Looking back on the last four months, to many of us it feels like the stock and bond markets have been run through the ringer. However, it really hasn’t been nearly as bad as it feels. We have certainly seen some big intra-day moves, but they have been both positive and negative. As of April 30th, the Dow Jones Industrial Average is down 1.6%, the S&P is down 0.4%, and the Nasdaq composite is up 2.7% for the year. In the bond market, the Barclay’s Aggregate Bond Index is down 2.4%, the S&P Preferred Stock Index is down 1.1%, and the S&P US Mortgage Backed Securities Adjustable Rate index is up 0.1% for the year. While none of this is great news, it’s also not horrible news. So why does it feel so bad?

We believe part of the explanation is the stock and bond markets have been making big, dramatic moves and the media has been sensationalizing it. On March 30th, MarketWatch published an article with the title, “What struggled in the first quarter? Stocks, bonds, basically everything.” For the opening line of the article, they borrowed a dramatic line from Charles Dickens, “It was the best of times, it was the worst of times.” On Feb 21st, CNBC reported “Rising bond yields stomp out stock rally after Fed report confuses market.” On February 11th, CNN reported “Why the bond market is freaking out Wall Street,” and on February 5th, they reported “Dow plunges 1,175 – worst point decline in history.” The constant barrage of sensational negative headlines make it harder to focus on the fact that markets have remained essentially flat for the first four months of 2018 after a fantastic 2017.

Interestingly, the media seems to have a much harder time sharing positive news. A look at earnings shows the S&P 500’s earnings growth is on track to reach +24%. 1 Sales growth looks like it’s on track to reach over 8%. 2So where is the media in reporting this important information? Trying to find examples of the media reporting this positive data has proven much harder for us than finding examples of their negative biased reporting. As an example, on April 27th the New York Times published an article titled, “U.S. Economy Grew by 2.3% in First Quarter, Easing Slightly.” The first line of the article was, “The figure falls short of President Trump’s goal of at least 3%.” They failed to mention it was 0.3% higher than expectations, and they they failed to note that since 2010, First Quarter GDP has been running significantly lower than the total annual GDP. Specifically, the Average Second Quarter GDP since 2010 has been 2.05 times greater than the average First Quarter GDP. We’ve found a similar relationship in the Third and Fourth Quarter GDP data too. Again, going back to 2010, the Average Third Quarter GDP has been 1.85 times First Quarter GDP and the Average Fourth Quarter GDP has been 1.69 times the Average First Quarter GDP. We will not know if the relationship between First Quarter, Second Quarter, Third Quarter, and Fourth Quarter GDP will remain consistent until the end of the year, but if we were to forecast 2018 GDP based upon this relationship, it would predict 2018 GDP would be equal to 3.8%. To be clear, we are not predicting 2018 GDP growth will be 3.8%, we are simply stating that the media seems to be very adept at sharing partial data and sensationalizing their message.

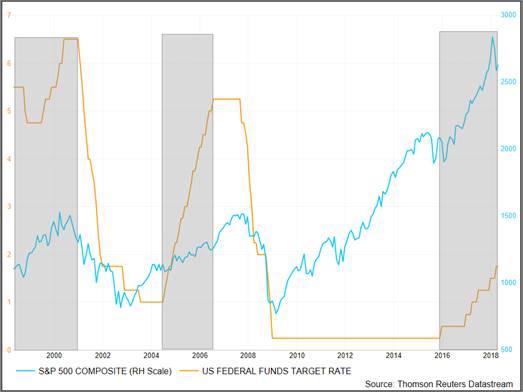

Further, we question the logic used by many of the market pundits. Over the last month we’ve repeatedly heard in the media that the rise in interest rates is causing the market to sell off. We’re not quite sure where they are getting their information from, but it seems to lack historical context. Below, we’ve included two charts covering the last 20 years. In the first chart (S&P 500 vs. 10-yr Treasury yield), the PURPLE line is the rate on the 10-year Treasury, and the BLUE line is the S&P 500. We’ve highlighted in GREY the periods where the rate was climbing, and as you can see, the typical stock market reaction to rising rates is to go UP. In the second chart we show the S&P 500 in relation to the Fed Funds Rate. The ORANGE line is the Fed Funds Rate and the BLUE line is the S&P 500. Again, you see the relation is that when the Fed is raising rates, the market usually goes UP.

Chart 1: S&P 500 and 10 yr-Treasury yield

Chart 2: S&P 500 and Fed Funds Rate

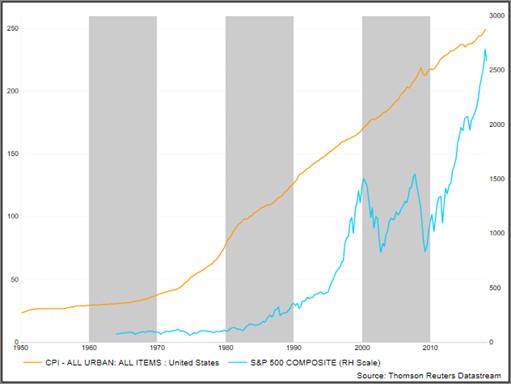

We’ve heard similar arguments with respect to inflation, and find them to be equally unfounded. The typical argument we hear is that with the cost of materials and wages up, profitability will go down, and therefore the stock market will go down. In the chart below, we’ve shown the S&P 500 (BLUE) in relation to inflation (ORANGE), and it’s clear that inflation has been much more stable than the market has been. Further, when inflation goes up, the S&P 500 goes up (for those who like statistics, the correlation between inflation and the S&P 500 is >0.9, which is a very high positive correlation). The incorrect assumption market commentators are making is that the sale price of finished goods and services cannot go up and will not go up despite increases in the cost of the inputs (labor and raw materials…).

Chart 3: Inflation vs. S&P 500

The question they (and investors) should ask themselves is, “can the price of finished goods and services continue to increase?” The answer to this question depends on personal income. Why? Because while none of us like to pay more for things, we’ve all made a regular habit of it, and our income determines if we can. According to US Census data, in 1980 the median sale price of homes was $64,600. By 1990, it had increased to $122,900. In 2000, the median price was $169,000, and in 2010 the median was $221,800. How could Americans afford to buy homes with all these increases? Because with a 1.9 times increase in home prices from 1980 to 1990 Americans realized a 2.2 times increase in personal income. Between 1990 and 2000 the median home price increased by 1.4 times and wages increased by 1.8 times. From 2000 to 2010, the median home price increased by 1.3 times with a 1.5 times increase in personal income.

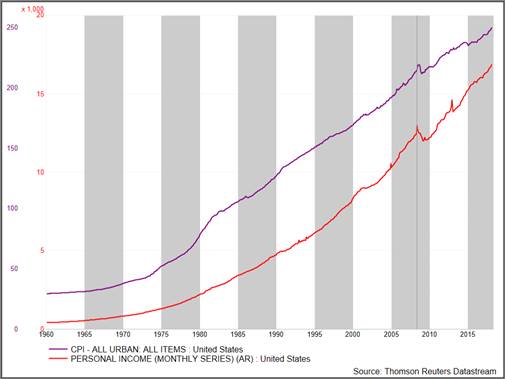

Perhaps those who claim current inflation will cause the economy to stall believe things will be different this time despite the data indicating otherwise. The chart below shows inflation (PURPLE) and personal income (RED). You can see that since 2012, wage growth has outpace inflation, suggesting to us that the price of finished goods and services can and will continue to climb, allowing the value of the stock market to continue to climb.

Chart 4: Inflation vs. Personal Income

As the data continues to unfold, we will share the changes with you and we will look at adjusting our position in the markets accordingly. For the present, we believe the economic data and the corporate earnings data suggest stocks should outperform bonds again this year. We also believe it suggests investors may want to consider adding to positions on weakness.

Click here to request more information.

Categories: Monthly Market Commentary