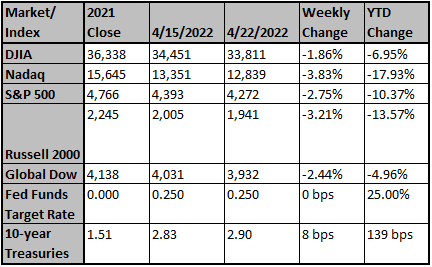

U.S. equities were down last week, with the S&P 500 falling 2.7%. The week’s slide was broadly attributed to increasingly hawkish central bank commentary by the Fed and the ECB. Q1 earnings so far are outpacing expectations. The only positive sectors were REITs (+1.2%) and consumer staples (+0.4%); the worst performing sectors were communication services (-7.7%) and energy (-4.6%).

2020 saw both supply & demand shocks as health concerns mounted. But fiscal & monetary support were very aggressive (demand bounced back). By 2021, vaccines provided hope, and U.S. core inflation started to ease in the summer (“transitory!”). But this did not last. The Delta variant hit, and child-care & U.S. schools opened cautiously in the fall of 2021. The labor market started to overheat. Then the Omicron variant hit & global supply-chain interruptions as well as surging U.S. wage data spooked the Fed in 4Q. In 1H of 2022, there have been new supply shocks: the Russia/Ukraine conflict pressuring food & energy and new China lockdowns & port backups.

Against this backdrop, the U.S. labor market is dealing with the thrust from the previous 2020/21 stimulus. Initial jobless claims remained very low at 184,000 last week. The U.S. economy doesn’t go into recession without labor market weakness, based on history (the best “stimulus” remains a job). U.S. PMIs also remain in expansion territory currently. The U.S. LEI increased +0.3% m/m in March.

So supply & demand do not match. There’s continued inflation, given global imbalances & continued shocks.

Accordingly, this is where we are: the market has digested the Fed pivoting from emergency monetary policy (0% fed funds) to neutral (2-3% fed funds + QT). We have seen some “peak inflation” evidence (eg, U.S. used-car prices reversing), so the Fed does not yet have to aim for overly “tight” (4-5% fed funds). But Fed Chair Powell has indicated that U.S. rate hikes should accelerate, as there’s a desire to get to neutral quicker … just in case that’s not enough.

Quantitative Tightening (QT) is also set to be part of the policy shift in 2022. We should remember that Quantitative Easing (QE) was employed to solve the liquidity trap that developed after the 2008 financial crisis. If inflation expectations are too low, rate cuts can support short-term borrowers but eventually one hits the lower bound (roughly 0%). QE helps solve the “trap” of debt/assets being too high even at 0% rates since QE bids up longer-term asset prices.

Today we are in the opposite situation. If inflation expectations are too high, short-term interest rates should rise to tighten policy. QT can also be added, especially if there’s a liquidity glut. In this case, it’s rational to expect asset values to moderate. QT should work the opposite of QE, as a liquidity glut (inflation) is the opposite of a liquidity trap.

Strategas’ Fixed Income Strategist Tom Tzitzouris has noted that a balanced tightening (rates + QT) is necessary this cycle. Short-term borrowers (“unreliable partners”) are those that borrow in roughly the 0-5 year part of the yield curve. We can think of small & medium businesses, students, car buyers, and credit card users. Rate hikes matter here. Long-term borrowers (“reliable partners”) borrow in the longer end of the yield curve. We can think of mega-cap companies that borrow for share repurchases or dividends, but also homebuyers, state & local governments, and the U.S. Treasury. The equity market (claims on long-duration cash flows) should also be affected. Quantitative Tightening (QT) matters here.

The more balanced the tightening (short + long), the greater the chance of an economic soft landing.

As such, home prices & equities should both be part of the monetary policy transmission mechanism. U.S. housing is already under downward pressure. U.S. mtg applications declined -5.0% w/w last week, and existing home sales fell -2.7% m/m in March.

But the global economy is not synchronized. While the Fed is tightening, further stimulus in China is likely needed. Divergent policies matter. We’re watching the developing weakness in China’s yuan closely. The Japanese yen has also weakened as BoJ has insisted on maintaining an easy posture.

If China’s economy heals, commodity prices (already disrupted) could see renewed upward pressure. But this would likely be unwelcome elsewhere. Put simply, a sharp China recovery might come at the expense of Europe (already sensitive to rising energy prices). It’s tough to get all economies working together until we get to a better equilibrium.

Bottom line: considerable risks remain abroad. Even solving one risk (China lockdowns) may create another (Europe recession as commodity prices rise). But numerous central banks are being forced to move by domestic markets above all else. We appear to be in a “tighten until something breaks” mode, as both monetary & fiscal policy are focused on bringing down inflation in many countries.

Tightening is aiming for a period of below-trend growth … to better balance supply & demand.

Wage data (especially the U.S. Employment Cost Index & Atlanta Fed wage tracker) remain key for our outlook. If inflation becomes entrenched in future expectations, it becomes self-reinforcing through local contracts & a wage-price spiral.

If the FOMC decides inflation will not moderate on its own, the first step would be to take the fed funds rate above the inflation rate. Positive real rates are a minimum for creating restrictive economic conditions. The core PCE inflation rate is 5.4% y/y currently. That’s a big (additional) step with some cracks already in the U.S. data.

The Fed is still trying for an economic soft landing. The pathway has become narrow for this outcome. This is going to have to be a joint effort (Fed + private sector). The Fed cannot bring inflation down by themselves without another pivot & shock to the financial system.

So, will new supply shocks spook the Fed further in 2022/23, making them go neutral to tight (4-5% fed funds)? That determines a soft landing vs. a recession in our view. “Sticky” price components like rents, wages & long-run expectations should help answer this question.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by Refinitiv.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economy Week Ahead: Economic Growth, Inflation in Focus

GDP reports will show how both economies performed during a period marked by sharp rise and rapid fall in Covid-19 cases, surging inflation and the start of Russia's attack on Ukraine.

The Wall Street Journal

Currencies: U.S. dollar hits 2-year high as investors fle...

A closely followed U.S. dollar index hits a two-year high Monday as a global stock-market selloff and a plunge in commodity prices sparks a flight into haven assets.

MarketWatch

Workers changing jobs are receiving massive pay increases...

Americans who switched jobs this year are often receiving double-digit pay increases, according to a new survey, underscoring how a tight labor market has empowered workers and fueled inf...

Fox Business