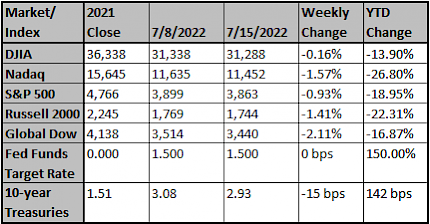

The Treasury yield curve flattened significantly over the course of the week as short-term yields rose and long-term yields dropped while inflation continued to run hotter than expected. The flattening of the yield curve started early in the week as China re-imposed Covid restrictions leading to concerns of additional slowdowns to the world economy. Data released on Wednesday showed the consumer price index increased at a 9.1% year-over-year rate for June, which is the highest annual increase in 41 years and above analyst expectations of 8.8%. This only accelerated the flattening of the yield curve, which was already inverted by the highest rate since February 2007. The spread between the 10-year yield and the 2-year yield finished the week at negative 21-basis-points. The producer price index also increased 11.3%, above expectations of 10.7%. This also led investors to speculate that the Federal Reserve may increase interest rates at an even faster pace in order to slow down inflation. After Wednesday’s inflation reading, the market expected at least a 75-basis-point rate increase in the Federal Funds Rate and the market implied probability of a 100-basis-point rate increase soared to 63% at the end of trading on Wednesday. However, that probability ended the week at only 19% after more dovish comments by Fed Governor Christopher Waller.

The S&P 500 Index returned -0.91% last week. Equities declined the first four days of the week as the index lost 2.78%. Equities have been under pressure as investors focus on inflation, the Federal Reserve’s response to inflation, the global economy due to Covid in China, and the chance of a future U.S. recession. Fears of slowing global demand put pressure on crude oil as it declined to its lowest levels since April 11, posting a -6.87% return for the week and closing at $97.59 per barrel on Friday. Some of the worst performing energy names included APA Corp, EOG Resources Inc., Halliburton Company, Baker Hughes Company, and Diamondback Energy Inc., all declining more than 6.00%. Negative news that affected equities included the 9.1% year-over-year June CPI number that was higher than expected and PPI also showed higher than expected levels for June, reflecting the continued growth in inflation since early 2021. The S&P 500 Index hit its low for the week in early trading on Thursday at 3,721, its lowest level since June 22. Financials were the earnings focus last week as JPMorgan Chase & Company, Wells Fargo & Company, Morgan Stanley, BlackRock Inc., and US Bancorp all missed expected earnings. However, on Friday, Citigroup Inc. announced they beat earnings expectations as demand for their services increased due to rising interest rates. The stock jumped 13.23% on the day, helping pull the entire financials sector to the top and the S&P 500 Index to post a 1.92% return, though not enough to overcome the prior four days. Communication services and energy were the worst performing sectors last week with most sectors in negative territory and only consumer staples posting an 11-basis point gain. Southwest Airlines Company was the best performing stock in the index last week, with a 7.85% return. The stock jumped on Tuesday after a Susquehanna analyst raised their rating on the company. Earnings season has started with second quarter announcements expected this week from Tesla Inc., Johnson & Johnson, Bank of America Corp, Verizon Communications Inc., Abbot Laboratories, Danaher Corp, AT&T Inc., International Business Machine, American Express Company, The Goldman Sachs Group Inc., and many more.

Despite supply chains normalizing some, global economic concerns remain. Eventually weaker growth should remove inflation pressures, but this is likely a process. “Peak inflation” remains different from “mission accomplished.” Even with some commodity prices down notably, concerns about “sticky” inflation (rents, wages) are set to push key policymakers toward a restrictive stance.

In some countries, the hit has been so substantial (eg, China GDP with lockdowns) that any economic weakness may be old news. But with lingering inflation driving many central banks to continue to tighten, there’s still not a typical monetary policy cushion available.

Global shocks have compounded on each other (pandemic, supply-chain problems, war) and there have been few places to hide. Europe is still dealing with the impact of the Russia/Ukraine conflict, especially when it comes to energy. Governments in Italy and the UK are in flux. Yet the European Central Bank (ECB) is set to hike.

The U.S. is feeling the impact of a Fed that is aiming for restrictive monetary policy. The 2yr/10yr yield curve has re-inverted. U.S. initial jobless claims rose to 244,000 last week, indicating a continued tone change (weaker) in the labor data. U.S. industrial production fell - 0.2% m/m in June. The Fed’s Beige Book also noted an increased risk of an economic downturn, stating that “economic activity expanded at a modest pace, on balance, since mid-May; however, several Districts reported growing signs of a slowdown in demand, and contacts in five Districts noted concerns over an increased risk of a recession.” (Beige Book, 7/13/22)

U.S. retail sales rose +1.0% m/m in June, with the control group up +0.8%. But inflation is eating up these gains. The U.S. CPI rose +1.3% m/m and 9.1% y/y in June (a new cycle high). The core (ex food & energy) CPI again surged +0.7% m/m (!) and 5.9% y/y, so the gains are becoming broad-based.

Consumer sentiment remained depressed with the U of Michigan survey at 51.1 in July. Importantly long-run inflation expectations fell back below 3% in last week’s release.

The U.S. economy doesn’t go into recession without labor-market weakness, based on history. If we have a “jobs-plentiful recession” in 1H of 2022, that 1) would be odd and 2) likely is not enough for the Fed given high inflation. With supply constraints, we’re getting weak GDP without the cycle-resetting flush that would accompany significant job loss (this may be coming).

Fed Chair Powell has previously noted that factors beyond the Fed’s control (eg, geopolitics, supply-chain issues) will determine whether they can bring inflation down to the 2% target with the labor market still strong. The plan still seems to be to destroy job openings before destroying jobs.

Dispatch to Jackson Hole

Strategas Research had the opportunity to again travel to Jackson, WY this past week and attend the Rocky Mountain Economic Summit in Victor, ID with the Global Interdependence Center (GIC). Last year the debate was about inflation (transitory/not). This year the debate was over recession (yes/no).

Imbalances were still evident. Local home prices in the area have been surging, and some real-estate brokers were no longer listing individual prices on their window ads. The town was reasonably busy, with hotels sold out & traffic around the national parks. While a number of health experts at the conference expressed concern about continuing COVID-19 issues, it was difficult to square this with the solid retail & food service activity in town.

Concerns about inflation remained. As has been the case for a year, there’s been a level-shift higher in some prices, as markets have tried to clear in the presence of supply-chain disruptions. What that means for longer-term expectations remains the question.

But the biggest concern was about recession. While activity in the town was busy, it was noticeably lighter vs. last year. The idea that “the social contract has been broken” remained relevant when considering how policymakers from national political parties down to city-level governments have behaved over the past two years. Increasing crime was still a focus by those from urban centers (numerous participants noted that return-to-office plans for employees were moving slowly). What a new social contract will look like, and whether individuals will continue to vote with their feet (by moving location), remained open questions. There was hope that the country overall would have a more normal school year in the fall.

Bottom line: a year ago 10-year Treasury yields were 1.3%, today they are 2.9%. A significant change in inflation has been priced in, and now concerns are about real growth. As we’ve noted previously, this business cycle has been atypical, as it has been driven by services & a health crisis rather than goods & a financial crisis. The Fed fighting the inflation that has resulted (which is necessary) threatens a renewed downturn (we’re looking for a fed funds hike of +75bp at the July meeting). The FOMC likely wants to avoid a stop-and-go monetary policy, so until its clear inflation expectations are anchored for at least several months it will be difficult to see tailwinds for risk assets broadly.

Source: First Trust, Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Stock Futures Rise as Banks Give Updates

Wall Street looked set to open higher as traders considered results from Goldman Sachs and Bank of America. Commodity prices rebounded following a weak stretch.

The Wall Street Journal

Stocks Continue Rally with Corporate Earnings in Focus

Goldman Sachs and Bank of America are among the groups reporting results Monday. Investors remained concerned about the economic outlook.

Barrons

Inflation Has Outpaced Wage Growth. Now It's Cutting Into...

Sales are sluggish compared with how much prices have risen-except when it comes to dining out.

The Wall Street Journal