The big headline is that year-over-year inflation came in at +4.2%. What the headline leaves out is that inflation hit a period low in May 2020, meaning much of the inflation data we are seeing now is simply “catching up” to where things would have been if we had never had the 2020 recession. It also fails to mention that inflation almost ALWAYS runs higher during the recovery from a recessionary period.

Summary:

- More often than not, stocks appreciate in an inflationary environment

- Cash loses value during inflationary periods

- Inflation adjusted bond performance historically has been weak during periods of high inflation

- Timing the market has proven an impossible task, often leading to underperformance

- The U.S. CPI rose +0.8% m/m in April, with the core (ex food & energy) index up +0.9%. Used car prices spiked (+10.0% m/m) but inflation gains were broad-based as economic re-openings have created bottlenecks.

- On a y/y basis, the headline CPI was up 4.2% and the core 3.0% (most since 1996).

- There’s other global news indicating higher inflation. Consistent with the recent gain in commodity prices, China’s producer price index (PPI) rose in April.

- Bottom line: in general central bankers have indicated they expect current price gains to be transitory. Fed Vice-Chair Clarida said this morning that the rise in April inflation surprised him. However, the weak jobs report last week was also a surprise. The duration & composition of inflation (rather than the number we pop up to) is likely to be a key focus. Rent inflation remained tame in the April report. If that changes, it will be much more difficult to keep calling the inflation move fleeting

Analysis:

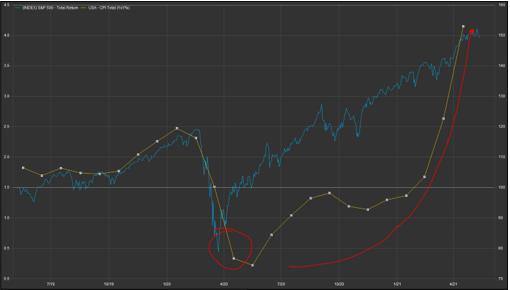

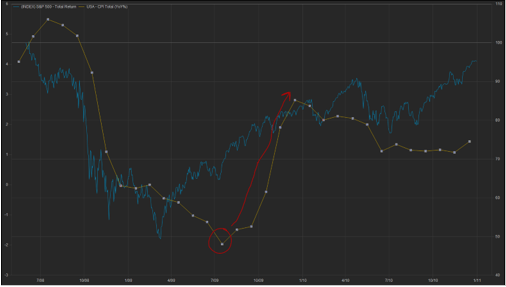

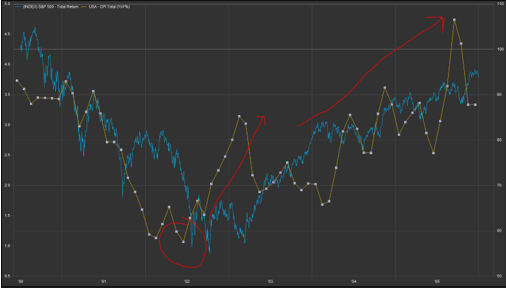

It is true that the economy’s reopening and the increase in Money Supply (M2) are very likely contributing to “excess inflation,” but, this is NORMAL and EXPECTED. Below we have included charts showing the drop in inflation for the 2020 recession, the 2008 recession, and the 2000 recession. For the 2008 and the 2000 recessions we can also see inflation heating up during the economy’s recovery. In the charts below you can see it is quite normal for inflation to run hot after a recession ends.

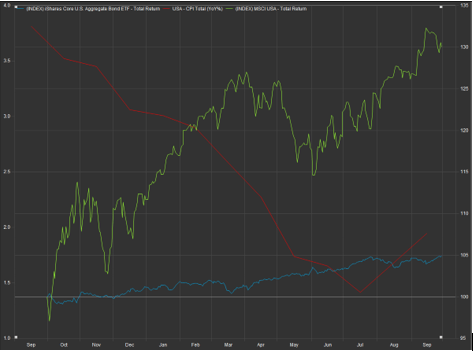

Inflation and the S&P 500: 5/2019 to 5/2021

Inflation and the S&P 500: 5/2008 to 12/2010

Inflation and the S&P 500: 6/30/2000

So while headline inflation is an attention grabbing statement (after all, none of us really like high inflation), the big question for investors is not how high will inflation go, but rather, what will inflation do to investors’ net worth and their lifestyle. To answer these questions, we think it is helpful to review what happened in the twelve months following the “hotter” inflationary periods after a recession ended.

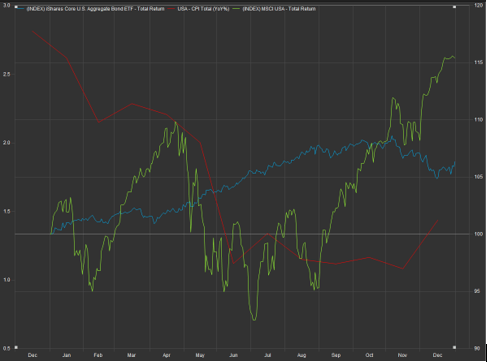

Inflation peaked in September 2005 following the 2000 recession. The chart below shows what the S&P 500, the Barclay’s Aggregate Bond Index, and inflation did for the 12 months following September 2005.

S&P 500, AGG, and Inflation: September 2005 to September 2006

The S&P 500 was up 10.8%, AGG (iShares Core US Aggregate Bond ETF) was up 3.3%, and inflation dropped from 4.7% to 2.0% (annualized rate). Looking back, between investing in stocks (+10.8%), investing in bonds (+3.3%), and moving to cash (+1.0%*), an investor’s best course of action during this period would have been to remain in the stock market. Looking at “real rates of return” for these three asset classes, meaning net of inflation, the only one of these three asset classes to produce a positive real rate of return was the stock market. To calculate the real return of an asset you need to subtract inflation from the rate of return. For the S&P 500, that was 10.8% - 4.7% (inflation) = +6.1%. For AGG, the result was 3.3% - 4.7% = -1.4%. For cash, the result was 1.0% - 4.7% = -3.7%. During this period, stocks did the best job of preserving investor net worth and lifestyle.

Following the 2008 recession, inflation peaked in December 2009. By December 31, 2010, the S&P 500 was up 15.6%, AGG was up 6.4%, cash (represented by the Schwab Cash Reserves Money Market’s average yield) was 0.8%, and inflation had fallen from 2.8% to 1.4%.

S&P 500, AGG, and Inflation: December 2009 to December 2010

Although both stocks and bonds produced positive real returns during this period, stocks dramatically outperformed bonds. Cash again produced a negative real rate of return.

Inflation peaked a second time after the 2008 recession in September 2011, and one year later the S&P 500 was up 30.2%, AGG was up 5.0%, and inflation had fallen from 3.8% to 1.9%. Again, both stocks and bonds produced positive real returns, but once again stocks dramatically outperformed bonds, and cash again produced a negative real rate of return.

S&P 500, AGG, and Inflation: September 2011 to September 2012

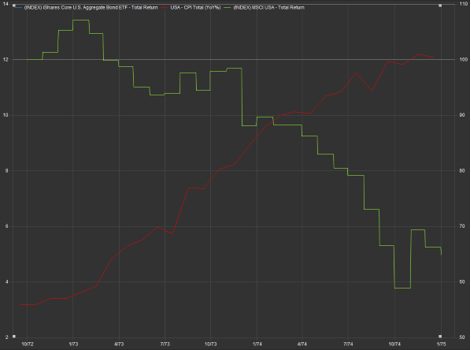

Much of the “fear” over inflation appears to stem from the market and inflation data from the early 1970s. Below is a chart showing the MSCI Total US Equity Index and Headline Inflation from September 1972 through December 1974. During the period, inflation climbed to 12.2% and the MSCI Total US Equity Index fell 33.6%.

MSCI Total US Stock Market and Inflation

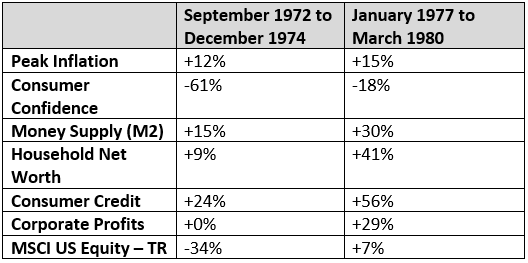

Although many blame the drop in the stock market on inflation, the data does support this presumption. We can compare September 1972 through December 1974 with January 1977 through March 1980. These were two of the periods in recent US history with the highest inflation numbers. Below is a table comparing various data sets between the two periods. If “inflation” were to blame for the stock market tumbling, then January 1977 through March 1980 should have performed worse than September 1972 through December 1974, but it did not. It actually outperformed 41%.

This data suggests what we already intuitively know; the economy is complex and no single factor (inflation or otherwise) will determine its behavior. Many factors together are required to either push the economy forward or pull it backward. Further, when the economy (as measures by GDP) is growing, the stock market tends to perform better. When GDP is contracting, the stock market tends to perform worse.

With the exception of the 1987 flash crash, which recovered in 18 months, there have been NO other sharp, long-term drops in the US stock market that were not also accompanied by a sharp drop in (or negative) US GDP. This tells us that the question of the day is NOT so much what the inflation number is, but rather what will GDP do. With the economy continuing to reopen, capital expenditures increasing, a much higher money supply (M2), rising wages, a dramatic build-up in savings over the last year, record corporate margins, very high levels of corporate cash and very high free cash flows, we cannot imagine a sharp drop in GDP is on the horizon yet. This leads us to believe that although volatility is climbing, the market is not on the precipice of a prolonged, sharp drop, but rather is likely to keep grinding its way higher.

Please call us or email us with any questions that you would like to discuss.

Sincerely,

Fortem Financial

(760) 206-8500

team@fortemfin.com