We hope you all had a great weekend. We wanted to share with you an email that a good client of ours sent this weekend. He wrote that we probably know all of this, but he found it fascinating and an easy read. He wrote that he finally understands where we are at and why the markets keep going higher. The article he sent was entitled “Americans have never been RICHER” and the introduction went like this.

Contrary to what the media will have you believe, the U.S. Consumer is actually in excellent shape. Yes, there are MILLIONS of Americans who lost their jobs and have yet to regain them. But there are MILLIONS more who didn’t and their finances have never looked better.

- SAVINGS UP

- HOME EQUITY UP

- STOCK PORTFOLIO UP

- DEBT LEVELS DOWN

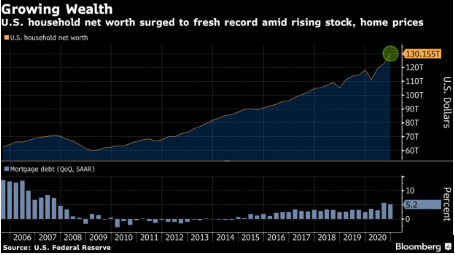

During the worst pandemic in 100 years, U.S household net worth ironically hit record highs!

This is because the FED fired up the printing press and never turned it off. But also because we all stopped doing stuff like this: “buying things we don't need with money we don't have.”

So we saved a lot, and many Americans are in far better financial shape than they were before the pandemic began.

And once the economy re-opens Americans will have mountains of money to spend on:

- TRAVEL

- DINING OUT

- SHOPPING

- PERSONAL CARE

And we believe the economy will ROAR back to life. Setting off a chain reaction of hiring across the entire service industry, which represents +86% of the US economy.

The article went on to discuss how great the economy and consumer are actually doing during the pandemic, and it comes as quite a surprise from where we were just one year ago. One year ago we had no idea what would happen to our economy if we shut it down, and shut it down we did. We were supposed to shut it down for a few weeks to bend the curve on overrunning hospitals, in the wake of what was being described at the time as the worst contagious disease we had seen in a very long time. Unfortunately, weeks turned into months. Yes, millions of Americans who were employed in industries like travel and restaurants suffered immensely during the pandemic, however, tens of millions of Americans employed in other industries were able to adapt to the pandemic economy and work more efficiently than they were able to before Covid-19.

We had no idea how bad the pandemic would be and only had the 1918 Spanish flu to look back at as an example. We have come a long way since then, and we know much more about the economy, the Coronavirus, and who it affects. The question we are faced with now is when do we go back to normal? We believe it will be sooner than later.

Over the last few weeks the "American Rescue Plan" has been fiercely debated. Proponents argue it is the stimulus we need to move past Covid-19 and opponents argue that much of the stimulus does not directly address Covid-19. Proponents argue the stimulus will help bring unemployment down faster, whereas opponents argue features of the bill (like the one supporting ailing pension funds) have little to do with Covid-19.

Because our specialty is investing (not politics), we like to go back to the facts and try to determine how they may affect the economy and the investment markets. We find it very interesting that 33 states ended 2020 with much higher tax revenues than they had in 2019. We find it especially interesting that, contrary to what might be expected after the high unemployment rates in California during the pandemic, that California ended 2020 with $19 billion more in tax revenue than it had collected in 2019.

Here are some of the key elements of the American Rescue Plan, and below we will discuss how we believe they may impact the economy and markets.

American Rescue Plan Benefits Companies with Underfunded Pensions

As Dan Clifton from Strategas highlighted last week, deeper in the bill is a provision allowing companies to “smooth” pension contributions. Companies with underfunded pension plans benefit from this provision as it will enable them to contribute less to their pensions this year and future years, with the savings moving straight to the bottom line.

Allowing pension plans to "smooth" their contributions will improve corporate profits by contributing less to their pension plans, which will add "profit" immediately to the bottom line. Initially, this will almost surely be good for the "market" as earnings will go up. It may also prove to be good for unemployment because as profits go up companies will have more money to spend on growth, which should stimulate hiring and reduce unemployment. In the long-run, however, allowing companies to "smooth" their pension plan contributions may increase corporate risk (and risk to pension plans) as they may be "less-well" funded in the future than they are currently. Further, if pension plans end up less-well funded in the future there may be a larger shock pension plans, and that could lead to layoffs and other cost saving strategies (so that corporations can free up cash flow to fund pension plans), which would almost surely be "bad" for the market and economy.

A Major Health Care Bill Inside Of A Stimulus Bill

Another under-the-surface component of the stimulus package is a major expansion of the ACA. It would be considered a landmark health care bill on a standalone basis, but it gets less focus than the consumer portions. The legislation is a major expansion of the ACA and should lead to a 10 percent increase in the number of people insured on the ACA exchanges. Managed Care companies ultimately should benefit.

An increase in the number of people on the ACA exchanges should create a more efficient exchange. If it can bring the cost of healthcare down, that should benefit the overall economy. However, thus far the exchanges have needed government subsidy. If they cannot operate at a profit, then the larger the exchange, the larger the government subsidy to support it. If the government has to subsidize the exchange, it removes capital from other parts of the economy where growth could be realized. We will just have to wait and see how this plays out.

Re-levering the Consumer & Reopening Benefits Travel Related Stocks

The American Rescue Plan is expected to provide more than $700 billion of aid to consumers within the first six months of passage and nearly three times as much in direct payments while the economy is reopening. Individuals are looking forward to traveling more in a post-covid world, and we expect a portion of the funds from the latest fiscal package to be used for just that.

We believe this will almost certainly be good for the economy and should help bring unemployment down at a quick pace. We believe we have already seen the benefit of stimulus on unemployment since the first round of Stimulus passed after the pandemic began. It provided much needed support to employment, and the rate of unemployment has been coming down (much quicker than expected) ever since. The question for many is will it be "too good," meaning that we will see runaway inflation as a result of all the stimulus spending. We believe the answer is no, and have commented on inflation various times over the last few weeks.

Looking at the longer-term, a possible side-effect of the significant stimulus spending is that long-term debt rates for our country keep climbing at a very quick pace. Increased debt in financial systems increases risk. The only reason the US has been able to increase its deficit spending so rapidly without a major shock to the economy is because the "debt service," or the amount of interest we have to pay on the debt each year, has actually gone down because the new debt was issued at much lower rates than the old debt that was expiring. Unfortunately, with rates as low as they now are, we will probably never be able to do this again in the future.

The government has been able to push both monetary and fiscal stimulus aggressively because we "were" in very good financial health before the pandemic ever began. Unfortunately, after the pandemic, we will be much more indebted as a nation, and we will be operating at a 0% interest rate. If our country is not deliberate about paying down the national debt and working to get to higher interest rates in the future, we may at some point face the same realities that "PIGS" (Portugal, Italy, Greece, Spain) faced in 2008.

When these countries joined the European Union and were able to borrow at much lower rates (based on the Eurozone cost of capital), they saw a period of perceived economic prosperity. Their cost of debt fell considerably, which allowed them to operate at higher deficits while still managing their "debt." Unfortunately, when the "music stopped," they were caught with high national debt and an increasing cost of capital.

Their high level of debt and relatively low cost of interest left them unable to employ significant fiscal stimulus nor monetary stimulus, and they were only able to be "rescued" because larger economies that were more stable (Germany, Great Britain, the US, etc.) bailed them out. If the world's largest economies end up looking like the "PIGS," our question is who will bail them out? We hope as the economy reopens, the US will be fiscally responsible and use the increased revenue to pay down its debts and improve its long-term financial well-being.

Moving back to the present, we believe e-commerce will remain despite reopening, and that will benefit logistics companies.

Even once the economy fully reopens, we believe consumers will use a portion of their stimulus checks to continue to shop online despite the ability to return to the stores in person. The convenience of delivery for nearly all items was realized during the pandemic and will likely be the new trend. In such an environment, logistics companies will continue to benefit from increased volumes. Last week, Amazon acquired a minority stake in Air Transportation Services Group (ATSG).

There are few sure-things in the investment business, but betting on a boom in economic activity in the U.S. this year is the closest thing we have seen to a gimme in quite some time. With Fed Funds pegged at zero and the central bank continuing to buy financial assets, the fresh fiscal stimulus of close to $2 trillion set to enter the economy this year, Household Net Worth reaching an all-time of $130 trillion (an increase of $12 trillion or 10% over the same time last year), mass vaccinations, and a reopening of the economy picking up speed, it would not surprise us to see nominal GDP growth approaching 10% in 2021 with S&P operating earnings up close to 30%.

By our reckoning, there are three known unknowns as far as a continuation of the bull market is concerned – inflation, interest rates, and taxes. Generally speaking, inflation itself is not nearly as big a problem for the market as the Fed’s decision to fight it aggressively. On this score, we take the Chairman at his word that for 2021, at least, the Fed really only has a single mandate – full employment.

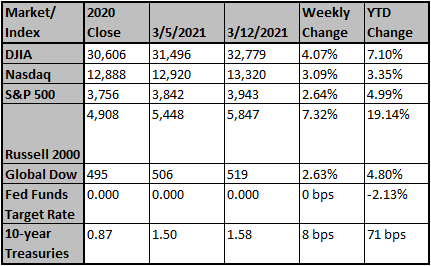

Higher long-term interest rates don’t particularly scare us either because there is nothing more normal than interest rates and stock prices going up at the same time at the start of a new business cycle. It’s not the initial stages of higher rates that get you. It’s the last phase when the Fed is fully engaged that does. Higher rates have and, in our opinion, will continue to influence the relative sector and style performance toward value and away from growth. With more than $13 trillion in negative-yielding debt globally, we are hopeful that the rise in rates will be manageable.

The final unknown – taxes – is, at this point, harder to handicap. With an inevitable need to increase the debt ceiling later in 2021, investors should brace for the potential for higher taxes on income, corporate profits, and dividends, and capital gains. We remain bullish but believe market gains will be harder to achieve, with alpha being driven far more by stock picking and sector rotation as the cost of debt capital rises as the cycle matures.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

The Pandemic Ignited a Housing Boom---But It's Different ...

Residential home sales are hitting peaks last seen in 2006, just before the bubble burst, but this time mortgages are stricter, down payments are higher, and a tight supply is supporting...

Wall Street Journal

Mar 15, 2021

For Wall Street, Everybody's a Post-Covid Winner

Analysts are optimistic about Covid-19 beneficiaries and losers, but might need to recalibrate even though consumers have plenty of dry powder.

Wall Street Journal

Mar 13, 2021

In the year of COVID-19, who has really benefited from th...

While some Americans have seen the value of their stock holdings soar, millions of low-income or unemployed people have missed the market boom.

USA Today

Mar 15, 2021