November rose at the fastest rate in the last four years.

- The Manufacturing ISM® Report On Business® also showed manufacturing accelerated in November, but not quite as fast as in October. Manufacturing production and new orders outpaced October's rates, while deliveries slowed.

- Claims for unemployment insurance are on the upswing after falling the past few weeks. In the week ended November 25, the advance figure for initial claims for unemployment insurance was 238,000, a decrease of 2,000 from the previous week's level, which was revised up by 1,000. The advance insured unemployment rate remained at 1.4%. The advance number of those receiving unemployment insurance benefits during the week ended November 18 was 1,957,000, an increase of 42,000 from the previous week's level, which was revised up 11,000.

Eye on the Week Ahead

The last week of November reveals some important economic information. The second report on the third-quarter GDP is out this week. The initial estimate in October showed the GDP increased at a 3.0% annualized growth rate. Also revealed this week is the report on personal income and spending for October. This indicator of inflationary trends is one of the economic reports relied on by the Fed in determining whether to raise interest rates.