Our call, going a little against the grain, is that we may be closer to the middle of the economic cycle than the end and that the effects of the tax cut and fiscal stimulus will extend the cycle further than most think possible. The ability to fully deduct capital expenditures for the next 5 years and the shift to a territorial tax system that frees up trillions of dollars in unrepatriated profits, provides major incentives for companies to invest in their own businesses. As a result, this… View More

April 2018

Post 1 to 7 of 7

1Q earnings are in full swing and growth expectations heading into the reporting period increased from 12.2% on December 31st to 18.5% currently. Normally, expectations get whittled down during the quarter and then earnings post a modest surprise off depressed expectations. With the earnings preannouncement ratio exceptionally low, stocks may be priced for perfection. However, earnings growth is expected to accelerate even further in the coming quarters as companies report better top-line grow… View More

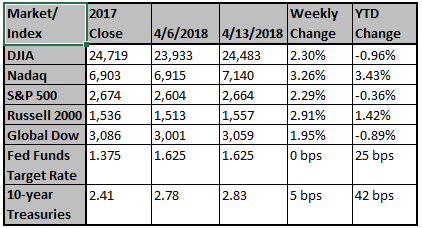

Markets rebounded this week as trade tensions eased. China’s President Xi Jinping’s speech this week at the Boao Forum reiterated past promises to increase imports, reduce import duties on automobiles, expand access to the country’s financial sector, and enforce intellectual property rights for foreign firms. Investors also responded positively to the prospect of a negotiated resolution to the tariff dispute; reports revealed that the U.S. and China had engaged in (unsuccessful) trade … View More

With all the talk about China, we wanted to share the attached article from Reuters. Since the first mention of tariffs, we've said that we DO NOT believe we will end up in a full blown trade war with China. It would not be in China's or our best interest. We've also cited multiple examples of both sides rolling their threats back after they were made. Below, we've included an article that again reiterates to us that much of what we're seeing may simply be posturing. Trump wants to appear st… View More

Markets declined last week as the trade dispute between the U.S. and China flared. On Monday, China provided a detailed list of tariffs on 128 U.S. products; the announcement was targeted retaliation for the 25% tariff on steel and 10% tariff on aluminum exports previously announced by President Trump. On Wednesday, the U.S. released a list of proposed tariffs on approximately $50 billion of Chinese imports, including medicine, aviation parts, and semiconductors. China responded with plans… View More

Looking at March, we observed 43% of its trading days experienced a spread of greater than 400 points between the day’s high and low. With spread between the market’s high and low at 743 points on March 1st and 737 points on March 27th, it’s apparent market volatility has returned. The VIX (volatility index) measured 19.97 (slightly ahead of its 20-year average of 19.4) on the last trading day of March. From reports published by the Investment Company Institute (ICI), we can see mon… View More

We are hearing more investors comment that the market makes no sense, at least for now. Today's selloff erasing Friday's gains only reinforces this idea for many. We would contend the market does make sense, and what we've experienced over the last couple of months reaffirms the market's sensibility. As January came to a close, Amazon, JP Morgan, and Berkshire Hathaway announced they were going to get into the healthcare business. This introduced a level of uncertainty in the markets.�… View More