We wanted to share with you some background on why we invest in balanced portfolios. During periods like February 19 through February 28, 2020, when the stock market comes under pressure, bonds tend to perform quite well. Over this period, the S&P 500 was down 12.4%, the Nasdaq was down 13.2%, and the Dow Jones was down 13.3%. The Barclays Aggregate Bond Index however was up 1.6% during this period. Because of this inversely correlated relationship between stocks and fixed income, fixed inco… View More

February 2020

Post 1 to 8 of 8

We want to share a short note on our thoughts. With the coronavirus now above the fold of every national newspaper, the complacency that’s dominated markets over recent months is finally being challenged. This is also evident in the sharp ETF outflows – over the last 3 days, some $16bn has been pulled from the SPY and nearly $3bn from the HYG (both records). As we wrote yesterday, a decent chunk of the market is sufficiently oversold, but it takes more time to chip away at sentiment. With s… View More

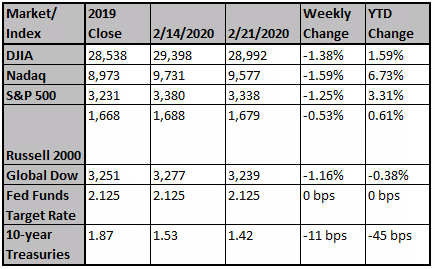

Monday, fear over the Coronavirus finally gripped investors, as both the Dow Jones Industrial Average and the S&P 500 index fell over 3% - the largest daily declines in two years. These drops wiped out all the gains for the year. Frankly, it’s amazing to us that the market had been so resilient! Maybe it’s because recent history with stocks and viruses is that markets overreact leading to significant buying opportunities along the way. Over a 38-day trading period during the height of t… View More

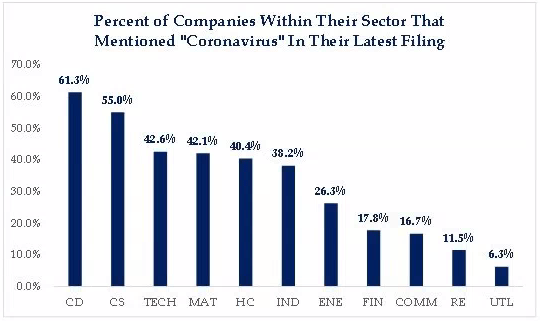

Coronavirus-related economic fears continue to dominate markets, but we believe effects will be short term and limited. Once investors begin to look past near-term risks, we think areas of the global financial market that have benefited on a relative basis (growth styles, defensive areas and bond market proxies) could take a hit. On balance, we think the equity bull market should continue, but we are concerned that valuations look stretched in some areas. Investor attention remains dominated b… View More

Markets are off sharply this morning as the virus headlines appear to have worsened over the weekend, yet we’re still struck with how complacent the options market has been. The daily put/call ratios remain very low, inconsistent with the type of fear often associated with an exogenous event like Coronavirus. This likely has to change, and lower prices are a catalyst. Ultimately we suspect this is a correction in an ongoing bull market, but better S&P support is still a ways off in the 305… View More

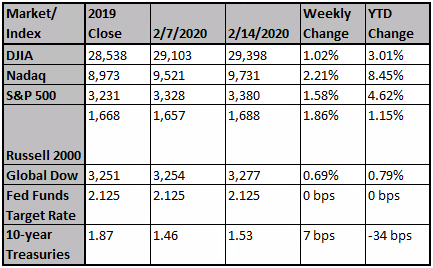

Once again, the major indices moved higher last week despite the on-going focus on the coronavirus. The Nasdaq (2.21%) led the major indices followed by the Russell 2000® Index (1.87%), the S&P 500® Index (1.58%) and the Dow Jones Industrial Average (1.02%). On Thursday, China announced revised diagnostic criteria for the virus; the change increased the number of cases to 66,492 with 1,523 deaths. The news unsettled the markets on Thursday, with modest gains in the Nasdaq and S&P 500®… View More

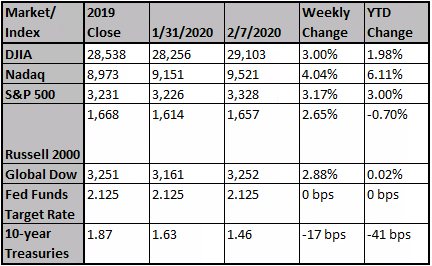

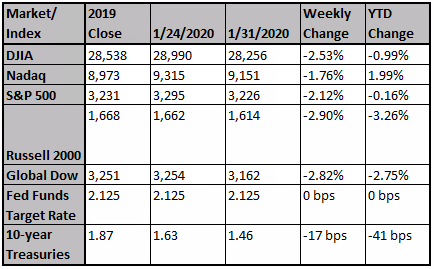

Last week, corporate earnings, and China’s announcement of a 50% tariff reduction on some U.S. products, provided momentum amidst coronavirus uncertainties. The Nasdaq (4.04%) led the major indices for the week followed by the S&P 500® Index (3.17%), the Dow Jones Industrial Average (3.00%) and the Russell 2000® Index (2.65%). The January employment report, 225,000 jobs added, far exceeded expectations of 161,500. Wage growth remains modest: 0.2% for the month for a 3.1% (+0.1%) annual i… View More

This week, uncertainties related to the global economic impact of the coronavirus overwhelmed the markets; the virus, first discovered in Wuhan China, has spread to at least 18 countries with almost 10,000 confirmed cases including 213 deaths. On Thursday, the World Health Organization declared an international health emergency; on Friday, the U.S. declared the virus a public health emergency. Friday’s 603 point selloff in the Dow Jones Industrial Average marked the largest one-day decline in … View More