The latest news on the coronavirus and the Super Tuesday primaries caused wild market gyrations last week. Joe Biden’s unexpected primary wins gave him a delegate lead over Bernie Sanders. The coronavirus, however, overtook the Super Tuesday results. China reported a slowing rate of new cases (99 new cases reported on March 6th) for a total of 80,651. Globally, the case count rose to 101,927 with 3,488 deaths. Strategies to contain the virus have led to school closings, work-from-home policies, cancelled events, and delayed travel plans.

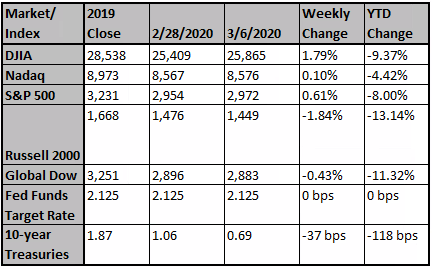

For the week, the Dow Jones Industrial Average gained 1.79%, followed by S&P 500® Index (0.62%), and the Nasdaq (0.10%) while the Russell 2000® Index declined (-1.84%). The CBOE Volatility Index, which has nearly tripled since mid-February, reflects the challenges for assessing the global economic impact of the virus. On Tuesday, the Federal Reserve lowered the Fed Funds rate by 50 basis points, its first emergency, inter-meeting rate change since 2008. Chairman Powell said, “We saw a risk to the outlook for the economy and chose to act. . . . We do believe that our action will provide a meaningful boost to the economy.” Across the globe, other central bank policy changes are under consideration although interest rates in both Japan and the European Union are already negative. The yield on the U.S. 10-year Treasury fell to an all-time low of 0.676% on Friday morning. The extraordinary demand for bonds reflects investors’ exodus from the equity markets. Some suggest that the yield on the 10-year might fall to 0% if the U.S. were to enter a recession. And still, even at these low rates, banks needed to purchase approximately $1.2 trillion of 10-year Treasuries for risk management for mortgages and bank deposits.

Oil prices plunged last week; Brent crude hit a low of $45.18 per barrel, its lowest price since June 2017, as quarantines and travel restrictions significantly reduce demand. $50 barrel is considered a breakeven point for many producers. OPEC, which met this week to discuss extending production cuts due to expire this month, ended with no deal; Russia would not agree to further production cuts.

The VIX index curve is among the most inverted we’ve seen in a decade and the 10-day average of put/call ratios is now solidly in the 95th percentile of all historical observations (fear has gripped the options market). We know that we don’t know how to model a global pandemic, and the move in 10-year yields and Oil overnight (oil down more than 20%) is nothing short of astonishing, but the prevalence of what will be severe oversold conditions and meaningful stress in sentiment over coming days are inputs often found closer to the end of a correction than at the beginning. As of this writing, more than 95% of S&P 500 issues that pay a dividend sport a yield in excess of that on the U.S. 10-Year Treasury. As we’ve noted over recent weeks, bottoming is a trying process and with an undercut of last Friday’s low certainly more likely than the 2018 v-bottom call, focus turns to the 2730 neighborhood for S&P support. Market internals (# of stocks making new lows, breadth and volume skews, etc.) will likely offer important clues in the weeks ahead (e.g., most stocks tend to bottom before the Index bottoms).

A respect for and understanding of history are valuable assets in moments like this. The 1962 (Kennedy), 1987 (Black Monday), and 1998 drawdowns (Asia Crisis) may prove to be more instructive than one’s immediate proclivity to look to the most recent crisis (2008) for a guiding framework. With macro moves of this magnitude, there are often causalities – it may be a leveraged player (e.g., LTCM in ’98), a corporate (Energy?), or a country (Greece in 2011, Saudi this time?). It’s not a pleasant exercise, but identifying the whale is part of the clearing process. If this is the start of a more pronounced bear market, you’re still likely to rally first as the long-term distribution phase takes time to play out (the 200-day average is still upward sloping at present). Even after 9/11 and Bear Stearns, big rallies followed before a resumption of the downtrend took hold. The irony of course is that today is the 11th anniversary of the March 2009 S&P low.

A few other observations: (1) The $ has not been a safe haven; (2) Gold remains strong; (3) Emerging Markets has outperformed recently; (4) Flows into Utilities are at an extreme; (5) The spread between the TLT and the 200-day average is approaching 2008 / 2011 type levels. This is a broken play, but we’re here to help – please don’t hesitate to call us.

Source: Strategas, Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Sincerely,

Fortem Financial

760-206-8500

team@fortemfin.com

Latest News

Oil plunges about 30% after Saudi Arabia slashes prices, ...

Saudi Arabia, the world's biggest oil exporter, is attempting to punish Russia, the world's second-largest producer, for balking on Friday at production cuts proposed by OPEC.

Bond Report: 30-year Treasury yield tumbles below 1% afte...

U.S. Treasury yields fall Monday as a breakdown in talks between major oil exporters sparked a sharp decline in oil prices, sending stocks and inflation expectations lower.

Fed slashing rates to zero is more likely than a recessio...

Top Wall Street economist Michael Gapen expects the Federal Reserve will do what's necessary to contain the coronavirus' impact on the U.S. economy -