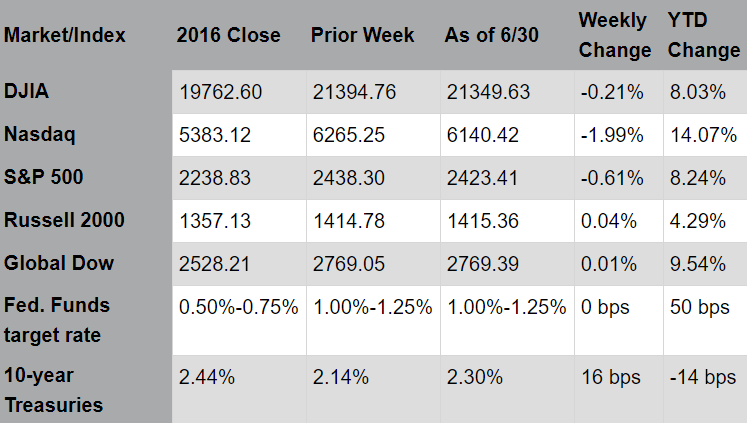

Markets were mixed last week as the Financials sector rallied while Technology lagged. On Wednesday, several banks announced dividend increases and share buybacks; the decisions followed the Federal Reserve’s determination that, for the first time in seven years, all of the banks subject to its Comprehensive Capital Analysis and Review (CCAR), the so-called “stress test,” had passed. Higher yields on Treasury bonds further supported the favorable outlook for financial companies. The technology-heavy NASDAQ underperformed as investors, in weighing the sector’s attractive growth prospects against strong year-to-date gains, may contemplate rotating into other areas.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

Small cap stocks, which have trailed large and mid caps thus far this year, may be a potential destination for these funds. Meanwhile, economic data remain generally supportive. The final estimate for first quarter GDP was increased to +1.4%, driven by a higher estimate for consumer spending; measures of consumer confidence are near 13-year highs. Still, the economy remains on a slow growth trajectory as durable goods orders declined and inflation eased. After oil prices fell into bear market territory last week, the sector recovered as overwhelmingly negative investor sentiment subsided. A slight increase in crude oil inventories was more than offset by reductions in supplies of refined products, including gasoline and distillates.

The results for the first half of the year are in: the S&P 500® Index and the Dow Jones Industrial Average posted their best performance in four years while the NASDAQ posted its best result since 2009; Technology and Health Care stocks enjoyed the strongest gains while the Energy sector was a notable laggard. Importantly, though, the market continued to advance despite the decline in oil prices during the second quarter. Moreover, and in contrast to recent years, the markets enter the second half of 2017 without the pall of Greek debt crises or Brexit weighing on sentiment. The relative calm should enable investors to focus on the health of the global economy and corporate profits.

Attention will now shift to the upcoming second quarter earnings season as companies provide updated outlooks for the remainder of the year. With the downturn in oil prices, companies in the Energy sector will be in focus; investors will look for updates on the current environment as well as managements’ expectations for near-term and longer-term activity. Overall, companies in the S&P 500® Index are expected to grow sales by 4.7% and earnings per share by 6.5%; the technology sector is forecast to lead earnings growth at 10.3%, followed by financials at 6.2%. The continued expansion in corporate profits, in combination with an improving global economic outlook, should sustain the market’s positive bias over the second half of the year.

Last Week's Headlines

- The final report on the first-quarter gross domestic product showed growth improved marginally, but it is still relatively weak compared to the fourth quarter. The GDP increased at an annual rate of 1.4% in the first quarter of 2017, according to the third and final estimate released by the Bureau of Economic Analysis. The second estimate released in May estimated the GDP growing at a rate of 1.2%. In the fourth quarter of 2016, the GDP increased 2.1%. The deceleration in the GDP in the first quarter reflected a downturn in private inventory investment, a deceleration in personal consumption expenditures (consumer spending), and a downturn in state and local government spending that were partly offset by an upturn in exports, an acceleration in nonresidential (business) fixed investment, and a deceleration in imports. Gross domestic income grew 1.0% in the first quarter, in contrast to a decrease of 1.4% in the fourth quarter.

- Consumers did more saving than spending in May, according to the Bureau of Economic Analysis. Personal income increased $67.1 billion, or 0.4%, in May, while disposable (after-tax) income jumped $71.7 billion, or 0.5%. However, personal consumption expenditures (consumer spending) rose a scant $7.3 billion, or 0.1%. The increase wasn't attributable to wages and salaries (+0.1%), but reflected increases in dividend income, personal income transfers (generally to savings, which rose 0.4%), and proprietors' income. Core prices, less food and energy, increased 0.1% and are up a marginal 1.4% year-on-year. While this report is not necessarily negative, it is in line with other economic indicators, which show inflation in particular, and the economy in general, slowed in May.

- The manufacturing sector may be weakening after new orders for long-lasting goods fell for the second consecutive month. New orders for durable goods fell $2.5 billion, or 1.1%, in May, following a 0.9% decrease in April. The drop in new orders is the largest monthly decrease in 6 months. Excluding transportation, new orders increased a marginal 0.1% for the month. Shipments of manufactured durable goods in May, up following two consecutive monthly decreases, increased $1.8 billion, or 0.8%, to $234.9 billion. Unfilled orders for manufactured durable goods in May, down following two consecutive monthly increases, decreased $2.3 billion, or 0.2%, to $1,120.1 billion. Inventories of manufactured durable goods in May, up 10 of the last 11 months, increased $0.7 billion, or 0.2%, to $395.4 billion.

- An uptick in consumer exports helped narrow the trade deficit in May, according to the Census Bureau. The international trade deficit was $65.9 billion in May, down $1.2 billion from $67.1 billion in April. Exports of goods for May were $127.1 billion, $0.5 billion more than April exports. Imports of goods for May were $193.0 billion, $0.8 billion less than April imports.

- The Conference Board Consumer Confidence Index®, which had fallen in May, increased somewhat in June. The index rose to 118.9 for June, up from May's 117.6 reading. Consumers remained upbeat about current economic conditions, but were less enthusiastic about the short-term outlook, as the Expectations Index declined from 102.3 in May to 100.6 in June.

- Respondents in the University of Michigan's Surveys of Consumers seemed to follow consumers' sentiments from The Conference Board's report. The Index of Consumer Sentiment dropped in June to 95.1 from 97.1 in May. Consumers viewed current economic conditions favorably, as that index increased from 111.7 to 112.5. However, the Index of Consumer Expectations decreased from 87.7 to 83.9 — an indication that consumers aren't too sure about the future of the economy.

- In the week ended June 24, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 2,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 241,000 to 242,000. The advance seasonally adjusted insured unemployment rate remained 1.4% for the week ended June 17, unchanged from the previous week's unrevised rate. During the week ended June 17, there were 1,948,000 receiving unemployment insurance, an increase of 6,000 from the previous week's revised level. The previous week's level was revised down by 2,000 from 1,944,000 to 1,942,000.

Eye on the Week Ahead

Trading should be slower during the holiday-shortened week. The June employment report is released at week's end. The unemployment rate has fallen over the past few months, but so has the number of new hires. Wage inflation has been moderate at best and isn't expected to pick up steam any time soon.