Sunday morning Senator Joe Manchin (D-WV) announced he will not support President Biden’s Build Back Better spending and tax package as is currently written. This is a major event that has broad investment implications from taxes on high-net-worth individuals to global companies to sectors such as renewable energy, healthcare, and consumer discretionary.

In our experience, sometimes legislation has to fail before it can succeed. Obamacare died three times before ultimately passing. But the takeaway from today’s announcement is that the current version of Build Back Better is likely dead.

Looking at the inflation comps over the next few months, inflation is likely to be elevated at least through March. The new surge of COVID further complicates passing a large spending package that does not deal with the pandemic. As such, tax increases and new spending increases are off the table for the time being.

But the headwinds to moving the legislation have been building for weeks.

- The highest inflation reading in 39 years;

- A Congressional Budget Office cost estimate showing the true cost of the spending is closer to $5 trillion of spending over 10 years;

- A new poll of West Virginia voters showing inflation is the biggest concern and voters believing Build Back Better will increase inflation; and

- The potential surge in new COVID cases as Democrats were looking to pass this unrelated spending.

- Democrats were also talking about overruling the Parliamentarian to get immigration provisions included in the legislation. None of this makes Manchin feel easy about the process. Republican Senator Jim Jeffords left the Republican Party in June 2001 when the Republicans overruled the Parliamentarian.

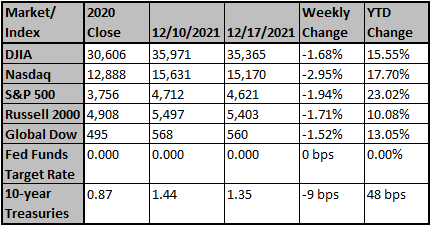

In the span of less than a week the Fed accelerated its plans to taper asset purchases and start raising rates, the number of Omicron cases have surged, and President Biden’s Build Back Better (BBB) program appears to have failed abruptly. The failure of BBB legislation may have little short-term impact on the economy. While many sell-side firms see this as a negative development for economic growth, we believe it is also important to remember that this should be a plus for corporate profits in absence of new tax increases in 2022 and 2023. The other recent macro developments are potentially more dangerous, however, especially since the government response to the new COVID variant may, symbiotically, have an outsized impact on inflation and potentially speed up the need for the Fed to tighten.

While it may seem counterintuitive, “soft” lockdowns and health guidelines could provide the impetus for faster inflation in goods in the absence of services on which to spend. As occurred after the $1.9 trillion (~9% of GDP) stimulus package passed in March, still-high levels of consumer and corporate spending, along with a tightening labor market may lead, once again, to too much money chasing too few goods.

While we believe it is important to remember that the largest capitalization tech and tech-like names (Facebook, Amazon, Apple, Microsoft, and Google) have acted more defensively than the Consumer Staples sector since 2012, we also remain cautious on high-flying tech names that trade as a multiple of sales as opposed to a multiple of cash flow or earnings. These stocks have been hammered as of late although long-term interest rates have remained low and even declined. This may be a function of the fact that few market participants know what to expect from the bond market once the Fed stops buying what is the current equivalent of all U.S. Treasury issuance by March 2022. We are maintaining our bias toward the Energy, Basic Materials, Financials, Industrials, and Discretionary sectors, remaining cautious on Technology and Communications. We believe the prospects for structurally-high inflation and an increase in interest rates will render valuation a far more important tool in capturing alpha as we head into 2022.

Largely Expecting Returns To Soften In 2022

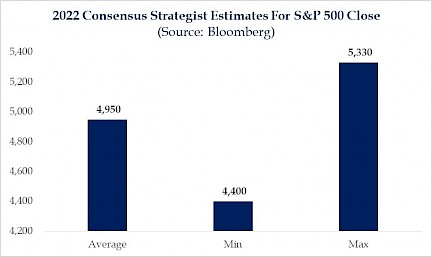

With 2021 looking to finish the year out with the S&P 500 up +20%, the strategist forecasts for 2022 are largely showing returns softening next year. The average of all estimates is 4,950, which would be a return of around 7% based on Friday’s close.

Top-Down Ests. Project Stronger EPS Growth Than Bottom-Up Data

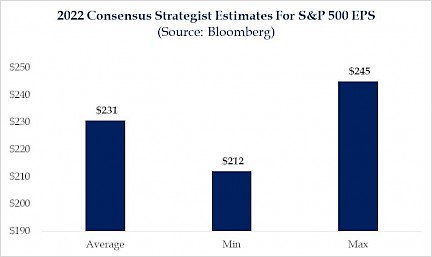

With the average 2022 EPS estimate at $231, strategists expect earnings growth to be around 12%. This is notably stronger than the bottom-up estimate data, which suggests earnings will come in around $223 for a growth rate of about 8%.

Lower Rates Is Out Of Consensus

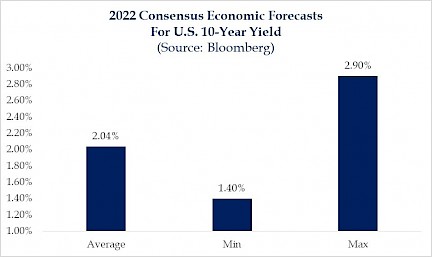

The expectation for higher rates continues to be a consensus call among forecasters. Currently, the consensus estimate for year-end 2022 is 2.04%, with a minimum estimate of 1.4%, which is essentially unchanged from where we are today.

Oil Prices Expected To Soften

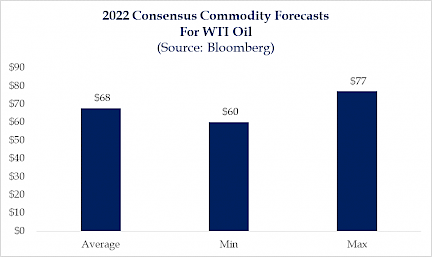

With commodity prices on the rise in 2021, we found it intriguing that current estimates for oil prices show the average at $68. However, one piece of news we felt went under the radar last week was comments made by the Saudi oil minister saying that unless energy investment increases, global oil supplies could fall 30% by 2030.

Source: Strategas

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments. Data provided by FactSet.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com

Latest News

Economy Week Ahead: Housing, Consumers, Inflation

Data due this week will likely show that core inflation rose at the fastest annual pace in almost four decades in November.

The Wall Street Journal

Stock Futures, Oil Prices Slump on Omicron Curbs

U.S. stock futures, oil prices and bond yields fell as investors worried that a rise in Omicron Covid-19 cases would stall economic growth and add pressure to inflation.

The Wall Street Journal

White House: Manchin position's on BBB is a "breach of hi...

After months of back-and-forth negotiations and overtures from the White House, Sen. Joe Manchin (D-W.Va.) chose an appearance on "Fox News Sunday" to announce he was torpedoing President...

axios