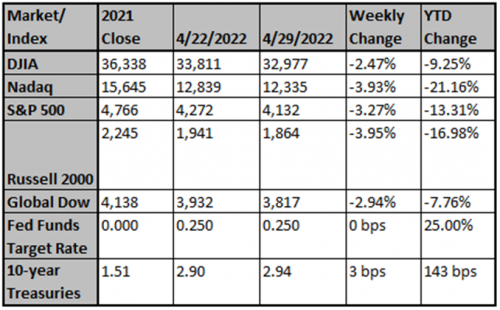

Equities were sharply lower last week (S&P 500 -3.3%) as stocks made their lowest close of the year. The week was capped off by a big Friday selloff. Some suggest risks are skewed toward a near-term rally given factors, including weak sentiment, low positioning, and oversold conditions. Treasuries were little changed, pausing after the big backup in yields over recent weeks. Best sectors were materials (-0.8%) and technology (-1.3%); worst sectors were consumer discretionary (-7.9%) and REITs (-5.7%).

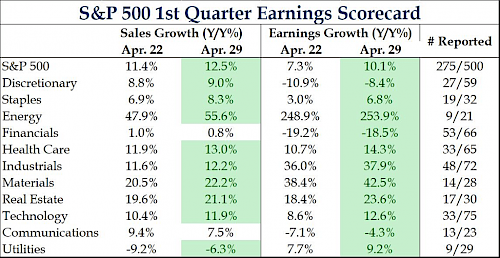

1Q Earnings Growth Touches Double Digits

For the first time this earnings season, the earnings growth rate touched double digits. No single sector is responsible for the improvement as companies beating estimates have been broad based. On the sales side, it has largely been in line with energy being the most notable sector beating. Despite earnings improving compared to the consensus, market performance has been underwhelming.

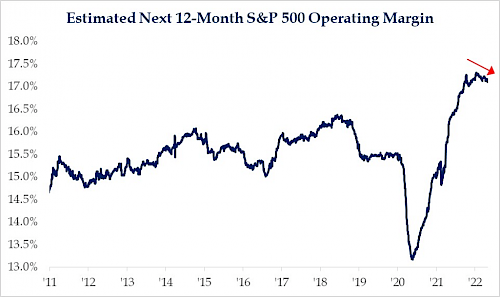

Operating Margins Continue To Trend Lower

While we have been watching margins for quite some time, they have really come into focus this earnings season. The trend lower that we’ve discussed is more noticeable, historically a worrisome signal for equities. Elevated costs can only be absorbed for so long. A slowdown in growth expectations would only add to the challenges.

Company Mentions Of “Shortages” Stabilizing

The mentions of “Shortages” in April were stable once again. We view this as a positive for companies given supply chain issues making it their way into headlines once again due to the shutdowns in China. We will be watching this closely over the coming months to see if companies are getting hit again.

Talk of “Inflation” Accelerates In April

While the market believes inflation either peaked in March or will peak in the next month or two, the talk of “Inflation” in company transcripts suggests otherwise. The acceleration seen in April is alarming and confirms that higher prices are likely to be with us for an extended period of time.

With the U.S. GDP deflator up 8% q/q Annualized Rate (!) and 7% y/y, it’s likely to be an awkward FOMC meeting this week. A +50 bp rate hike looks likely. Quantitative Tightening (QT) is on the way. This is true despite real GDP falling at a much weaker-than-expected -1.4% q/q annual rate in 1Q.

The Fed has pivoted from emergency monetary policy and wants to move to a “neutral” setting quickly. If wage gains continue to accelerate & longer-term inflation expectations become unanchored, the Fed may have to pivot again from “neutral” to “tight”. That type of policy would require a positive real fed funds rate (ie, fed funds above the inflation rate). Even using the core PCE, that’s still a ~5% target now. To be clear, the FOMC has not made that second pivot to “tight” yet, but they are likely to leave their options open given recent data.

We continue to use a 50% chance of a U.S. slowdown, a 35% chance of recession, and a 15% chance of an upside surprise.

The U.S. labor market is still dealing with the thrust from the previous 2020/21 stimulus. Initial jobless claims fell to 180,000 last week. The U.S. economy doesn’t go into recession without labor market weakness, based on history. So the 1Q real GDP contraction is likely to be treated as more noise than signal by the central bank.

There’s more evidence of an over-heating U.S. labor market: the U.S. Employment Cost Index (ECI) rose +1.4% q/q and 4.5% y/y in 1Q. Accelerating wage gains reinforce concerns about “sticky” inflation. U.S. wage data already helped spook the Fed in 4Q. In 1H of 2022, there have been compounding shocks: the Russia/Ukraine conflict pressuring food & energy and new China lockdowns & port backups.

Former Fed Chair Ben Bernanke had this to say in 2011: “After all, the Fed can’t create more oil. We don’t control the growth rates of emerging market economies. What we can do is basically try to keep higher gas prices from passing into other prices and wages throughout the economy and creating a broader inflation, which would be much more difficult to extinguish.” (Bernanke, Fed Press Conference, 4/27/2011)

Separately in 2022, the U.S. PCE deflator rose +0.9% m/m and 6.6% y/y in March, with the core (ex food & energy) deflator up +0.3% m/m and 5.2% y/y. These are still big numbers, even if the core did slow slightly y/y. The Dallas Fed trimmed-mean PCE accelerated to 3.7% y/y.

So supply & demand do not match. There’s continued inflation, given global imbalances & continued shocks. The Fed wants to keep these shocks from becoming ingrained in future inflation expectations.

Accordingly, this is where we find ourselves: the market has digested the Fed pivoting from emergency monetary policy (0% fed funds) to neutral (2-3% fed funds + QT). We have seen some “peak inflation” evidence (eg, U.S. used-car prices reversing), so the Fed does not yet have to aim for overly “tight” (4-5% fed funds). But Fed Chair Powell has indicated that U.S. rate hikes should accelerate, as there’s a desire to get to neutral quicker … just in case that’s not enough.

Bottom line: the weak -1.4% q/q A.R. advance reading on U.S. real GDP in 1Q looks like more noise than signal. But considerable risks remain abroad. Even solving one risk (China lockdowns) may create another (Europe recession as commodity prices rise). Despite all that, numerous central banks are being forced to move by domestic markets above all else. The U.S. labor market is overheating. We appear to be in a “tighten until something breaks” mode, as both monetary & fiscal policy are focused on bringing down inflation in many countries.

Tightening is still aiming for a period of below-trend growth … to better balance supply & demand.

The Fed is still trying for an economic soft landing. The pathway has become narrow for this outcome. This is going to have to be a joint effort (Fed + private sector). The Fed cannot bring inflation down by themselves without another pivot & shock to the financial system.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

The Fed's balance-sheet is about to shrink. Wall Street i...

Could the giant market for Treasury bonds seize up?

economist

Recession? Inflation? Making sense of US economy

The U.S. economy is riddled with uncertainty as inflation continues to take a toll. Fox Business reporter Shibani Joshi joined NewsNation to break it all down.

News Nation

Inflation Is Back, For Now. Here's How to Cope With It.

Start by prioritizing your spending and paring back to essentials

Next Avenue