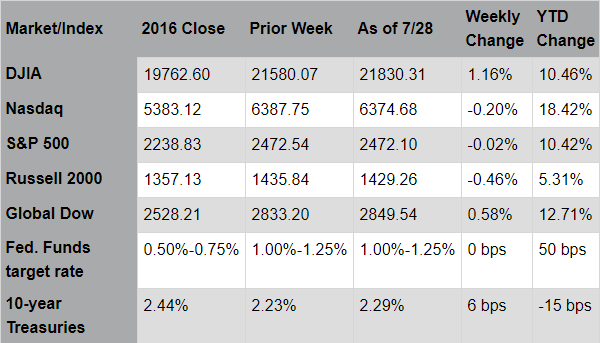

Markets, with the exception of the Dow Jones Industrial Average, were roughly flat last week; the Dow rose 1.2% on strong earnings results from Boeing, Caterpillar, and Verizon.The Energy sector outperformed as oil prices continued to rally; Brent crude, the international benchmark, gained 9% this week to close above $50 per barrel for the first time since early June. The increase was driven, in part, by Saudi Arabia’s comments on Monday of its plan to further reduce oil exports in order to boost prices; also, a sizable decline in last week’s U.S. crude oil inventories supported the view that a rebalancing may be well underway. Economic data were mostly positive; the initial estimate for second quarter GDP growth of 2.6% marked an acceleration from the first quarter’s 1.2%. Consumer confidence rose in July to 121.1, from 117.3 in June; survey respondents noted improved labor market conditions. And, the industrial economy is expanding after a two-year lull; the July preliminary PMI rose to 53.2, an improvement on June’s 52.0. The Federal Reserve met this week and kept rates unchanged while downgrading the outlook for inflation. The committee noted that economic activity remains healthy, with continued growth in household spending and business investment. And, Thursday night’s failed health care vote in the Senate dominated political headlines; yet, the market impact was negligible as investors have largely discounted prospects for legislative action.

Source: Pacific Global Investment Management Company

Chart reflects price changes, not total return. Because it does not include dividends or splits, it should not be used to benchmark performance of specific investments.

Market Week

Thus far, 57% of companies have reported second quarter earnings results; of these, 72.9% have met or exceeded analysts’ sales estimates, while 82.3% have met or exceeded analysts’ earnings per share estimates. Both figures are well above historical averages. The Energy, Industrials, and Financials sectors are leading the better-than-expected performance. Sales for the second quarter are now expected to increase 5.2%, while earnings are expected to increase 9.1%. The results correspond to the acceleration in GDP growth, and reaffirm the positive outlook for companies heading into the second half of 2017. Moreover, the global economy is improving, industrial activity in the U.S. is gaining momentum, and the Energy sector is emerging from its worst bear market in 30 years. These conditions would normally result in a strong move higher in stocks, particularly among economically sensitive areas such as transportation and industrial services, and small and mid-cap companies. And yet, investors seem largely unmoved; perhaps they believe that the current bull market may be due for a correction. Or, the malaise may simply reflect the typical summer doldrums. Regardless, the markets eventually work through these lackluster periods, and the preponderance of favorable economic and corporate data should support continued positive momentum for equities.

Source: Pacific Global Investment Management Company

Last Week's Headlines

- Slowing inflation was the primary reason the Federal Open Market Committee decided to keep the target range for the federal funds rate at its current 1.00%-1.25% range following last week's meeting. The Committee noted that the labor market has continued to strengthen and household spending and business fixed investment have continued to expand. However, overall inflation has declined, while wage inflation has remained low. The FOMC does not meet again until September.

- The initial (advance) estimate of the gross domestic product showed the second-quarter economy grew at a healthy annual rate of 2.6%. In the first quarter, the GDP increased 1.2%. The acceleration in GDP growth in the second quarter reflected a smaller decrease in private inventory investment, an acceleration in personal consumption expenditures, and an upturn in federal government spending. These movements were partly offset by a downturn in residential fixed investment and decelerations in exports and in nonresidential fixed investment. Disposable personal income increased $122.1 billion, or 3.5%, in the second quarter, compared with an increase of $176.3 billion, or 5.1%, in the first quarter (revised). It's important to note that the initial estimate of the GDP is based on source data that is incomplete and subject to revision.

- Good news for domestic manufacturers as new orders for long-lasting goods increased $14.9 billion, or 6.5%, in June. This increase follows two consecutive monthly decreases. However, the gain in new orders is attributable, in large part, to transportation, particularly aircraft. New orders excluding transportation increased only 0.2%. Shipments of manufactured durable goods in June, down three of the last four months, decreased $0.1 billion to $236.0 billion. This followed a 1.2% May increase. Unfilled orders for manufactured durable goods in June, up three of the last four months, increased $14.2 billion, or 1.3%, to $1,135.6 billion. This followed a 0.1% May decrease. Inventories continued to build, increasing $1.6 billion, or 0.4%.

- Following a surge in May, sales of existing homes fell 1.8% in June. Despite last month's decline, June's sales pace (5.52 million) is 0.7% above a year ago, but is the second lowest of 2017 (February, 5.47 million). The demand for existing housing remains strong, but a dearth of supply and climbing prices have kept interested buyers at bay. Total housing inventory at the end of June declined 0.5% to 1.96 million existing homes available for sale — 7.1% lower than a year ago. Unsold inventory is at a 4.3-month supply at the current sales pace, which is down from 4.6 months a year ago. The median existing-home price for all housing types (single family, condos, townhouses, and co-ops) in June was $263,800, up 6.5% from June 2016 ($247,600). June's median sales price surpassed May as the new peak after registering the 64th straight month of year-over-year gains.

- Sales of new single-family homes were only marginally better in June than existing home sales. New single-family home sales were at a seasonally adjusted annual rate of 610,000 — 0.8% above the revised May rate of 605,000 and 9.1% above the June 2016 estimate of 559,000. The median and average sales prices decreased in June from May. The median sales price of new homes sold was $310,800 ($324,300 in May). The average sales price was $379,500 ($381,400 in May). The seasonally adjusted estimate of new houses for sale at the end of June was 272,000, which represents a supply of 5.4 months at the current sales rate.

- The trade deficit decreased in June. The international trade deficit was $63.9 billion in June, down $2.5 billion from May. Exports of goods for June were $128.6 billion, $1.8 billion more than May exports. Imports of goods for June were $192.4 billion, $0.7 billion less than May imports.

- The Conference Board Consumer Confidence Index® rose to 121.1 in July, up from 117.3 in June. Surveyed consumers expressed growing optimism in the present state of the economy and the short-term outlook. On the other hand, the University of Michigan's Surveys of Consumers had consumer sentiment fall from 95.1 in June to 93.4 in July. This is still 3.8% higher than the reading from July 2016. Survey respondents were bullish about current economic conditions, but not so optimistic concerning future prospects for the economy.

- In the week ended July 22, the advance figure for seasonally adjusted initial claims for unemployment insurance was 244,000, an increase of 10,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 233,000 to 234,000. The advance seasonally adjusted insured unemployment rate remained 1.4%, unchanged from the previous week's unrevised rate. During the week ended July 15, there were 1,964,000 receiving unemployment insurance benefits, a decrease of 13,000 from the previous week's unrevised level.

Eye on the Week Ahead

Two important economic reports are out this week: personal income and outlays and the employment situation. The FOMC relies on the price index of the personal income and outlays report as an indicator of inflationary trends. On the employment front, June's report was mixed — as new hires increased, while wage growth was marginal at best. July's employment report is not expected to change much.