While last Thursday marked one of the first notable drawdowns in a several months, the S&P is barely off -2% from recent highs. With 45% of issues above their 50-day moving average, it’s also too soon to say market momentum is washed out, particularly given the overhang of the weaker seasonal period and the recent pick-up in the new low data. August 2017 doesn’t share much in common with August 2015 when the market was struggling to get back to breakeven for the year. Looking forward, it’s the character of the next advance that will likely be revealing as to the market’s strategic standing. We’re watching credit conditions and the relative performance of the Industrials sector for clues. The Transports are also at a key juncture here, near 200-day moving average support.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

The VIX is up roughly 50% over the last few days and likely speaks to what is still a fragile sentiment environment, as does the meaningful spike in put volume for the South Korean ETF – both conditions are bullish from a contrarian perspective, but likely too early to play just yet. Curiously, lower yields have not translated into any relative advantage for the REITs, which remain underperformers because of headwinds from Retail brick and mortar holdings.

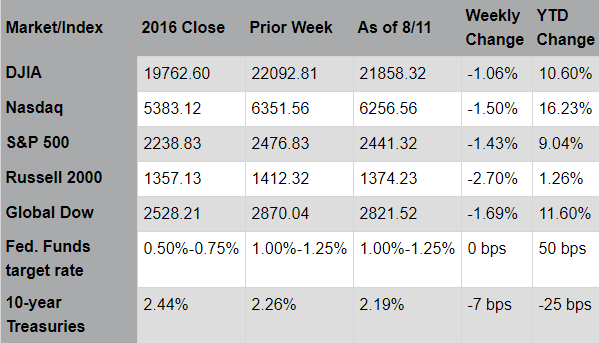

Markets declined last week on escalating tensions between the U.S. and North Korea. Small cap stocks and sectors which respond well to economic growth were particularly hard hit; prices for Treasuries and gold rose as investors adopted a “risk off” sentiment. The prospect of a military conflict, while seemingly remote, unnerved investors who had enjoyed a relatively benign investing environment so far this year. Indeed, the CBOE Volatility Index (VIX), which had been trading near historical lows, spiked 55% this week to close near its highest level since the November 2016 elections. And yet, geopolitical and other “macro” risks are a staple of investing. The North Korean episode is the latest in a surprisingly regular series of events that have shaken markets over the past several years: the Brexit vote in 2016; the Greek bailout negotiations in 2015; the Russia-Ukraine conflict and oil market selloff in 2014; the “Taper Tantrum” in 2013; and the European debt crises and “fiscal cliff” showdown in 2012. In the midst of these events, though, the major equity indexes have more than doubled over this five and a half year period. These episodes often have limited economic impact for individual companies and industries; the flare-ups, though, can create opportunities for long-term investors to selectively acquire stocks that others may have discarded in a move to avoid risk.

Politics have largely overshadowed the second quarter earnings season; nevertheless, results have been impressive. Over 90% of companies in the S&P 500® Index have reported earnings; of these, 70% have met or exceeded analysts’ sales estimates and 82% have met or exceeded analysts’ earnings per share estimates. Sales for the quarter are now expected to rise 5.2%, while earnings are expected to rise 10.2%. These results, which are significantly above initial expectations, reaffirm a positive outlook for corporate profits. Department store retailers Macy’s and Nordstrom were in focus this week. The companies pointed to a strong start to the popular back-to-school shopping period. Yet, weak overall traffic patterns and concerns over online competition persist; the stocks were down 11% and 4%, respectively. Other companies perceived to be “Amazon proof,” such as Home Depot, have outperformed thus far this year. Next week, specialty retailers, including Home Depot, TJX Companies (owner of T.J. Maxx and Marshalls), and L Brands (owner of Victoria’s Secret and Bath & Body Works) will report earnings. The updated results and management commentaries will provide important insights into the state of retail with regard to the rapidly evolving nature of their businesses, particularly as it relates to online competition, as well as broader consumer sentiment.

Source: Strategas and Pacific Global Investment Management Company

Last Week's Headlines

- According to the Job Openings and Labor Turnover report for June, the number of job openings increased to 6.2 million (+461,000). Over the month, the number of hires fell from 5.5 million in May to 5.4 million in June. There were 5.2 million total separations in June, little changed from May. Job openings increased in a number of industries, with the largest increases occurring in professional and business services (+179,000), health care and social assistance (+125,000), and construction (+62,000).

- The monthly federal government budget deficit was $43 billion in July on the heels of a June deficit of $90 billion. Total government receipts were $232 million, while total outlays were $275 million. The total budget deficit for fiscal 2017 sits at $566 billion — 10.6% higher than the $512 billion deficit over the same 10-month period last year.

- There continues to be little upward movement in consumer prices. The Consumer Price Index rose 0.1% in July following no movement in June and a 0.1% drop in May. The CPI has risen 1.7% over the last 12 months ended in July. Prices less food and energy also increased 0.1% for the month and 1.7% over the last 12 months.

- Dwindling inflationary pressure has been the theme over much of 2017, and the latest figures from the Producer Price Index continue that trend. The prices producers receive for their goods and services declined 0.1% in July, following a 0.1% increase in June. Over 80% of the decrease is attributable to a 0.2% drop in services, although prices for goods edged down 0.1%. Prices less the volatile components of food, energy, and trade services were unchanged in July, while prices less food and energy fell 0.1%.

- In the week ended August 5, the advance figure for seasonally adjusted initial claims for unemployment insurance was 244,000, an increase of 3,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 240,000 to 241,000. The advance seasonally adjusted insured unemployment rate remained 1.4%, unchanged from the previous week's unrevised rate. During the week ended July 29, there were 1,951,000 receiving unemployment insurance benefits, a decrease of 16,000 from the previous week's revised level. The previous week's level was revised down 1,000 from 1,968,000 to 1,967,000.

Eye on the Week Ahead

July's report on housing starts is out this week. The housing market has been up and down so far this year, with low inventory and rising prices discouraging would-be home shoppers. However, housing starts and building permits were up in June — a trend builders and homebuyers would like to see continue in July. Another report released this week, the Treasury's Industrial Production Index, not only shows how much factories are producing, but it also measures how much factory capacity is in use.