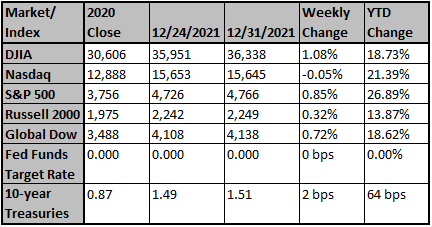

S&P 500 Finishes 2021 Up 28.7%

With the S&P 500 finishing the year up 28.7% on a total return basis, 2021 ranked as the 21st best year for the index since 1926. It was also the 36th time that the total return was greater than 20%. More importantly, in the year following a +20% return, the S&P on average has returned 11.3%, with 69% of the readings being positive.

2021 Saw The Fourth Smallest Drawdown Since 1987 For The S&P

Those investors who entered 2021 with a bearish outlook never really got their chance to take advantage of any sell-offs. The max drawdown for the index was just -5.2% which ranks as the fourth smallest pullback since 1987.

70 New Highs Were Made Last Year

My colleague, Todd Sohn, tells me that there were 70 new highs made in 2021. This is the second-best year for new highs, only behind 1995, where there were 77 new highs made. Historically, when the number of new highs has been at elevated levels, the market has gone through a stretch in the following years of more new highs.

S&P 500 Is More Top Heavy Than Ever

The top 10 issues in the S&P 500 comprise nearly 30% of the overall index, making it more top-heavy than ever, with the historical average being closer to 21% based on data from 1980. Furthermore, the 6.9% weight that Apple carries makes it the largest single-issue ever in the index. Investors have to go back to the mid-1980s to find an issue besides Apple that has made up more than 6%.

Source: Strategas

Each year we like to bring you the top 10 predictions from one of our favorite portfolio manager and Friend Bob Doll. Bob was the head of Merrill Lynch investments when we were at Merrill Lynch and he is now the Chief Investment Officer at Crossmark asset management. His predictions have been very insightful and his track record has been better than most.

2021 Review

Equities have enjoyed strong gains since the pandemic low of 2020, aided by massive monetary and fiscal stimulus, excess consumer savings, and incredibly negative real policy rates and bond yields. 2021 experienced amazing earnings growth, which powered equities higher offset only slightly by rising inflation and interest rates. In fact, earnings expectations exceeded beginning of the year estimates by a record amount as corporate revenue growth and profit margins exceeded expectations. COVID variants entered the mix at a few points, creating some volatility and style rotation. Although it was a tug of war, growth beat value, large beat small, and the U.S. beat non-U.S. equities. Treasury yields ironically reached their high for the year in March (1.75% for 10-year Treasury) and cyclical stocks beat defensive stocks handily.

Risk taking was heavily incentivized by extreme monetary and fiscal reflation. For example, meme stocks captured headlines several times during the year as short squeezes created significant upside in some stocks with little overall market impact. These types of activities were amplified because consumers enjoyed record (more than $2 trillion) excess savings created by government transfer payments and reduced consumption in some COVID-impacted industries.

During the year, one of the most noteworthy developments was a substantial rise in inflation from the less than 2% annual rate that existed for about a decade to nearly 7%, the highest in about 40 years. Belatedly, the Fed admitted that inflation was not transitory and has accelerated its recently announced tapering program, preparing the way for rate hikes in 2022. Policymakers acted as if the economic cycle was fragile and ready to fall into recession even though the threat of deflation had long since ended.

Given these developments, 2022 will likely be more challenging for investors, as the Fed and other central banks progressively unwind accommodative policy in response to the ongoing economic recovery/expansion and elevated inflation readings. While economic and earnings growth are likely to be good, a “too-high” inflation backdrop and rising real interest rates suggest less favorable and more volatile conditions for investors than have prevailed since the pandemic lows.

With this backdrop I proceed as usual with fear and trepidation (and hopefully some good educated guesses) to unveil my prognostications for 2022 in the form of Bob’s 10 Predictions.

10 Predictions for 2022

- U.S. real growth and inflation remain above-trend but decline from 2021 levels.

- Inflation falls, but core inflation remains stuck at around 3%.

- For the first time since 1958/1959, 10-year Treasuries provide a second consecutive year of negative returns.

- Stocks experience their first 10% correction since the pandemic and fail to make the gains widely expected.

- Cyclical, value, and small stocks outperform defensive, growth, and large stocks.

- Financials and energy outperform utilities and communication services.

- International stocks outperform the U.S. for only the second year in the last decade.

- Values-based investing continues to gain share.

- After a 60+ year low in 2021, federal interest expense as a percentage of revenue begins a long-term move higher.

- Republicans gain at least 20-25 House seats and barely win the Senate.

Source: Bob Doll at Crossmark

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economy Week Ahead: Eurozone Manufacturing, U.S. Jobs Report

This week's economic indicators will feature measures of U.S. and European manufacturing, the U.S. trade deficit and Friday's much-watched employment report for America.

The Wall Street Journal

Iveco Truck Spinoff Targets Growth in Challenging Industr...

CNH Industrial NV's Iveco Group NV will start trading later Monday in Milan, following Daimler AG's spinoff of its truck division to better confront

Bloomberg

Jobs report and Fed meeting minutes: the week in business.

Jurors in the Elizabeth Holmes trial will continue to deliberate, and a report will show how many people quit their jobs in November.

The New York Times